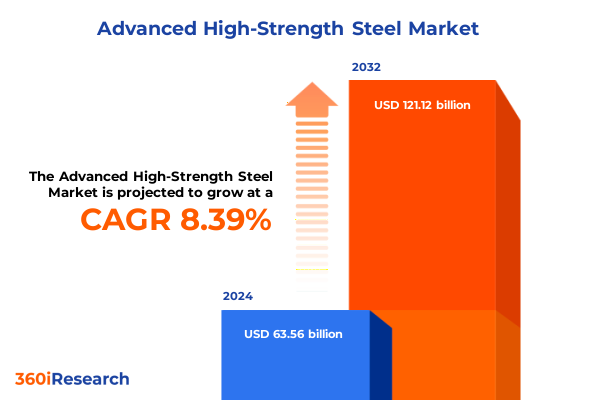

The Advanced High-Strength Steel Market size was estimated at USD 67.89 billion in 2025 and expected to reach USD 72.52 billion in 2026, at a CAGR of 8.62% to reach USD 121.12 billion by 2032.

Unveiling the Pivotal Role of Advanced High-Strength Steel in Driving the Next Generation of Structural Performance, Lightweighting, and Design Innovation

Advanced high-strength steel has emerged as a foundational pillar in the evolution of modern engineering and design, offering an unparalleled combination of strength and formability that traditional alloys cannot match. Initially developed to address the automotive industry’s need for lighter yet safer body-in-white structures, this class of steel alloys has rapidly transcended its origins to establish a critical role across construction, energy, aerospace, and infrastructure sectors. Recent regulatory demands for enhanced fuel efficiency and carbon reduction have intensified the focus on materials that deliver superior performance without compromising safety or durability.

Continued advances in alloy composition, heat treatment processes, and production techniques have propelled the adoption of advanced high-strength steel, driving improvements in weight reduction and cost efficiency. As manufacturers navigate tightening environmental standards and rising raw material costs, the ability to integrate complex phase metals, dual-phase formulations, and martensitic grades into scalable production lines has become a defining competitive differentiator. Leading producers have responded by investing heavily in quenching & partitioning technologies and continuous annealing lines, optimizing yield strength while enhancing ductility.

Against this backdrop of innovation and demand, this executive summary distills the critical drivers shaping the advanced high-strength steel domain. Through a structured exploration of transformative shifts, recent tariff influences, segmentation insights, regional dynamics, corporate strategies, and strategic recommendations, decision-makers will gain the clarity needed to navigate the increasingly complex material landscape and accelerate growth within their own operations.

Exploring Transformational Shifts Reshaping the Advanced High-Strength Steel Landscape Through Sustainability, Digitalization, and Alloy Innovation

The advanced high-strength steel arena is undergoing three profound shifts that are redefining material performance and production paradigms. The first of these arises from an industry-wide commitment to sustainability, where life-cycle analyses and carbon-footprint targets are driving manufacturers to refine alloy chemistries and streamline energy-intensive processes. By integrating lower-emission annealing systems and optimizing heat treatment cycles, producers are achieving substantial environmental gains while simultaneously improving mechanical properties.

In parallel, digitalization has taken center stage, enabling real-time process monitoring, predictive maintenance, and quality assurance at unprecedented levels of precision. The adoption of smart furnaces, integrated sensor networks, and advanced analytics platforms is facilitating tighter control over microstructural evolution, reducing scrap rates, and ensuring consistent performance across large production volumes. This shift toward data-driven operations is empowering stakeholders to accelerate product development cycles and mitigate supply chain disruptions.

Finally, the rapid advancement of next-generation alloy innovations is expanding the capabilities of high-strength steels into new application domains. Emerging formulations such as quenching & partitioning grades and novel hot stamping alloys are delivering exceptional strength-to-weight ratios, while continuous annealing techniques are enabling the scalable production of complex phase steels with higher toughness. Together, these shifts are converging to create a more adaptable, efficient, and environmentally responsible high-strength steel ecosystem.

Examining the Far-Reaching Cumulative Effects of 2025 United States Tariff Measures on Supply Chains, Pricing Dynamics, and Reshoring Initiatives

In 2025, the United States implemented a series of tariff adjustments targeting key steel imports, generating cumulative effects that have reverberated across the advanced high-strength steel supply chain. These measures, designed to protect domestic capacity and encourage reshoring, have increased input costs for downstream manufacturers, prompting many OEMs to reassess sourcing strategies. While some producers have leveraged local partnerships to stabilize supply, others have encountered elevated raw-material premiums, leading to intensified cost-management efforts and price negotiations.

