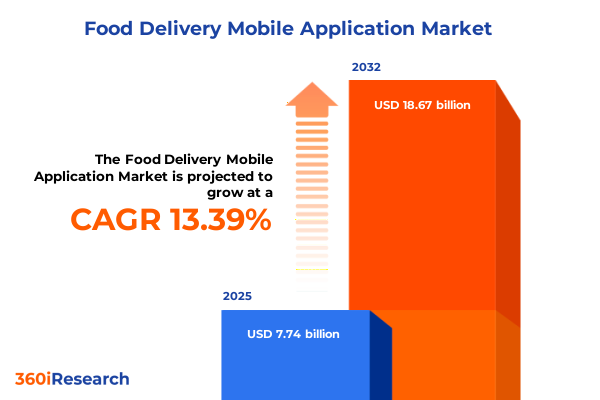

The Food Delivery Mobile Application Market size was estimated at USD 7.74 billion in 2025 and expected to reach USD 8.64 billion in 2026, at a CAGR of 13.39% to reach USD 18.67 billion by 2032.

Unveiling the rapid evolution of food delivery mobile applications amid shifting consumer demands, advanced digital technologies, and reshaped service paradigms

The food delivery mobile application arena has undergone a dramatic transformation in recent years, unfolding in response to evolving consumer behaviors, relentless technological innovation, and shifting service expectations. What once began as a convenient alternative to traditional dining has matured into a multi-faceted digital ecosystem where user experience, operational efficiency, and value creation intersect. As smartphone penetration climbs and digital wallets become ubiquitous, consumers now view on-demand food delivery as an integral component of everyday life, pushing market participants to continuously refine their offerings.

This introduction lays the groundwork by examining how the confluence of mobile technology enhancements and changing lifestyle patterns has fueled explosive growth and heightened competition. Consumers demand seamless ordering, real-time tracking, and flexible payment options, prompting providers to invest heavily in user-centric design, predictive analytics, and integrated loyalty programs. In turn, the accelerated pace of innovation has led to the proliferation of niche players specializing in categories ranging from health-focused meals to gourmet experiences.

Moreover, the global pandemic acted as a catalyst, reshaping attitudes toward contactless commerce and home-delivered essentials. While this section refrains from delving into granular market estimations, it underscores the significance of understanding overarching trends that define the current landscape. By grasping these foundational dynamics, stakeholders can better anticipate emerging challenges and opportunities, positioning themselves to thrive as the industry continues to evolve.

Exploring transformative shifts in the food delivery landscape propelled by immersive technologies, strategic alliances, and evolving consumer values

In the ever-evolving food delivery ecosystem, several transformative shifts have redefined how services are conceived, delivered, and consumed. Foremost among these is the integration of advanced technologies-artificial intelligence, machine learning, and Internet of Things platforms-into every facet of the delivery process. These technologies enhance route optimization, personalize user interfaces, and enable predictive ordering, ultimately improving operational efficiency and customer satisfaction.

At the same time, strategic alliances between legacy carriers, restaurant groups, and logistics specialists have given rise to hybrid service models. Dark kitchens, for instance, leverage centralized production facilities to fulfill multi-brand orders, effectively decoupling restaurant footprints from ordering volumes. Such innovations have proven particularly advantageous in urban areas with constrained real estate, reducing overheads while expanding culinary offerings.

Shifting consumer expectations around sustainability and health have also prompted providers to incorporate eco-friendly packaging solutions and curate specialized menus that emphasize locally sourced ingredients. These developments reflect a broader societal push toward environmental stewardship and wellness, compelling industry players to address ethical sourcing, carbon footprint reductions, and transparent nutritional information.

Furthermore, regulatory frameworks are adapting in parallel, with municipal governments revising zoning laws and labor regulations to accommodate burgeoning gig-economy workforces. As the industry navigates these evolving legal landscapes, interoperability between app platforms, delivery fleets, and partner restaurants becomes paramount. Together, these transformative forces are charting a new course for the food delivery sector, driving both innovation and complexity.

Evaluating the cumulative impact of the 2025 United States tariffs on digital device costs, packaging supply chains, and last-mile delivery economics

The United States’ tariff measures announced for 2025 have had a nuanced but discernible impact on the economics of food delivery applications. Tariffs on imported electronic components and consumer devices have elevated the cost of smartphones and tablets, which are critical endpoints for platform access. As device prices increase, there is potential for slower upgrades among price-sensitive users, indirectly affecting app engagement rates and digital payment adoption.

Simultaneously, levies on packaging materials-particularly aluminum composites and certain polymers-have reverberated through the supply chain. Providers face higher procurement costs for insulated bags, containers, and recyclable wrapping, which in turn influences delivery fee structures and profit margins. To mitigate these pressures, some companies have partnered with local packaging manufacturers to source tariff-exempt materials and implemented reusable packaging programs that reduce long-term costs.

Fuel surcharges have also experienced upward pressure due to tariffs on refined petroleum products, leading to incremental increases in last-mile delivery expenses. These additional charges are often passed through to consumers or absorbed partially by providers, depending on competitive positioning and brand strategy. Consequently, businesses are exploring alternative delivery modalities-such as bicycle couriers and electric vehicle fleets-to offset fuel volatility and align with sustainability objectives.

