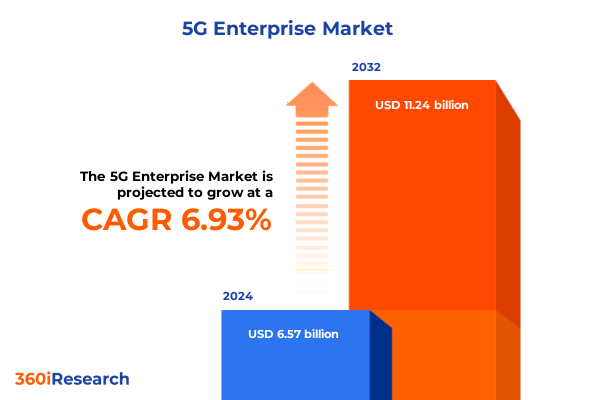

The 5G Enterprise Market size was estimated at USD 6.87 billion in 2025 and expected to reach USD 7.19 billion in 2026, at a CAGR of 7.27% to reach USD 11.24 billion by 2032.

Executive Introduction to 5G Enterprise Innovations Driving Transformational Opportunities and Strategic Priorities for Modern Organizations

The emergence of fifth-generation wireless connectivity has ushered in a profound shift in enterprise communications, enabling organizations to reimagine operational models and accelerate digital transformation initiatives. As industries grapple with demands for ultra-reliable performance, ultra-low latency interactions, and ubiquitous high-bandwidth access, 5G stands poised to unlock new capabilities across manufacturing, healthcare, transportation, and beyond. From empowering real-time analytics at the network edge to securing mission-critical applications, this paradigm elevates the enterprise ecosystem to unprecedented levels of agility and resilience.

By harnessing advanced network slicing techniques, enterprises can customize connectivity profiles to specific use cases, ensuring dedicated performance for applications such as remote robotics and immersive collaboration. Furthermore, the integration of multi-access edge computing platforms brings compute power closer to data sources, reducing latency and optimizing resource utilization. Against this backdrop, decision-makers must navigate a complex tapestry of technological options, regulatory considerations, and evolving business objectives. This report initiates a comprehensive exploration into how 5G is transforming enterprise landscapes, examining key shifts, trade dynamics, segmentation insights, regional nuances, and actionable recommendations for leaders aiming to capitalize on this groundbreaking network evolution.

Revolutionary Technological and Market Dynamics Shaping the Enterprise 5G Landscape Amid Evolving Connectivity Demands and Business Models

Enterprise 5G adoption reflects a convergence of technological innovations and shifting market dynamics that collectively redefine connectivity standards. Network virtualization, in tandem with software-defined networking architectures, has decoupled hardware from control logic, enabling operators and enterprises to orchestrate network resources dynamically. At the same time, advancements in network slicing have matured to accommodate diverse quality-of-service requirements within a single physical infrastructure, supporting everything from real-time video streaming to mission-critical industrial automation.

Simultaneously, the rise of private cellular networks is empowering organizations to deploy dedicated 5G infrastructures that guarantee security, coverage, and performance without relying solely on public operators. These private deployments often leverage edge data center installations where latency-sensitive workloads can execute closer to the point of need. Meanwhile, AI-driven network management tools continuously analyze performance metrics, predict potential bottlenecks, and automate remediation processes, ensuring consistent service levels. Together, these transformative shifts are redefining how businesses architect their digital ecosystems, break down traditional silos, and deliver differentiated services to end users.

Assessing the Cumulative Effects of 2025 United States Tariffs on Enterprise 5G Investments Supply Chains and Competitive Positioning

Early in 2025, new tariff measures imposed by the United States government on imported network equipment introduced heightened cost pressures across the enterprise 5G supply chain. By levying increased duties on antennas, radio frequency modules, and core network components manufactured internationally, these tariffs have necessitated strategic recalibrations by both vendors and end users. Equipment manufacturers have responded by diversifying supplier portfolios and exploring localized production partnerships to mitigate duty exposure and maintain price competitiveness.

Enterprises evaluating their 5G deployments have faced the challenge of balancing total cost of ownership with performance requirements. While some organizations absorbed incremental costs to ensure project timelines remained intact, others reassessed procurement strategies, extending upgrade cycles or adopting phased rollouts that align capital expenditures with broader digital transformation roadmaps. Furthermore, service providers have begun packaging financing structures and managed services agreements that offset tariff-driven price increases through predictable operational expenditures. As these measures take effect, stakeholders must continuously monitor trade policy developments and engage with technology partners to safeguard implementation plans against future regulatory shifts.

Revealing Critical Segmentation Insights Unveiling Components Industry Verticals Enterprise Sizes Deployment Models and Network Architectures

Insight into enterprise 5G adoption is best contextualized through a multifaceted segmentation framework that dissects market dynamics across components, industry verticals, enterprise size, deployment mode, and network architecture. Component analysis reveals that hardware investments span antennas and RF equipment, core network elements, edge infrastructure, and radio access network solutions, while service-driven expenditures focus on consulting and integration, managed services, and support and maintenance offerings. Software spend is increasingly oriented toward multi-access edge computing platforms, network management solutions, and security and analytics tools designed to orchestrate end-to-end connectivity reliably.

