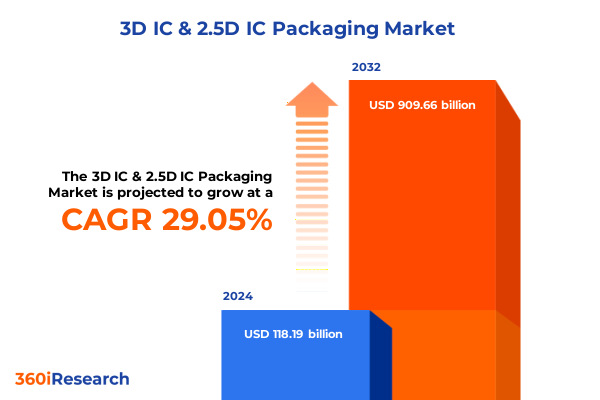

The 3D IC & 2.5D IC Packaging Market size was estimated at USD 151.02 billion in 2025 and expected to reach USD 192.98 billion in 2026, at a CAGR of 29.24% to reach USD 909.66 billion by 2032.

Emerging Paradigms in 3D and 2.5D Integrated Circuit Packaging Ushering a New Era of Performance and Miniaturization Across Diverse Industries

The rapid evolution of semiconductor devices has brought packaging technologies from passive enclosures to active enablers of performance, power efficiency, and form-factor innovation. As devices become smaller and integration densities skyrocket, conventional planar packaging approaches face limitations in interconnect length, thermal management, and signal integrity. Against this backdrop, three-dimensional and two-and-a-half-dimensional packaging architectures emerge as transformative enablers. These advanced integration techniques transcend the constraints of traditional substrates by vertically stacking die or arranging chiplets on high-density interposers, thus delivering unprecedented bandwidth, reduced latency, and enhanced energy efficiency.

Moreover, the convergence of heterogeneous integration demands packaging solutions that seamlessly support dissimilar materials and varied functional blocks-ranging from logic and memory to sensors and power devices-within a unified footprint. By embedding Through-Silicon Vias or leveraging silicon, glass, or organic interposers, manufacturers can realize compact systems capable of supporting next-generation applications such as artificial intelligence accelerators and high-speed networking. As a result, 3D IC and 2.5D IC packaging have garnered attention from both device makers and system integrators seeking to push the boundaries of miniaturization and performance.

This executive summary synthesizes the pivotal dynamics shaping advanced packaging adoption, from geopolitical headwinds to regional ecosystems, and offers strategic guidance for stakeholders aiming to capitalize on emerging opportunities. Through comprehensive analysis of technological advances, regulatory shifts, and competitive strategies, this document lays the foundation for informed decision-making in an era defined by rapid innovation and intensifying competition.

Transformative Shifts in Semiconductor Packaging Landscape Driven by Advanced 3D and 2.5D Integration Techniques and Material Innovations

The semiconductor packaging domain is undergoing a profound metamorphosis driven by breakthroughs in materials, processes, and design methodologies. Hybrid bonding techniques, for instance, have revolutionized interconnect density by enabling direct copper-to-copper contacts between die surfaces, thereby slashing power consumption and bolstering signal integrity. Concurrently, the refinement of micro-bump arrays and fine-pitch redistribution layers has accelerated the adoption of wafer-level chip-scale packaging in both two-and-a-half-dimensional and three-dimensional constructs.

Furthermore, the emergence of high-resistivity silicon interposers and low-temperature glass substrates has opened new frontiers for thermal dissipation and mechanical stability. These material advances support the integration of high-power components and complex RF modules essential for 5G networks and beyond. In parallel, design-for-manufacturing tools have integrated artificial intelligence to optimize placement, routing, and thermal forecasting, enabling steeper learning curves for design teams and compressing development cycles.

In addition, collaboration models between integrated device manufacturers, foundries, and OSATs (outsourced semiconductor assembly and test providers) have adapted to support chiplet-based ecosystems. Standardized chiplet interfaces and cross-vendor intercompatibility initiatives are fostering a modular approach that simplifies customization and accelerates time to market. As these transformative shifts gain momentum, they redefine the landscape for system designers and supply-chain actors alike, heralding a new era of modularity, scalability, and performance in semiconductor packaging.

