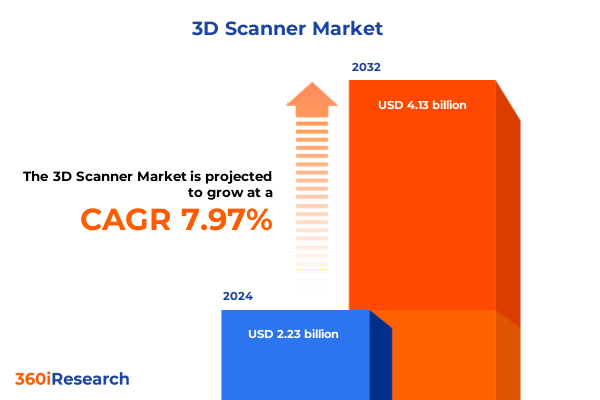

The 3D Scanner Market size was estimated at USD 2.41 billion in 2025 and expected to reach USD 2.60 billion in 2026, at a CAGR of 7.99% to reach USD 4.13 billion by 2032.

A Comprehensive Introduction Establishing the Scope, Strategic Objectives, and Core Context for the 3D Scanner Market Landscape Analysis

With the rapid convergence of digital design, precision engineering, and advanced visualization technologies, the global 3D scanner market has emerged as a critical enabler of innovation across a multitude of industries. This executive summary opens by establishing the strategic context of this analysis, emphasizing the transformative potential of 3D scanning in enhancing operational efficiency, accelerating product development, and driving forward emerging applications from aerospace and defense to medical and cultural heritage preservation.

The scope of this summary extends across an in-depth examination of core market segments categorized by offering, type, range, installation, and end-use industry, coupled with a thorough assessment of regional dynamics spanning the Americas, Europe, Middle East & Africa, and Asia-Pacific. The analysis integrates both macroeconomic and microeconomic factors to deliver a holistic perspective on how technological advances, supply chain evolution, and regulatory shifts are shaping the competitive landscape and value chain of 3D scanner solutions globally.

With a clear set of objectives, this section aims to inform executives, investors, and technology strategists about the primary market drivers, emerging challenges, and actionable insights uncovered through rigorous research. By bridging high-level strategic themes with granular operational considerations, the executive summary provides a foundation for key decision-makers to chart a course through an increasingly complex and opportunity-rich market environment.

The introduction further delineates the methodological framework utilized to ensure data integrity and relevance, underscoring the integration of qualitative insights from industry experts with quantitative metrics sourced from leading market studies. This blend of evidentiary sources ensures that each strategic implication presented herein is both empirically grounded and practically relevant for stakeholders seeking to maintain a competitive edge in this fast-evolving domain.

Exploration of the Major Technological Disruptions and Market Dynamics That Are Redefining the 3D Scanner Industry Landscape Worldwide

The 3D scanner market has undergone a series of transformative shifts driven by rapid advancements in sensor technologies and data processing capabilities. Over the past several years, innovations in LIDAR, structured light, and laser triangulation have enabled devices to capture increasingly detailed geometries at higher speeds, while improvements in photogrammetry systems have unlocked new possibilities for large-scale and high-resolution scanning. Concurrently, the integration of artificial intelligence and machine learning algorithms into scanning workflows has automated feature recognition, anomaly detection, and predictive maintenance, thereby elevating the value proposition of modern 3D scanner deployments.

In parallel, the rise of Industry 4.0 and the Internet of Things has fostered closer interoperability between 3D scanners and adjacent systems, ranging from robotics and additive manufacturing platforms to cloud-based analytics suites. As manufacturers seek to streamline end-to-end digital threads, demand for turnkey solutions combining hardware precision with real-time software integration has grown significantly. This shift has also prompted the emergence of service-oriented business models, where data-as-a-service offerings and subscription licensing have supplemented traditional capital equipment sales.

Moreover, the proliferation of portable and handheld scanners has expanded the reach of point-cloud technologies into new use cases, from on-site maintenance inspections in energy and power facilities to rapid prototyping workflows in automotive R&D centers. These on-the-go solutions have been further enabled by advancements in battery technology and wireless connectivity, reinforcing a broader trend toward mobility and user empowerment.

Finally, regulatory developments around data privacy, export controls, and measurement standards have begun to influence both product roadmaps and market access strategies. As global stakeholders navigate divergent compliance frameworks, agility in product certification and supply chain resilience has become a determining factor for sustained competitiveness.

