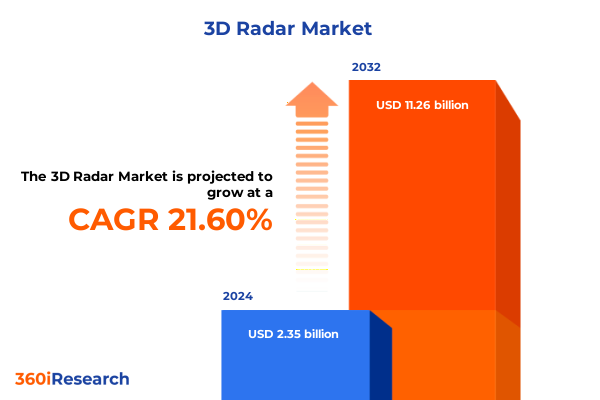

The 3D Radar Market size was estimated at USD 2.86 billion in 2025 and expected to reach USD 3.47 billion in 2026, at a CAGR of 21.63% to reach USD 11.26 billion by 2032.

Exploring the Evolutionary Leap of Three-Dimensional Radar Technologies Shaping the Future of Aerial, Maritime, and Terrestrial Surveillance Networks

Three-dimensional radar represents a pivotal advancement from conventional two-dimensional systems, delivering volumetric imaging that captures range, azimuth, and elevation with unprecedented clarity. This evolution in radar technology addresses the increasing demand for high-resolution detection capabilities across complex domains, including defense, civil aviation, and maritime security. By integrating digital beamforming and phased-array antenna designs, three-dimensional radar systems facilitate enhanced situational awareness, enabling operators to track multiple targets in cluttered environments while distinguishing altitude variations that were historically difficult to resolve. Such improvements are essential as aerial and surface threats grow more sophisticated, and as civilian applications expand into collision avoidance and weather monitoring, where precise spatial resolution can dramatically improve safety and efficiency.

As the global security landscape intensifies, the ability to rapidly detect, classify, and respond to diverse objects in three dimensions has become critical. Traditional two-dimensional radars often lack the vertical discrimination necessary for detecting modern aerial threats like low-flying unmanned aerial vehicles and cruise missiles. In contrast, three-dimensional radar architectures employ algorithms that process elevation data concurrently with azimuth and range, yielding a comprehensive picture of the operational space. These systems leverage advancements in high-performance computing and signal processing to deliver real-time volumetric imagery, supporting swift decision-making in time-sensitive scenarios. As both government agencies and commercial operators pursue next-generation surveillance solutions, three-dimensional radar stands at the forefront of innovation, offering multi-domain applicability and robust performance under challenging environmental conditions.

How Cutting-Edge AI Integration and Advanced Beamforming Are Redefining Three-Dimensional Radar Capabilities Across Defense and Civilian Sectors

The trajectory of three-dimensional radar innovation has been profoundly influenced by the integration of artificial intelligence and machine learning. Contemporary systems embed AI-driven algorithms to automate target detection, classification, and tracking, significantly reducing operator workload and enhancing situational awareness. These AI models, trained on vast datasets of radar returns, can adapt to complex electromagnetic environments characterized by signal overlap and interference. Consequently, modern three-dimensional radars can distinguish between benign objects and potential threats with remarkable accuracy, even under electronic warfare conditions. This synergy of AI and radar processing is accelerating the shift toward autonomous sensing platforms capable of continuous learning and adaptive performance in heterogeneous operational theaters.

Beyond software, hardware developments in digital beamforming and MIMO architectures are transforming three-dimensional radar capabilities. By controlling the phase and amplitude across large antenna arrays, these systems can generate agile, high-gain beams that scan volumetric space dynamically. Digital beamforming enables simultaneous multi-beam operation, delivering comprehensive coverage without mechanical rotation. Meanwhile, hybrid analog-digital MIMO approaches strike an optimal balance between performance and power consumption, facilitating compact, mobile deployments. These advances are not limited to defense; commercial applications such as air traffic control and autonomous vehicle radar rely on compact, cost-effective three-dimensional radar modules that harness the same beamforming principles to achieve real-time environmental mapping. This confluence of AI and advanced beamforming constitutes a transformative shift in radar design and deployment strategies.

Assessing the Far-Reaching Effects of United States 2025 Trade Tariff Policies on Three-Dimensional Radar Supply Chains and Cost Structures

In early 2025, the United States implemented a universal baseline tariff of 10 percent on all imported goods, effective April, which compounded existing duties and targeted measures affecting critical technology imports including radar components and semiconductors. For Chinese electronics, this baseline was layered atop Section 301 tariffs, resulting in semiconductor import duties escalating to 50 percent by mid-2025. These elevated tariffs have notably increased the cost base for three-dimensional radar systems, given their reliance on advanced integrated circuits, high-speed processors, and specialized radio-frequency front ends sourced globally.