The layered tariff framework has also spurred a strategic pivot toward supplier diversification, as organizations seek to mitigate exposure to potential trade policy shifts. By exploring alternative trade corridors and forming joint ventures in tariff-exempt jurisdictions, stakeholders are working to safeguard material availability. This approach has accelerated investment in near-shoring initiatives, particularly along the U.S. Gulf and East Coast, where logistical advantages can partially offset elevated duty burdens.

Despite temporary inflationary pressures on end-product pricing, the tariff environment has catalyzed long-term supply-chain resilience. Domestic mills have ramped up capacity for specialty steels, while processor alliances have standardized quality protocols to deliver just-in-time inventories. As trade uncertainties persist, the interplay of protective measures and collaborative strategies is reshaping the advanced high-strength steel ecosystem toward greater self-sufficiency and agility.

Distilling Critical Segmentation Insights to Understand Market Dynamics Through Forms, Processing Technologies, Grades, Applications, and Distribution Channels

A nuanced understanding of advanced high-strength steel emerges only when the market is dissected across multiple dimensions of segmentation. When comparing coils, plates, and sheets & strips, each form factor reveals distinct advantages: coils serve high-volume roll forming lines, plates accommodate heavy-section structural requirements, and sheets & strips enable precise stamping operations. The interplay of thickness, formability, and processing speed determines the optimal choice for diverse application targets.

Processing technologies further differentiate competitive offerings. Cold stamping excels at producing high-precision, complex parts with minimal springback, while continuous annealing lines ensure uniform metallurgical properties across extensive coil lengths. Hot stamping processes leverage rapid heating and quenching to achieve ultra-high tensile strengths, and quenching & partitioning techniques offer a unique balance of strength and ductility by decoupling microstructural transformations from cooling rates. Each technology pathway imposes distinct equipment and quality-control requirements, shaping producer specialization.

Within each form and process pairing, the selection of complex phase, dual phase, martensitic, or trip grades influences performance targets. Complex phase steels deliver high energy absorption for safety components, dual-phase variants balance strength with stretchability for structural reinforcements, martensitic alloys achieve exceptional hardness for safety-critical applications, and trip grades provide superior crashworthiness through transformation-induced plasticity. These metallurgical choices guide design engineers in aligning component specifications with regulatory and performance benchmarks.

Applications in aerospace, automotive, construction, energy, and infrastructure underscore the breadth of advanced high-strength steel utilization. In aerospace, lightweight panels and landing-gear brackets benefit from high stiffness-to-weight ratios; within automotive OEM production, door rings and reinforcements optimize crash performance; construction beams and façade panels achieve greater load-bearing efficiency; energy platforms demand corrosion-resistant plates for offshore installations; and infrastructure projects utilize welded assemblies for bridges and rail systems.

Distribution channels, whether through aftermarket channels serving maintenance and repair operations or direct OEM partnerships for original build programs, shape go-to-market strategies. Aftermarket suppliers prioritize flexibility and rapid replenishment of replacement parts, while OEM alliances focus on long-term contracts, co-development of steel grades, and integrated supply-chain planning. Understanding these distinct routes to market is essential for designing robust commercialization plans that align production capabilities with end-user procurement models.

This comprehensive research report categorizes the Advanced High-Strength Steel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Processing Technology

- Grade

- Application

- Distribution Channel

Revealing Key Regional Insights Highlighting How Americas, Europe Middle East and Africa, and Asia-Pacific Markets Drive Demand, Innovation, and Competitive Dynamics

The Americas region underscores the strategic importance of domestic production and resilient supply chains. North American steelmakers have capitalized on tariff protections to expand capacity for high-strength alloys, reinforcing partnerships with automotive assembly hubs in the Midwest and Gulf Coast energy platform fabricators. Meanwhile, demand in South America is propelled by construction and infrastructure projects, where the agility of local service centers in stocking coils and plates has proven vital for project timelines.