Industry vertical segmentation demonstrates that sectors such as banking, financial services, and insurance prioritize secure, low-latency transactions and fraud mitigation, whereas energy and utilities stakeholders emphasize remote asset monitoring and grid resilience. Government and public safety agencies leverage 5G for emergency response coordination, and healthcare providers deploy connected medical devices and telehealth services across hospitals and clinics as well as pharmaceutical and biotech operations. Manufacturing enterprises break down further into discrete and process segments, each harnessing 5G for robotics control, predictive maintenance, and real-time quality assurance workflows.

Examining enterprise size highlights that large corporations pursue expansive private network implementations, often integrating multiple campuses, while small and medium entities-ranging from mid-tier operations to micro and small ventures-favor cloud-managed service models to access advanced connectivity without extensive in-house expertise. Deployment mode segmentation underscores the prevalence of hybrid architectures blending cloud, private cloud, public cloud, and on-premises data center strategies, with edge data centers complementing corporate data facilities. Lastly, network architecture differentiation between non-standalone and standalone 5G frameworks influences upgrade pathways, interoperability considerations, and migration planning throughout digital transformation journeys.

This comprehensive research report categorizes the 5G Enterprise market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Network Architecture

- Industry Vertical

- Enterprise Size

- Deployment Mode

Uncovering Regional Nuances in the Enterprise 5G Market Across Americas Europe Middle East Africa and Asia Pacific Ecosystems

A regional lens on enterprise 5G adoption underscores distinctive growth trajectories and regulatory contexts shaping market evolution across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, robust infrastructure investments and collaborative frameworks between telecommunications operators and large enterprises have accelerated private network rollouts, particularly within manufacturing and logistics hubs. Regulatory incentives and spectrum licensing reforms in the United States and Canada have further catalyzed trials and commercial deployments, fostering an ecosystem of localized integration partners and system integrators.

Across Europe Middle East and Africa, diverse adoption patterns reflect the continent’s varied economic landscapes and government initiatives. Western European nations emphasize harmonized spectrum allocation and cross-border interoperability, while the Middle East invests heavily in smart city pilots and critical infrastructure modernization. African markets, despite infrastructure challenges, demonstrate growing interest in private enterprise networks to support mining, agriculture, and utilities sectors, leveraging cost-effective equipment and managed service models to overcome capital constraints.

In the Asia Pacific region, leading economies such as Japan, South Korea, and China continue to champion nationwide 5G deployments, with enterprises in automotive, electronics manufacturing, and financial services forging partnerships to develop innovative use cases. Southeast Asian nations prioritize smart manufacturing corridors and digital logistics platforms, drawing on competitive equipment pricing and flexible deployment models. Across all regions, strategic collaboration between network operators, technology vendors, and end customers is key to surmounting deployment hurdles and realizing the transformative potential of enterprise 5G.

This comprehensive research report examines key regions that drive the evolution of the 5G Enterprise market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Dissecting Key Corporate Players Driving Innovation Partnerships and Strategic Alliances in the Competitive Enterprise 5G Ecosystem

Leading technology vendors and telecommunications operators occupy pivotal roles in shaping the enterprise 5G ecosystem through ongoing innovation, strategic partnerships, and ecosystem development initiatives. Global network infrastructure providers have introduced modular hardware portfolios tailored to private network deployments, collaborating with systems integrators to deliver turnkey solutions for sectors ranging from smart manufacturing to digital healthcare. Simultaneously, cloud and edge service companies have integrated 5G connectivity offerings into their platforms, enabling enterprises to access scalable compute and analytics capabilities alongside secure network services.

Several key alliances between equipment manufacturers and hyperscale cloud providers have emerged, combining deep domain expertise in radio access network design with advanced cloud-native orchestration tools. These collaborations facilitate end-to-end service assurance and accelerate time to market for transformative applications such as real-time video inspection and automated logistics tracking. On the services front, consultancies with specialization in industrial digitalization are advising enterprises on readiness assessments, proof of concept trials, and managed operations, ensuring that technology deployments align closely with business objectives and yield measurable returns.

Moreover, open innovation forums and developer communities have formed around emerging standards for network slicing, edge computing, and AI-driven orchestration, fostering interoperability and accelerating the maturation of cross-industry use cases. As the competitive landscape evolves, enterprises must carefully evaluate vendor roadmaps, cross-industry partnerships, and ecosystem health to identify the optimal blend of technology providers and service partners that will support long-term 5G success.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G Enterprise market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AT&T Inc.

- China Mobile Limited

- Cisco Systems, Inc.

- Ericsson AB

- Fujitsu Limited

- Hewlett Packard Enterprise Company

- Huawei Technologies Co., Ltd.

- Intel Corporation

- Mavenir Systems, Inc.

- NEC Corporation

- Nokia Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Verizon Communications Inc.