The macroeconomic impact of sustained high tariffs on semiconductors has also manifested in broader budgetary pressures for radar manufacturers and end users. Economic modeling by the Information Technology & Innovation Foundation indicates that a 25 percent duty on semiconductor imports can reduce U.S. GDP growth by nearly 0.2 percent in the first year, rising to 0.76 percent over ten years if maintained, and potentially creating a net fiscal loss due to diminished economic activity. These factors translate into higher procurement costs for defense and civil programs, compelling organizations to absorb price increases or reallocate limited funds from modernization initiatives to supply chain mitigation strategies. Additionally, export controls on critical raw materials such as gallium and germanium have further disrupted radar component availability, underscoring the strategic necessity of diversified sourcing and domestic production investments to offset tariff-induced constraints.

Unveiling Critical Insights into Three-Dimensional Radar Market Segmentation by Frequency, Range, Deployment, Application, and End-User Dynamics

Examining three-dimensional radar through the lens of frequency band segmentation reveals distinct adoption trends. C Band systems have emerged as the workhorse for balanced coverage and resolution, serving medium-range surveillance and air traffic control, while L Band solutions continue to support long-range early warning due to their robust atmospheric penetration. S Band radars, with moderate range and resolution, are gaining traction in weather monitoring where volumetric precipitation mapping is critical. At the same time, X Band implementations are carving out a niche in high-resolution, short-range defense applications where precise target discrimination is paramount.

Range-based segmentation underscores the diversity of three-dimensional radar deployment. Solutions designed for distances under 50 kilometers address localized perimeter security and collision avoidance, requiring compact form factors and rapid scan rates. Mid-range systems spanning 50 to 150 kilometers dominate air and missile defense roles, balancing detection envelope size with resolution demands. Meanwhile, long-range radars exceeding 150 kilometers specialize in maritime domain awareness and strategic threat detection, leveraging high-power transmitters and large aperture arrays to extend surveillance far beyond national borders.

Deployment modes further distinguish three-dimensional radar capabilities. Airborne platforms utilize lightweight, low-SWaP (size, weight, and power) radars integrated onto fixed-wing and rotary aircraft to provide high-altitude volumetric imaging. Land-based installations, often incorporating multi-face arrays, deliver stationary, persistent coverage for critical infrastructure protection. Naval systems employ stabilized, gimbaled arrays to maintain horizon scanning and volumetric coverage in dynamic sea conditions, ensuring reliable situational awareness for surface and subsurface defense.

When viewed by application, air and missile defense remains the most advanced and heavily funded, driving innovations in electronic counter-countermeasures and network-centric integration. Air traffic control employs three-dimensional radars to manage increasing flight volumes with precise altitude resolution, enhancing safety and efficiency. Collision avoidance in automotive and unmanned systems leverages compact volumetric sensors for robust obstacle detection. Surveillance and reconnaissance platforms depend on three-dimensional imaging to distinguish moving targets in cluttered environments. Meanwhile, weather monitoring applications benefit from volumetric scanning to model atmospheric phenomena and predict severe weather events with greater accuracy.

From an end-user perspective, defense agencies dominate procurement due to the high capability demands of modern threat environments. Civil aviation authorities are increasing investments in three-dimensional systems to upgrade aging infrastructure and comply with NextGen and SESAR air traffic modernization programs. Marine operators leverage volumetric radars for navigation and collision avoidance in congested ports and offshore operations. Meteorological services integrate three-dimensional radar data into predictive models to advance climate research and public safety initiatives.

This comprehensive research report categorizes the 3D Radar market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Frequency Band

- Range

- Deployment

- Application

- End-user

Mapping Regional Dynamics: Analyzing Three-Dimensional Radar Adoption Patterns and Growth Drivers Across the Americas, EMEA, and Asia-Pacific

In the Americas, the United States leads the charge with significant defense modernization programs funding three-dimensional radar upgrades for both continental and expeditionary missions. Civil aviation regulators are concurrently investing in volumetric surveillance systems under the NextGen initiative, seeking to enhance airspace capacity and safety. Canada and Brazil are also deploying advanced radars for border security and maritime domain awareness, leveraging partnerships with domestic and international systems integrators to implement networked radar architectures.