Europe, Middle East & Africa presents a highly diverse landscape, marked by stringent emissions regulations and a push toward circular economy principles. European Union directives on carbon intensity have accelerated the adoption of low-emission production techniques, prompting major producers to retrofit continuous annealing lines with electric furnaces. In the Middle East, infrastructure diversification initiatives have spurred demand for heavy-plate grades in maritime and oil-and-gas applications, while select African markets are emerging as growth corridors for automotive body-in-white components produced through hot stamping.

Asia-Pacific remains a powerhouse for both production volume and innovation. Leading steelmakers from Japan and South Korea continue to pioneer grade development, investing heavily in quenching & partitioning research and digital mill platforms. China’s emphasis on advanced manufacturing has elevated consumption in automotive and energy storage applications, driving capacity expansions in coastal provinces. Meanwhile, emerging economies across Southeast Asia and Oceania are forging new processing joints, leveraging OEM partnerships to localize sheet & strip processing and cold-stamping operations closer to final assembly lines.

This comprehensive research report examines key regions that drive the evolution of the Advanced High-Strength Steel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the Strategic Positioning and Competitive Advantages of Leading Players in the Advanced High-Strength Steel Industry Through Collaborative Innovation and Sustainable Practices

Leading companies in the advanced high-strength steel domain have embraced collaborative research and strategic partnerships to secure long-term growth. Through joint ventures with automotive OEMs, certain producers have co-developed bespoke dual-phase and complex phase grades optimized for next-generation vehicle architectures. These alliances extend beyond product co-design to encompass shared pilot lines and reciprocal quality assurance programs, ensuring that launches adhere to exacting performance standards.

R&D investment remains a cornerstone of corporate strategy, with major players channeling resources into cutting-edge heat treatment technologies and alloy refinement. By integrating digital twins and advanced simulation platforms, top companies can model microstructural evolution under varied quenching scenarios, accelerating the time to commercialization for high-performance grades. Concurrently, targeted acquisitions of specialty steel service providers have expanded footprint capabilities, enabling vertically integrated supply chains from slab casting through coil finishing.

Focus on sustainability credentials is another hallmark of leading firms. Carbon capture retrofits, renewable-energy integration, and circular scrap-return programs are delivering verifiable reductions in greenhouse gas intensity. Through transparent reporting frameworks and third-party life-cycle assessments, these companies not only meet regulatory thresholds but also differentiate their offerings in procurement processes that prioritize environmental performance. This multi-pronged approach to innovation, production agility, and sustainability is solidifying competitive advantages in an increasingly discerning marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced High-Strength Steel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansteel Group

- ArcelorMittal S.A.

- China Baowu Steel Group Corp., Ltd.

- China Steel Corporation

- CITIC Limited

- Cleveland-Cliffs Inc.

- Danieli & C. S.p.A.

- Essar Group

- Hyundai Steel Co., Ltd.

- JFE Steel Corporation

- Jindal Stainless Limited

- JSW Steel Limited

- Kobe Steel Ltd.

- Metinvest Holding, LLC

- NanoSteel Co.

- Nippon Steel Corporation

- Nova Steel

- Novolipetsk Steel

- Nucor Corporation

- Posco Group

- Salzgitter Flachstahl GmbH

- SSAB AB

- Steel Authority of India Limited

- Steel Technologies LLC

- Stelco Holdings Inc.

- Tata Steel Limited

- Ternium S.A.

- ThyssenKrupp AG

- United States Steel Corporation

- Voestalpine AG

Crafting Actionable Strategic Recommendations for Industry Leaders to Align with Emerging Advanced High-Strength Steel Trends, Optimize Operations, and Accelerate Market Leadership

To thrive amid evolving regulations, supply-chain complexities, and performance demands, industry leaders should prioritize a holistic technology roadmap. This begins by accelerating investment in digital process controls and integrated sensor networks to enhance quality consistency and reduce scrap rates. By harnessing predictive analytics, operations teams can preemptively address equipment bottlenecks and unlock higher throughput without compromising metallurgical precision.

Simultaneously, organizations must cultivate diversified sourcing ecosystems. Establishing partnerships with regional service centers and forging alliances with tariff-free exporters will mitigate the volatility arising from shifting trade policies. Near-shoring critical coil and plate processing closer to end-user markets not only circumvents duty burdens but also shortens lead times and reduces logistical carbon footprints.