Assessing the Cumulative Effects of 2025 United States Tariff Measures on Supply Chain Dynamics and Cost Structures in Advanced IC Packaging

In 2025, a series of tariff adjustments implemented by the United States government have introduced new complexities to the global semiconductor packaging supply chain. These measures, targeting key packaging substrates and certain advanced interconnect components, have elevated procurement costs and prompted a recalibration of sourcing strategies. As a result, manufacturers have embarked on alternative vendor qualification processes, diversifying their supplier portfolios to mitigate exposure to tariff-affected regions.

Transitioning production across borders has led to extended lead times and amplified inventory carrying expenses. Suppliers, in turn, have negotiated cost-sharing arrangements, absorbing portions of the incremental tariff burden to preserve order volumes and maintain competitive pricing. Nonetheless, the cumulative effect has strained project timelines for high-performance computing modules and telecommunications equipment, compelling design teams to factor in geopolitical risk from the initial product definition stage.

Despite these headwinds, some ecosystem participants have leveraged the tariff environment to accelerate investments in local manufacturing capacities. By forging partnerships with domestic OSATs and fostering joint development programs, companies aim to shorten supply feedback loops and align more closely with near-shore demand centers. Consequently, the tariff-induced realignment has spurred a wave of strategic collaborations and capacity expansions that may yield long-term resilience, even as short-term cost pressures persist.

Deep Insights into Market Segmentation Revealing Application and Packaging Technology Diversifications Propelling 3D and 2.5D Packaging Trajectories

Insights drawn from application segmentation reveal a tapestry of demand drivers guiding packaging preferences across diverse end markets. In advanced driver assistance systems and in-vehicle infotainment systems, where automotive OEMs prioritize reliability under thermal stress, three-dimensional packaging architectures deliver compact sensor fusion modules with robust thermal pathways. Consumer electronics segments, such as smartphones, tablets, and wearables, demand wafer-level chip-scale packaging techniques that optimize form factor without sacrificing radio-frequency performance in compact enclosures. Meanwhile, diagnostic equipment and medical imaging devices benefit from fine-pitch interposer substrates that enable high-resolution signal processing in portable and stationary healthcare platforms. At the same time, data center servers, base stations, 5G infrastructure, AI accelerators, and network equipment harness bridge, glass, and silicon interposers to drive bandwidth-intensive workloads with minimal latency.

Turning to packaging technology segmentation, the two-and-a-half-dimensional domain has flourished through the refinement of bridge interposers, glass interposers, and silicon interposers, each offering distinct balance points between cost, performance, and thermal conductivity. Silicon interposers, with their mature process node compatibility, continue to serve high-end applications, while glass interposers appeal to mid-range deployments seeking cost efficiencies at scale. Meanwhile, within three-dimensional constructs, Through-Silicon Via (TSV) integration underpins ultra-dense vertical interconnect schemes commonly applied in stacked memory and logic assemblies, and wafer-level chip-scale packaging streamlines the bonding process for heterogeneous die stacks.

Collectively, these segmentation insights illuminate the nuanced interplay between end market requirements and packaging capabilities, underscoring the importance of tailored technology selections in aligning performance goals with cost considerations.

This comprehensive research report categorizes the 3D IC & 2.5D IC Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Packaging Technology

- Component

- Application

Strategic Regional Perspectives Highlighting the Americas, EMEA, and Asia-Pacific Trends Shaping 3D and 2.5D Packaging Adoption and Innovation

Regional dynamics in the Americas are shaped by a robust ecosystem of design houses, foundries, and outsourced assembly and test providers concentrated in the United States and Canada. Government initiatives aimed at bolstering domestic semiconductor manufacturing have incentivized onshore capacity expansions, fostering collaborations between OEMs and regional fabricators. These programs not only alleviate lead-time uncertainties but also encourage the development of workforce competencies in high-precision packaging and testing. Conversely, Brazil and Mexico emerge as regional hubs for lower-cost assembly, capitalizing on geographic proximity and favorable trade agreements to support scale-oriented segments.

In Europe, the Middle East, and Africa, policy frameworks emphasize supply-chain diversification and digital sovereignty. European Union directives have galvanized investments in sustainable packaging materials and standardization of chiplet interfaces to reduce dependency on external sources. At the same time, Middle Eastern stakeholders are exploring greenfield foundries, positioning themselves as alternative supply nodes for critical substrate materials. African markets, though nascent in advanced packaging, show growing interest in specialized applications such as power electronics and distributed renewable energy systems, setting the stage for future growth trajectories.