Europe, the Middle East, and Africa present a heterogeneous landscape of radar adoption. NATO member states prioritize three-dimensional radar as part of collective defense posture, often through multinational procurement initiatives that harmonize capabilities across allied forces. The Gulf Cooperation Council has accelerated investments in maritime and ballistic missile detection to safeguard strategic waterways, while North African nations are beginning to incorporate volumetric radars for coastal surveillance and counter-smuggling operations. Regional defense collaborations are shaping procurement strategies, with several joint programs under development to pool resources and share technological expertise.

Asia-Pacific has become a dynamic arena for three-dimensional radar deployment. China’s defense industrial base has scaled domestic production of next-generation volumetric radars, emphasizing indigenization and export potential. India is upgrading its coastal defense and airspace surveillance networks with mixed portfolios of foreign-acquired and domestically produced systems. Northeast Asian powers, including South Korea and Japan, are integrating three-dimensional radars into layered air defense and missile defense architectures, often coupling them with space-based sensors. Southeast Asian nations, facing increasing regional tensions and maritime security challenges, are selectively acquiring compact three-dimensional solutions to bolster territorial monitoring and search-and-rescue capabilities.

This comprehensive research report examines key regions that drive the evolution of the 3D Radar market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators: Strategic Positions and Technological Advances Driving Competition in the Three-Dimensional Radar Industry

Leading defense contractors and technology firms are deeply engaged in the three-dimensional radar sector, each leveraging unique strengths to capture market share. A prominent systems integrator with a legacy in air defense has enhanced its volumetric radars with digital receivers and open-system architectures, enabling seamless upgrades and network integration. Another industry heavyweight, known for its aerospace heritage, has introduced compact airborne three-dimensional arrays incorporating AI-based signal processing for unmanned platforms, expanding the addressable market.

Specialized radar manufacturers are also gaining prominence by focusing on modular, scalable designs that facilitate rapid configuration changes for diverse missions. One European firm has unveiled a family of multi-beam arrays that can be tailored for maritime surveillance or ground-based air-defense roles through software-defined reconfiguration, reducing logistical complexity. A leading electronics provider has concentrated on millimeter-wave three-dimensional modules for autonomous vehicle and security applications, benefiting from its existing expertise in automotive radar technologies.

Collaborations between radar specialists and semiconductor innovators are driving semiconductor packaging and RFIC integration optimized for three-dimensional imaging. Joint ventures are exploring gallium nitride (GaN) amplifiers that deliver higher power density and efficiency, supporting extended-range volumetric scans. Partnerships are also forming between radar developers and artificial intelligence startups, combining domain-specific signal processing algorithms with advanced machine learning models to automate threat detection and reduce false alarms. As global programs increasingly prioritize interoperable, networked sensor webs, companies that excel in systems engineering, supply chain resilience, and software-defined capabilities are positioned to lead the three-dimensional radar market.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D Radar market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus Defence and Space

- Aselsan A.Ş.

- BAE Systems plc

- Bharat Electronics Limited

- Blighter Surveillance Systems Ltd.

- Cobham plc

- Elbit Systems Ltd.

- General Dynamics Corporation

- Hensoldt AG

- Honeywell International Inc.

- Indra Sistemas, S.A.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mitsubishi Electric Corporation

- Northrop Grumman Corporation

- Qatar Navigation

- RADA Electronic Industries Ltd.

- Raytheon Technologies Corporation

- Reutech Radar Systems (Proprietary) Limited

- Rheinmetall AG

- Saab AB

- Terma A/S

- Thales Group

Strategic Roadmap for Industry Leaders to Navigate Technological, Regulatory, and Supply Chain Challenges in Three-Dimensional Radar Deployment

Industry leaders should prioritize investment in AI-driven signal processing platforms that can be updated in the field to counter emerging threats and evolving operational requirements. By adopting open-system architectures and standardized interfaces, organizations can streamline integration with command-and-control networks and facilitate rapid deployment of software enhancements. This strategic focus will also reduce lifecycle costs by enabling modular upgrades rather than complete hardware replacements.

To mitigate tariff and supply chain risks, executives must diversify sourcing strategies and pursue partnerships that support domestic production of critical radar components, including RFICs, power amplifiers, and high-performance processors. Establishing dual-sourcing agreements and investing in regional manufacturing hubs can buffer against geopolitical disruptions and ensure continuity of supply for advanced radar programs. Concurrently, firms should explore collaborative research initiatives with academia and government laboratories to accelerate the indigenization of specialized materials such as gallium nitride and monolithic microwave integrated circuits.

Cultivating alliances across the defense and commercial sectors will unlock shared R&D resources and create economies of scale for emerging three-dimensional radar technologies. Joint development agreements with unmanned systems manufacturers, satellite operators, and cybersecurity providers can expand the application scope of volumetric radars, from persistent surveillance to integrated airspace management. Moreover, promoting interoperability standards and participating in multi-domain exercises will demonstrate system reliability to prospective customers and reinforce long-term procurement commitments.