Analysis of the Ripple Effects of 2025 United States Tariff Measures on Supply Chains, Pricing Structures, and Industry Profitability in the 3D Scanner Sector

In 2025, the United States implemented a series of tariff measures targeting imported precision components and finished 3D scanning systems, aimed at bolstering domestic manufacturing and encouraging onshore supply chain development. These levies, which encompass high-precision cameras, LIDAR modules, and specialized photogrammetry rigs, have introduced upward pressure on landed costs for original equipment manufacturers and end customers alike. Consequently, device pricing across key verticals such as aerospace, automotive, and medical instrumentation has experienced a notable uptick, prompting many organizations to reassess their capital procurement timelines and total cost of ownership models.

From a supply chain perspective, the tariff regime has accelerated the migration of critical component sourcing toward alternative markets, including Southeast Asia and select European manufacturing hubs. This strategic realignment has not only diversified risk exposure but has also strained logistics networks as firms navigate longer lead times and shifting trade corridors. Some leading scanner developers have pursued joint ventures and licensed production arrangements to mitigate tariff impacts, effectively localizing assembly operations closer to primary consumption markets.

Moreover, the tariffs have catalyzed renewed investment in domestic research and development initiatives, with government incentives partially offsetting increased import costs. Public-private partnerships have emerged to support the refinement of indigenous sensor fabrication processes, data processing architectures, and calibration standards. While these efforts hold promise for long-term supply chain sovereignty, the transition phase presents short-term challenges in aligning volume scalability with quality benchmarks historically established by global incumbents.

Strategically, industry participants are advised to adopt a dual-pronged approach that balances near-term cost management through supplier diversification with mid- to long-term investments in local capabilities. This framework will be vital to sustain innovation pipelines and preserve margin structures in a landscape shaped by evolving trade policies.

Insights into Critical Market Segmentation Dimensions Illuminating the Diverse Drivers and Adoption Patterns Across 3D Scanner Applications

Insights into offering segmentation reveal that the Hardware category, which encompasses a diverse array of components such as Cameras and Sensors, Data Processing Units, Encoders and Motors, Laser Projectors, LIDAR Sensors, and Photogrammetry Rigs, continues to draw the lion’s share of R&D investment as manufacturers strive to enhance scanning resolution and throughput. Meanwhile, the Services domain-covering Calibration and Maintenance, Consulting Services, Installation and Setup, Software Integration, and Training and Support-has become increasingly strategic, with end users valuing continual operational optimization and tailored implementation assistance. In parallel, growth in the Software and Solutions segment, driven by 3D Modeling Software, Analysis and Simulation Software, Point Cloud Processing Software, Reverse Engineering Software, Scan-to-CAD Software, and Scanning and Imaging Software, underscores the market’s shift toward comprehensive digital solutions that transform raw scan data into actionable intelligence.

When evaluating the market by scanner Type, the boundary between 3D Laser Scanners and Structured Light Scanners highlights contrasting performance attributes, where laser-based systems excel in long-range and outdoor applications, and structured light devices achieve superior accuracy in controlled, short-range environments. Range-based distinctions further differentiate Long-Range, Medium-Range, and Short-Range 3D Scanners, with each subcategory aligning to specific industry use cases-from large-scale infrastructure surveys to high-precision part inspections. Installation Type segmentation, dissecting Fixed versus Portable deployments, reveals that portability has become a key enabler for on-site inspections, while fixed stations remain indispensable in manufacturing and laboratory settings that demand consistent environmental controls.

End-use Industry analysis paints a nuanced portrait of adoption across Aerospace and Defense, Architecture and Construction, Artifacts and Heritage Preservation, Automotive, Electronics, Energy and Power, Medical, and Mining sectors. Each vertical presents unique requirements-from the extreme precision and materials compatibility needed for aerospace components to the robustness and mobility demanded by mining operations-reinforcing the criticality of tailoring scanner offerings and service bundles to distinct application landscapes.

This comprehensive research report categorizes the 3D Scanner market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Type

- Range

- Installation Type

- End-use Industry

Comparative Regional Perspectives Revealing Growth Catalysts, Regulatory Environments, and Adoption Trends Across Global 3D Scanner Markets

Regional analysis of the 3D scanner ecosystem reveals distinctive growth drivers and market dynamics across the Americas, Europe, Middle East and Africa, and Asia-Pacific. In the Americas, the convergence of advanced manufacturing clusters and deep investments in automotive and aerospace R&D has sustained robust demand for high-precision scanning systems, while onshore reshoring initiatives and public incentives have further stimulated capital equipment purchases. The North American market’s emphasis on comprehensive service networks and localized support models underscores a preference for end-to-end solutions that prioritize uptime and operational reliability.

In the Europe, Middle East and Africa region, stringent regulatory frameworks around product compliance and data security have shaped vendor strategies, compelling suppliers to achieve certifications that address regional directives. Simultaneously, Europe’s mature construction and heritage preservation sectors have driven adoption of both portable and fixed scanning systems for facade surveys and archaeological documentation, whereas mining interests in Africa have catalyzed demand for ruggedized and long-range scanning platforms suitable for open-pit and underground operations.