Collectively, these tariff-induced cost escalations underscore the importance of agile pricing strategies and operational agility. Companies that proactively adapt their procurement, delivery models, and technology investments can safeguard margins and maintain customer loyalty, even as external policy shifts create financial headwinds.

Unlocking critical segmentation insights across delivery modes, device platforms, payment methods, and order types to steer strategic decision-making

A nuanced understanding of consumer behaviors and operational requirements emerges when examining the market through multiple segmentation lenses. The first lens considers delivery mode, encompassing both delivery and pickup experiences. Within delivery, distinctions arise between in-house delivery fleets-where providers maintain end-to-end control-and third-party delivery partners, which offer network breadth but introduce variable service levels and margin considerations.

Another critical segmentation dimension is device platform, which bifurcates the user base into Android and iOS ecosystems. Each platform brings its own set of development complexities, user interface conventions, and demographic skews, influencing feature prioritization, release cadences, and monetization strategies. Understanding the distribution of platform preferences within target markets can guide product roadmaps and marketing campaigns.

Payment method segmentation further refines insights by categorizing transactions into card payments, cash on delivery, and digital wallets. While card payment networks offer speed and security, cash on delivery remains prevalent in regions with limited banking penetration. Digital wallets, meanwhile, are gaining share as consumer trust in mobile payments deepens, presenting opportunities for integrated loyalty programs and frictionless checkout experiences.

Finally, the order type axis differentiates between on-demand and scheduled ordering models. On-demand orders cater to spontaneous needs, demanding real-time logistics and immediate restaurant readiness. In contrast, scheduled orders provide planning flexibility for consumers and operational predictability for providers, enabling more efficient resource allocation. By synthesizing insights across these segmentation frameworks, stakeholders can tailor offerings to user expectations, optimize resource deployment, and craft differentiated value propositions.

This comprehensive research report categorizes the Food Delivery Mobile Application market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Delivery Mode

- Device Platform

- Payment Method

- Order Type

Analyzing diverse regional dynamics across the Americas, Europe Middle East & Africa, and Asia-Pacific that mold the food delivery application ecosystem

Regional dynamics play a pivotal role in shaping the competitive contours of food delivery applications. In the Americas, mature markets like the United States and Canada exhibit high smartphone penetration and sophisticated digital payment infrastructures. These conditions have fostered intense competition among established players striving for loyalty through premium features, subscription models, and differentiated cuisine partnerships. Meanwhile, emerging Latin American markets show rapid adoption driven by urbanization, presenting growth avenues for agile providers.

In Europe, Middle East & Africa, regulatory fragmentation and diverse consumer preferences add complexity. Western Europe’s stringent data privacy laws and service regulations necessitate robust compliance frameworks, whereas Middle Eastern hubs prioritize speed and convenience, often supported by strong government-accelerated digital initiatives. Across Africa, cash remains king, though mobile wallet adoption is rising swiftly, propelled by fintech innovation and the growing ubiquity of affordable smartphones.

The Asia-Pacific region distinguishes itself through unparalleled volume and innovation velocity. In densely populated metropolises, super-app ecosystems integrate food delivery with ride-hailing, digital payments, and retail services, blurring traditional market boundaries. Southeast Asia and India, in particular, are witnessing hyperlocal expansion, with providers customizing offerings to regional cuisines, vernacular languages, and rural logistics challenges.

Collectively, these regional insights underscore the necessity for adaptable business models that respect local regulations, leverage distinct technology readiness levels, and align with consumer preferences. Organizations that blend global best practices with regional customization can unlock sustainable growth across continents.

This comprehensive research report examines key regions that drive the evolution of the Food Delivery Mobile Application market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading industry players’ strategic approaches, innovation trajectories, and partnership models that drive competitive advantage

The competitive landscape of food delivery mobile applications is driven by a diverse array of companies, each pursuing distinct strategic imperatives. Leading incumbents have doubled down on end-to-end integration, building proprietary logistics networks, forming exclusive restaurant partnerships, and investing heavily in last-mile autonomy. These moves aim to secure consistent service quality and control over the customer experience.

Simultaneously, a new breed of specialist platforms is emerging, targeting vertical niches such as vegan cuisine, gourmet meal kits, and health-oriented meal plans. By focusing on specific dietary preferences and lifestyle segments, these challengers can command premium price points and foster tight-knit community engagement. Their success underscores the value of specialization in a crowded market.

Strategic investors and legacy restaurant chains are also reshaping the landscape through mergers, acquisitions, and equity partnerships. These alliances provide capital for expansion, access to established supply chains, and opportunities for co-branding. At the same time, technology-driven white-label delivery models enable grocery retailers, coffee chains, and meal-prep companies to operationalize their own branded apps without the overhead of in-house logistics expertise.