- ZTE Corporation

Strategic Recommendations for Industry Leaders to Capitalize on 5G Enterprise Opportunities Enhance ROI and Futureproof Digital Infrastructure

Industry leaders seeking to derive maximum business value from enterprise 5G deployments should prioritize clear alignment between technology investments and strategic objectives. Decision-makers are advised to initiate targeted pilot programs in collaboration with technology partners to validate high-impact use cases such as real-time asset tracking, autonomous guided vehicles, and immersive training environments. By adopting iterative proof-of-concept approaches, organizations can refine technical requirements, measure performance outcomes, and build internal change management capabilities before scaling broadly.

Risk mitigation strategies include diversifying hardware suppliers and evaluating managed services agreements that bundle Equipment as a Service models with integrated lifecycle management. This approach can reduce upfront capital commitments while ensuring access to the latest hardware revisions. Additionally, enterprises should develop comprehensive security frameworks that span network, application, and endpoint layers, leveraging analytics solutions to detect anomalies and enforce policy compliance across private and public network segments.

To foster cross-functional adoption, leaders must cultivate organizational readiness by investing in workforce training programs focused on 5G operations, automation tools, and data analytics. Collaboration between IT and operational technology teams is critical to break down silos and drive unified governance models. Finally, establishing feedback loops that capture user experiences and performance metrics will inform continuous optimization, guiding strategic investment decisions and reinforcing alignment with long-term digital transformation goals.

Comprehensive Research Methodology Underpinning the Analysis of Enterprise 5G Trends Data Sources and Analytical Frameworks

The analysis presented in this report is grounded in a rigorous research framework that triangulates data from multiple primary and secondary sources. Industry interviews with network architects, operations executives, and technology providers provided firsthand insights into adoption drivers, deployment challenges, and future innovation pathways. Publicly available regulatory filings, spectrum auction records, and vendor release notes were consulted to verify technology roadmaps and clarify regional licensing environments.

Secondary research encompassed analysis of whitepapers, industry consortium publications, and technical standardization bodies to corroborate market trends and elucidate emerging best practices in network slicing and edge compute integration. Quantitative data regarding network investments and procurement cycles were synthesized through a combination of financial disclosures and anonymized surveys of IT procurement teams across diverse verticals. All data points were cross-validated through a data triangulation methodology, ensuring consistency and reliability of findings.

Qualitative insights derived from executive roundtables and focused workshops enriched the quantitative analysis, enabling a holistic understanding of enterprise priorities and technology vendor strategies. The final report underwent an internal peer review process, ensuring methodological rigor, factual accuracy, and alignment with the latest industry developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G Enterprise market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G Enterprise Market, by Component

- 5G Enterprise Market, by Network Architecture

- 5G Enterprise Market, by Industry Vertical

- 5G Enterprise Market, by Enterprise Size

- 5G Enterprise Market, by Deployment Mode

- 5G Enterprise Market, by Region

- 5G Enterprise Market, by Group

- 5G Enterprise Market, by Country

- United States 5G Enterprise Market

- China 5G Enterprise Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Synthesis of Insights and Forward-Looking Perspectives on Enterprise 5G Adoption Impact and Strategic Imperatives for Organizations

This report synthesizes an array of insights spanning technological innovation, trade policy impacts, segmentation dynamics, regional developments, and competitive strategies within the enterprise 5G landscape. By examining component-level considerations alongside vertical-specific use cases, the analysis captures the multifaceted nature of 5G deployments and underscores the importance of tailored approaches for distinct organizational contexts. Regional differences further illustrate that no single blueprint applies universally; instead, enterprises must adapt strategies to local regulatory regimes, ecosystem maturity, and partner capabilities.

Looking ahead, enterprises that successfully integrate private 5G networks with cloud-native architectures and edge computing platforms will unlock new operational efficiencies and competitive differentiation. The intersection of AI-driven orchestration and real-time analytics promises to elevate service assurance and enable autonomous network operations, while converged fixed and wireless solutions will streamline the IT infrastructure landscape. As trade policies and supply chain dynamics continue to evolve, resilient procurement strategies and strategic alliances will prove critical to maintaining momentum in 5G adoption.

Ultimately, organizations that align technology investments with clear business objectives, cultivate cross-functional competencies, and embrace iterative deployment approaches will be best positioned to navigate the complexities of enterprise 5G and capture its transformative potential.

Take Action Today to Secure Comprehensive Enterprise 5G Market Intelligence and Drive Strategic Growth with Personalized Expert Support

To explore the full depth of these insights and equip your organization with strategic guidance tailored to your unique needs, we encourage you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Engaging in a personalized consultation will allow you to address specific challenges, discuss use cases most relevant to your sector, and gain clarity on investment priorities for enterprise 5G deployments. Secure a comprehensive understanding of market dynamics, technology trends, and competitive positioning by requesting the complete research report. Take this opportunity to accelerate your digital transformation roadmap and establish a robust 5G strategy that drives lasting competitive advantage.

- How big is the 5G Enterprise Market?

- What is the 5G Enterprise Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?