A robust R&D agenda is essential for sustaining product differentiation. Leaders should co-invest with OEMs in advanced alloy trials and pilot-scale quenching & partitioning lines to refine strength-ductility balances. Collaborative innovation accelerates validation cycles, enabling rapid scale-up of next-generation grades tailored to aerospace and energy sector requirements.

Finally, embedding sustainability as a core strategic pillar will unlock both regulatory compliance and market preference. Pursuing renewable energy integration, circular scrap utilization, and transparent life-cycle reporting positions companies to meet buyer expectations and secure premium contracts. These actionable steps will empower stakeholders to navigate complexity, drive innovation, and solidify leadership in the advanced high-strength steel arena.

Detailing the Rigorous Research Methodology Employed to Deliver Comprehensive Insights Into Advanced High-Strength Steel Dynamics, Data Sources, and Analytical Frameworks

This comprehensive analysis leveraged a combination of primary and secondary research methodologies to ensure depth and rigor. Primary insights were obtained through structured interviews with key executives, materials scientists, and supply-chain managers across steelmaking, processing, and OEM organizations. These discussions provided firsthand perspectives on technological adoption, tariff impacts, and regional demand drivers.

Secondary research incorporated a systematic review of industry publications, trade association reports, regulatory filings, and academic journals focused on metallurgical advancements. Proprietary databases were consulted to trace historical production trends, process innovations, and corporate strategies. Data triangulation was achieved by cross-referencing public disclosures with interview findings, enhancing the reliability of qualitative conclusions.

Analytical frameworks included SWOT assessments for major players, PESTEL evaluations of regional markets, and segmentation mapping across forms, technologies, grades, applications, and distribution channels. Synthesizing these methods delivered robust, actionable insights while safeguarding confidentiality of sensitive information. The result is a multidimensional perspective that equips decision-makers with the strategic clarity necessary to navigate the evolving advanced high-strength steel landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced High-Strength Steel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced High-Strength Steel Market, by Form

- Advanced High-Strength Steel Market, by Processing Technology

- Advanced High-Strength Steel Market, by Grade

- Advanced High-Strength Steel Market, by Application

- Advanced High-Strength Steel Market, by Distribution Channel

- Advanced High-Strength Steel Market, by Region

- Advanced High-Strength Steel Market, by Group

- Advanced High-Strength Steel Market, by Country

- United States Advanced High-Strength Steel Market

- China Advanced High-Strength Steel Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Comprehensive Insights to Conclude on the Future Outlook of the Advanced High-Strength Steel Industry and Its Strategic Imperatives for Stakeholders

Bringing together the transformative shifts in sustainability, digitalization, and alloy innovation with the tangible effects of recent tariff measures, this executive summary paints a cohesive picture of an industry in dynamic evolution. The segmentation and regional analyses underscore the diverse pathways through which advanced high-strength steel is reshaping applications from lightweight automotive structures to heavy-load infrastructure components.

As global demand intensifies and regulatory landscapes become more intricate, industry participants must embrace collaborative innovation, strategic sourcing, and sustainability as cornerstones of growth. The insights presented here serve as a blueprint for navigating complexities, unlocking new performance frontiers, and reinforcing competitive positioning.

Ultimately, the future of advanced high-strength steel will be defined by those who can seamlessly integrate technological advancements with resilient supply-chain strategies and environmental stewardship. Stakeholders equipped with these actionable insights are poised to lead the next chapter of structural performance excellence.

Engage Directly with Ketan Rohom to Secure This Definitive Advanced High-Strength Steel Market Research Report and Empower Strategic Decision-Making for Sustainable Growth

To access the comprehensive insights, data, and strategic guidance contained in this advanced high-strength steel research report, reach out to Ketan Rohom, Associate Director of Sales & Marketing. His expertise in market dynamics, coupled with a deep understanding of industry imperatives, makes him the ideal partner to guide you through the report’s transformational findings and tailor solutions to your organization’s unique challenges and opportunities.

Engaging with Ketan will unlock exclusive access to in-depth analyses, proprietary intelligence on tariffs, segmentation nuances, and regional developments that are critical for crafting forward-looking strategies. Initiate a conversation today to explore custom engagement options, secure your copy of the report, and empower your leadership team with the actionable intelligence needed to capitalize on the evolving advanced high-strength steel landscape.

- How big is the Advanced High-Strength Steel Market?

- What is the Advanced High-Strength Steel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?