Asia-Pacific remains the epicenter of OSAT activity, with established leaders in Taiwan, South Korea, and Japan driving innovation in both 3D and 2.5D domains. Mainland China’s policy-led push for semiconductor self-sufficiency has accelerated infrastructure build-out, while India’s emerging ecosystem benefits from technology partnerships and talent development initiatives. Collectively, this region’s vertically integrated supply chains and scale economies continue to exert downward pressure on manufacturing costs, even as geopolitical considerations spur selective relocation of critical processes.

This comprehensive research report examines key regions that drive the evolution of the 3D IC & 2.5D IC Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Spotlighting Strategic Collaborations Technological Prowess and Competitive Differentiators in IC Packaging

A diverse set of technology leaders and specialist OSATs define the competitive contours of the advanced packaging landscape today. Global assembly giants leverage scale and cross-site flexibility to meet rising demand across automotive, consumer, and data center verticals, while niche players differentiate through proprietary interposer fabrication techniques and materials science expertise. Collaborative ventures between foundries and OSATs have become commonplace, with joint offerings that streamline design-to-assembly workflows and reduce qualification cycles.

Integrated device manufacturers maintain an edge by aligning packaging roadmaps with silicon process nodes, ensuring targeted optimizations in interconnect density and thermal paths. These players have augmented their packaging portfolios through acquisitions of boutique assembly houses and investments in pilot lines for next-generation heterogenous integration. Meanwhile, leading semiconductor fabricators have unveiled open standards initiatives to foster interoperability among chiplet suppliers and system integrators, accelerating ecosystem development for modular designs.

Complementing these developments, specialized material suppliers and equipment vendors continue to introduce breakthroughs in underfill compounds, laser drilling systems, and metrology platforms. By collaborating closely with assemblers and design teams, these innovators refine processing windows and enhance yield predictability for both 2.5D interposer bonding and 3D stacked die assemblies. As a result, the industry’s collective push for higher performance and reliability is underpinned by a finely tuned network of stakeholders advancing complementary technologies.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D IC & 2.5D IC Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd.

- Broadcom Inc.

- ChipMOS TECHNOLOGIES INC.

- Fujitsu Semiconductor Ltd.

- GlobalFoundries Inc.

- Intel Corporation

- JCET Group Co., Ltd.

- Micron Technology, Inc.

- Powertech Technology Inc.

- Samsung Electronics Co., Ltd.

- Siliconware Precision Industries Co., Ltd.

- SK hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Tianshui Huatian Technology Co., Ltd.

- Tongfu Microelectronics Co., Ltd.

- United Microelectronics Corporation

Actionable Strategic Recommendations Empowering Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in IC Packaging Landscape

Leaders in the semiconductor packaging domain must prioritize strategic alignment between their integration roadmaps and overarching business objectives. Embracing standardized chiplet interfaces and participating in cross-industry consortia can reduce design fragmentation and accelerate ecosystem maturity. In parallel, companies should intensify investments in hybrid bonding and advanced interposer platforms to secure technology leadership in high-growth segments such as AI accelerators and next-generation telecom infrastructure.

Risk mitigation strategies remain essential in light of tariff uncertainties and geopolitical flux. Establishing dual-sourcing arrangements across multiple geographies not only hedges against supply disruptions but also provides negotiation leverage with key suppliers. Firms can further strengthen resilience by co-investing in regional assembly capabilities, aligning with governmental incentives, and cultivating local talent pools proficient in advanced packaging processes.

Finally, fostering a continuous innovation culture through in-house pilot lines, digital twins for process simulation, and integrated data-analytics platforms will enhance yield optimization and shorten time-to-market. By embedding sustainability criteria into material selection and energy management practices, organizations can appeal to environmentally conscious end customers and comply with evolving regulatory standards. Collectively, these actionable recommendations empower industry leaders to navigate complexity, capture emerging opportunities, and maintain a competitive edge in the rapidly evolving IC packaging landscape.