Finally, companies must enhance their regulatory and compliance capabilities to navigate evolving export controls and tariff frameworks effectively. Proactive engagement with policymakers and trade bodies will enable organizations to anticipate regulatory shifts, advocate for balanced measures, and secure exemptions or favorable terms for critical radar components. By combining technological foresight with agile business models, industry leaders can capitalize on global opportunities while safeguarding against escalating trade and geopolitical complexities.

Uncovering Market Realities: Comprehensive Research Methodology Leveraging Primary Interviews, Secondary Data, and Expert Validation in Three-Dimensional Radar Analysis

This research leverages a mixed-methodology approach encompassing both primary and secondary data collection to deliver a comprehensive view of the three-dimensional radar market. Primary insights were obtained through structured interviews with senior defense procurement officers, radar systems engineers, and program managers across NATO member states, Asia-Pacific regional commands, and leading civil aviation authorities. These interviews provided real-world perspectives on capability requirements, procurement timelines, and integration challenges.

Secondary research included an exhaustive review of publicly available government procurement records, technical whitepapers, patent databases, and semiconductor industry reports to track technological advancements and supply chain dynamics. Trade publications and open-source analysis were scrutinized to identify recent tariff rulings, export control modifications, and strategic alliances impacting three-dimensional radar development. Patent filing trends were also analyzed to gauge the pace of innovation in beamforming, AI-based processing, and GaN power amplifier technologies.

Data triangulation was applied to validate findings, matching anecdotal evidence from industry experts with quantitative trends observed in government budgets, manufacturing statistics, and tariff schedules. An expert validation panel, consisting of former radar program directors and academic researchers, reviewed draft findings to ensure accuracy and relevance. Market segmentation frameworks were refined through iterative feedback, aligning frequency band, range, deployment mode, application, and end-user definitions with consensus industry standards.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D Radar market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D Radar Market, by Frequency Band

- 3D Radar Market, by Range

- 3D Radar Market, by Deployment

- 3D Radar Market, by Application

- 3D Radar Market, by End-user

- 3D Radar Market, by Region

- 3D Radar Market, by Group

- 3D Radar Market, by Country

- United States 3D Radar Market

- China 3D Radar Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings: The Imperative of Advanced Three-Dimensional Radar Systems in Strengthening Global Security and Operational Efficiency

The evolution of three-dimensional radar systems underscores the critical intersection of advanced hardware, sophisticated signal processing, and strategic policy considerations. Cutting-edge beamforming technologies and AI-driven processing engines have enabled volumetric imaging capabilities that were once the realm of science fiction, now deployed in defense, civil aviation, maritime security, and weather forecasting. Yet, the landscape is equally shaped by external factors such as trade policies, supply chain resilience, and international collaboration frameworks that dictate component availability and cost structures.

As global defense and civilian agencies modernize their surveillance infrastructures, three-dimensional radar stands out as a transformative enabler of multi-domain awareness and rapid decision-making. The industry’s competitive dynamics favor agile innovators who can deliver modular, interoperable solutions while navigating evolving tariff regimes and export control landscapes. Regional demand patterns highlight the need for tailored strategies that address the unique security priorities of the Americas, EMEA, and Asia-Pacific.

Ultimately, the successful deployment of three-dimensional radar will hinge on a balanced approach that integrates technological excellence with robust supply chain strategies and proactive regulatory engagement. Stakeholders who embrace open-system architectures, invest in domestic production, and cultivate cross-sector collaborations will be best positioned to capitalize on the burgeoning need for volumetric sensing solutions. This confluence of innovation, policy, and partnership will define the next chapter in three-dimensional radar’s ascent as an indispensable tool for safeguarding critical assets and ensuring operational superiority.

Connect with Ketan Rohom to Secure Your Comprehensive Three-Dimensional Radar Market Research Report and Accelerate Informed Decision-Making

To explore the full depth of market intelligence on three-dimensional radar and empower your strategic planning with detailed insights that span emerging technologies, regional trends, and competitive landscapes, reach out to Ketan Rohom today. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through the report’s comprehensive chapters and tailored data offerings, ensuring that you secure actionable intelligence aligned with your organization’s objectives and technological roadmap. Contact Ketan to arrange a personalized briefing, unlock executive summaries, and receive custom data modules that will inform your investment, procurement, and partnership decisions in the rapidly evolving three-dimensional radar market.

- How big is the 3D Radar Market?

- What is the 3D Radar Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?