The Asia-Pacific landscape is characterized by rapid industrialization, urbanization-driven infrastructure projects, and growing healthcare investments, all of which have amplified requirements for scalable scanning solutions. Major manufacturing hubs in East Asia continue to lead in component fabrication and system assembly, while emerging markets in Southeast Asia are increasingly leveraging portable and mid-range devices for quality assurance in electronics and energy applications. Across each region, strategic partnerships, channel expansions, and region-specific value propositions have become critical determinants of market penetration and sustained growth.

This comprehensive research report examines key regions that drive the evolution of the 3D Scanner market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Overview of Leading Industry Participants Highlighting Competitive Positioning, Innovation Initiatives, and Collaborative Ventures

Leading manufacturers and solution providers within the 3D scanner industry are pursuing multifaceted strategies to maintain competitive advantage. Several prominent hardware vendors have accelerated the rollout of next-generation devices that integrate advanced photonics and AI-based image processing, aiming to deliver unprecedented levels of precision and data clarity. Concurrently, established software developers are enhancing interoperability features, enabling smoother integration with digital twin platforms and cloud-native architectures, thereby extending the utility of point-cloud data across the enterprise.

Strategic collaborations between sensor specialists and systems integrators have gained momentum, creating bundled offerings that combine hardware, embedded analytics, and professional services under unified support agreements. Such alliances not only streamline procurement cycles but also reinforce vendor differentiation through seamless customer experiences. Merger and acquisition activity has similarly underscored this trend, as larger technology conglomerates seek to absorb niche scan-to-CAD and reverse-engineering capabilities, effectively broadening their 3D digitalization portfolios.

Investment in after-sales service infrastructure has emerged as a key battleground, with leading players establishing regional calibration labs and mobile support fleets to meet the rigorous uptime expectations of critical industries such as medical device manufacturing and energy exploration. At the same time, targeted partnerships with academic institutions and research consortia are fueling breakthroughs in materials analysis and multi-sensor fusion, promising to unlock new applications and growth vectors in sectors ranging from semiconductor fabrication to cultural heritage documentation.

Overall, the competitive landscape is characterized by an accelerating convergence of hardware innovation, software sophistication, and service excellence, compelling all participants to continually refine their value propositions and operational footprints.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Scanner market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3D Systems Corporation

- Acad Technologies

- Altem Technologies Pvt. Ltd.

- ARK Technology

- Artec Europe, S.a.r.l.

- Autodesk, Inc.

- Automated Precision, Inc.

- Carl-Zeiss AG

- Creaform Inc.

- Direct Dimensions, Inc.

- Engineering & Manufacturing Services, Inc.

- EngRx Corp.

- Envirolaser3D

- FARO Technologies, Inc.

- Hexagon AB

- Holoxica Ltd.

- Jenoptik AG

- K Tech CNC

- Keyence Corporation

- Konica Minolta, Inc.

- Law Abiding Technology

- Maptek Pty Limited

- Matter and Form, Inc.

- Micro-Epsilon Group

- Mitutoyo Corporation

- NavVis GmbH

- Nikon Metrology

- Nordson Corporation

- Numetrix Technologies

- Objex Unlimited

- OGI Systems Ltd.

- Onpoint Building Data

- Photoneo s. r. o.

- Precise 3D Metrology & Design Solutions Pvt. Ltd.

- Prevu3D Inc.

- Scantech (Hangzhou) Co., Ltd.

- ShapeGrabber Inc.

- Shining 3D Tech Co., Ltd.

- Skydio, Inc.

- Thor3D

- Topcon Positioning Systems, Inc.

- Trimble Inc.

- Visionary Semiconductor Inc.

Pragmatic Strategic Recommendations Guiding Industry Leaders to Capitalize on Emerging Opportunities and Navigate Evolving 3D Scanner Market Challenges

To navigate the evolving 3D scanner market and secure sustainable growth, industry leaders should prioritize investments in next-generation sensing technologies that enhance resolution and throughput while optimizing cost per scan. By aligning research and development initiatives with end-user requirements-be it ultra-portability for field inspections or high-fidelity data capture for precision manufacturing-manufacturers can differentiate their portfolios in a crowded marketplace. Moreover, forging partnerships with software developers and systems integrators will enable the delivery of holistic solutions that address the full scan-to-analysis continuum.

Simultaneously, organizations should implement supply chain diversification strategies to mitigate the impact of trade policies and component shortages. Cultivating relationships with alternate suppliers in multiple geographies and exploring localized production or assembly models can enhance resilience and reduce lead times. Complementing this approach with dynamic pricing and financing options will help maintain competitive positioning and support customer adoption in price-sensitive verticals.