Comprehensive Research Methodology Leveraging Primary and Secondary Data Streams Ensuring Rigorous Analysis of 3D and 2.5D IC Packaging Markets

Our analysis integrates insights from a rigorous primary research program encompassing in-depth interviews with senior packaging engineers, supply chain directors, and design-center leaders. These expert dialogues spanned key regions and industry segments, uncovering nuanced perspectives on technology adoption, cost trade-offs, and qualification challenges. Concurrently, a comprehensive secondary research effort synthesized technical papers, patent filings, industry roadmaps, and quarterly financial disclosures to chart the evolution of packaging technologies.

Triangulation of data streams involved cross-referencing proprietary equipment shipment figures with public assembly site announcements and government incentive programs. This multilayered approach ensured that our conclusions rest on a balanced blend of quantitative indicators and qualitative insights. Furthermore, iterative validation workshops were conducted with a panel of practitioners to stress-test preliminary findings, refine assumptions, and incorporate real-world constraints observed in pilot production environments.

To enhance methodological transparency, we documented our research scope, data-collection instruments, and analytical frameworks in an appendix. Limitations associated with emerging technologies-such as variable yield trajectories for wafer-level processes or nascent standards for chiplet interoperability-were clearly delineated to guide interpretation of results. By adhering to these rigorous protocols, the study delivers robust, actionable insights for stakeholders navigating the complex terrain of 3D and 2.5D IC packaging.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D IC & 2.5D IC Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D IC & 2.5D IC Packaging Market, by Packaging Technology

- 3D IC & 2.5D IC Packaging Market, by Component

- 3D IC & 2.5D IC Packaging Market, by Application

- 3D IC & 2.5D IC Packaging Market, by Region

- 3D IC & 2.5D IC Packaging Market, by Group

- 3D IC & 2.5D IC Packaging Market, by Country

- United States 3D IC & 2.5D IC Packaging Market

- China 3D IC & 2.5D IC Packaging Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Concluding Perspectives Synthesizing Key Findings Underscoring Future Trajectories and Strategic Imperatives in Advanced IC Packaging Domain

Advanced three-dimensional and two-and-a-half-dimensional packaging solutions stand at the forefront of semiconductor innovation, addressing the mounting demands for higher performance, reduced power consumption, and smaller device footprints. This analysis has elucidated how material breakthroughs, process refinements, and collaborative ecosystem models are collectively reshaping design methodologies. Regional dynamics and policy interventions further nuance the landscape, presenting both opportunities and headwinds for stakeholders with diverse strategic priorities.

As tariff measures compel supply-chain realignments and diversification, the industry’s collective emphasis on resilience and agility has never been more pronounced. Insight into sector-specific application drivers, from automotive safety systems to data center compute accelerators, underscores the criticality of matching packaging architectures to performance requirements. Meanwhile, segmentation analysis highlights the tailored value propositions of silicon, glass, and bridge interposers alongside Through-Silicon Via and wafer-level integrations.

Looking ahead, continued focus on standardization, sustainable materials, and digitalized process control will catalyze further scaling of heterogeneous integration. By embracing the strategic recommendations outlined herein, industry participants can navigate complexity, optimize resource allocation, and capture the full potential of advanced IC packaging innovations. This journey demands proactive collaboration, disciplined execution, and an unwavering commitment to technological excellence.

Drive Strategic Advantage Now by Partnering with Ketan Rohom to Unlock Executive Insights into 3D and 2.5D IC Packaging Opportunities

Are you poised to transform your strategic roadmap with the most incisive insights in advanced IC packaging? Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure a tailored executive brief that delves deeply into the nuances of 3D IC and 2.5D IC packaging innovations. By partnering with Ketan, you gain priority access to proprietary analyses, industry benchmarks, and scenario-based recommendations designed to inform critical investment decisions.

Whether you aim to optimize your supply chain, accelerate time to market for next-generation devices, or establish competitive differentiation through cutting-edge integration techniques, this bespoke report will arm you with the clarity and confidence needed for executive-level deliberations. Contact Ketan today to arrange a confidential briefing or to request sample excerpts that highlight the transformative potential of this research.

Unlock unparalleled strategic advantage in a rapidly evolving landscape by leveraging the depth and rigor of this comprehensive study. Reach out now to translate advanced packaging insights into actionable pathways for growth and innovation.

- How big is the 3D IC & 2.5D IC Packaging Market?

- What is the 3D IC & 2.5D IC Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?