Service and support excellence will increasingly serve as a critical differentiator. Deploying regional calibration hubs and mobile maintenance teams will bolster uptime guarantees and foster deeper customer engagement. Additionally, expanding training programs and knowledge transfer initiatives can accelerate end-user proficiency, driving higher utilization rates and unlocking opportunities for value-added recurring revenue through software subscriptions and data analytics services.

Finally, industry stakeholders should embrace sustainability imperatives by optimizing device energy efficiency and sourcing environmentally responsible materials. Demonstrating a commitment to circular economy principles not only aligns with corporate social responsibility objectives but also resonates with an evolving buyer base that places growing emphasis on greener technology solutions.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Literature Review, and Robust Data Validation Processes for Market Insights

This research draws upon a rigorous, multi-tiered methodology designed to deliver robust market insights and strategic foresight. The foundation of the analysis is a comprehensive secondary literature review, encompassing industry publications, technology white papers, regulatory filings, and financial reports. This desk research established a baseline understanding of historical trends, emerging technologies, and macroeconomic drivers influencing the 3D scanner market.

To supplement secondary findings, a primary research phase engaged with a broad spectrum of stakeholders, including product managers, R&D engineers, end-user procurement specialists, and thought leaders in academic and standards-setting organizations. In-depth interviews and structured surveys were conducted to elicit firsthand perspectives on adoption barriers, performance requirements, and future innovation priorities. These qualitative inputs were systematically coded and triangulated against published data to validate assumptions and refine key insights.

Quantitative metrics were integrated through proprietary data modeling, combining shipment statistics, revenue figures, and regional trade flow analyses. The aggregation of these datasets supports cross-segment comparisons and identification of growth corridors. To ensure the highest level of accuracy, data points underwent rigorous validation checks, including consistency assessments, outlier analysis, and peer review by subject matter experts.

The resulting methodological framework ensures that the findings and recommendations presented in this report are grounded in empirical evidence, enriched by expert judgment, and capable of guiding strategic decision-making within the dynamic 3D scanner ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Scanner market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Scanner Market, by Offering

- 3D Scanner Market, by Type

- 3D Scanner Market, by Range

- 3D Scanner Market, by Installation Type

- 3D Scanner Market, by End-use Industry

- 3D Scanner Market, by Region

- 3D Scanner Market, by Group

- 3D Scanner Market, by Country

- United States 3D Scanner Market

- China 3D Scanner Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Reflections on Market Evolution, Strategic Imperatives, and Future Outlook for Stakeholders in the 3D Scanner Domain

As the 3D scanner market continues to evolve under the influence of technological breakthroughs, shifting trade policies, and region-specific growth drivers, this executive summary has distilled the essential themes shaping the competitive landscape. The breakdown of market segments by offering, type, range, installation, and end-use industry highlights the nuanced requirements of diverse application areas, while regional analysis underscores the importance of tailored go-to-market strategies across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

Leading players have responded to these complexities through targeted innovation, strategic partnerships, and expanded service portfolios, setting a high bar for value delivery and customer support. At the same time, the 2025 tariffs in the United States and corresponding global supply chain realignments have served as a catalyst for onshore manufacturing initiatives and collaborative research endeavors aimed at sustaining technological leadership.

To thrive in this dynamic environment, stakeholders must adopt a balanced approach that integrates cutting-edge hardware development with software-driven analytics, resilient supply chain management, and an unwavering focus on end-user outcomes. By aligning strategic actions with the actionable recommendations provided in this summary, organizations will be well positioned to capitalize on emerging growth corridors and manage inherent market risks.

In closing, the insights presented here are intended to serve as a strategic compass, empowering decision-makers to navigate both immediate challenges and long-term opportunities in the rapidly expanding 3D scanner domain.

Engage with Ketan Rohom to Unlock Full Access to Proprietary 3D Scanner Market Intelligence and Support Strategic Decision Making

For organizations seeking a comprehensive, data-driven foundation to inform strategic investment and operational planning in the 3D scanner domain, direct engagement with Ketan Rohom, the Associate Director overseeing Sales and Marketing, will unlock full access to the proprietary research and detailed analyses contained in the complete market report. By partnering early in the decision-making cycle, stakeholders gain a tailored overview of emerging growth corridors, competitive benchmarking, and sector-specific best practices crafted into actionable frameworks. Whether the priority is to refine product roadmaps, optimize supply networks, or strengthen customer-centric service models, a conversation with Ketan Rohom provides a seamless gateway to personalized insights and expanded data sets. Reach out to discuss customized reporting options, enterprise licensing arrangements, and expert consultation modules that can be integrated into broader organizational initiatives. Secure your strategic advantage today by tapping into the full repository of market intelligence designed to support market entry, expansion, and innovation in the rapidly evolving 3D scanner ecosystem.

- How big is the 3D Scanner Market?

- What is the 3D Scanner Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?