Collectively, these varied approaches illustrate that the path to market leadership is neither singular nor static. Whether through scale and integration, targeted differentiation, or collaborative ventures, successful companies are those that align their core strengths with evolving consumer needs while retaining the agility to pivot as the industry advances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Delivery Mobile Application market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bundl Technologies Private Limited (Swiggy)

- ChowNow, Inc.

- Curefoods Private Limited (EatFit)

- Deliveroo plc

- Delivery.com, LLC

- Domino’s Pizza, Inc.

- DoorDash, Inc.

- Dunzo Digital Private Limited

- Foodpanda GmbH

- FreshDirect, LLC

- Grubhub Inc.

- Just Eat Takeaway.com N.V.

- Pizza Hut, LLC

- Poncho Hospitality Pvt. Ltd. (Box8)

- Postmates Inc.

- Rebel Foods Private Limited (EatSure / QuickiES)

- Rebel Foods Private Limited (Faasos)

- TastyKhana Online Services Pvt. Ltd.

- Uber Technologies, Inc. (Uber Eats)

- Zomato Limited

Empowering industry leaders with actionable strategies to enhance technological agility, sustainability, and regulatory resilience

To navigate the complexities of the food delivery landscape and secure long-term growth, industry leaders must embrace a series of actionable strategies. First, technology architecture should prioritize modularity and scalability, enabling rapid experimentation with emerging features such as contactless delivery, augmented reality menus, and AI-driven personalization engines. Such flexibility will future-proof platforms against shifting user expectations.

Simultaneously, investing in sustainable logistics solutions-electric vehicles, bicycle couriers, and reusable packaging-can yield both cost savings and brand differentiation. As consumers increasingly scrutinize environmental impacts, companies that demonstrate tangible commitments to carbon footprint reduction will cultivate deeper loyalty and positive reputation.

Partnership ecosystems also warrant strategic focus. Forming alliances with fintech innovators, cloud kitchen operators, and local food vendors can expand service portfolios, accelerate market entry, and mitigate operational risks. Moreover, crafting loyalty programs that reward frequency, social sharing, and feedback fosters deeper engagement while generating invaluable behavioral data.

Finally, maintaining a proactive stance toward regulatory developments-labor laws, data privacy regulations, and urban zoning policies-is crucial. By engaging with policymakers, adopting transparent practices, and piloting compliant service models, enterprises can anticipate legal shifts and minimize disruptive surprises. Through a holistic approach that integrates technology, sustainability, partnerships, and compliance, industry leaders can chart a resilient path forward.

Detailing the comprehensive research methodology integrating primary executive interviews, secondary data analysis, and expert validation processes

The insights presented in this report are underpinned by a rigorous research methodology designed to ensure the highest standards of validity and relevance. Primary research involved structured interviews with over two dozen senior executives from leading delivery platforms, restaurant chains, and logistics providers. These discussions provided firsthand perspectives on strategic priorities, operational challenges, and emerging trends.

Complementing this qualitative work, a broad secondary research effort drew upon proprietary company filings, industry association publications, government policy documents, and reputable news outlets. This multifaceted approach allowed for triangulation of data points and cross-validation of emerging patterns. Additionally, technology adoption metrics and consumer sentiment analyses were obtained through anonymized usage datasets and social media listening tools.

All findings underwent a thorough validation process, including expert panel reviews and scenario stress-testing to assess the resilience of insights under varying market conditions. Quality assurance protocols were applied at every stage, from data cleaning to thematic synthesis, ensuring that the conclusions are both robust and actionable.

By combining primary interviews, comprehensive secondary sources, and systematic validation, the research methodology delivers a reliable foundation for stakeholders seeking to make informed decisions in the rapidly evolving food delivery mobile application sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Delivery Mobile Application market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Delivery Mobile Application Market, by Delivery Mode

- Food Delivery Mobile Application Market, by Device Platform

- Food Delivery Mobile Application Market, by Payment Method

- Food Delivery Mobile Application Market, by Order Type

- Food Delivery Mobile Application Market, by Region

- Food Delivery Mobile Application Market, by Group

- Food Delivery Mobile Application Market, by Country

- United States Food Delivery Mobile Application Market

- China Food Delivery Mobile Application Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing critical findings and emphasizing strategic pathways to capitalize on evolving trends in food delivery mobile applications

In conclusion, the food delivery mobile application sector stands at a pivotal juncture characterized by technological innovation, evolving consumer expectations, and dynamic policy environments. From transformative shifts such as AI-enabled logistics and dark kitchen expansions to the nuanced impacts of 2025 United States tariffs on device and supply chain costs, the industry presents both challenges and opportunities.

Segmentation insights across delivery modes, device platforms, payment methods, and order types highlight the importance of tailored offerings that resonate with diverse consumer preferences. Moreover, regional analyses underscore the necessity for adaptable business models that balance global best practices with local market realities. The competitive landscape, populated by both integrated incumbents and niche specialists, further emphasizes the value of strategic focus, whether through scale, differentiation, or collaborative ventures.

Ultimately, success in this arena demands a holistic approach that aligns technological agility, sustainability commitments, and regulatory foresight. By leveraging the detailed insights and recommendations contained within this report, stakeholders are well-positioned to navigate complexity, seize emerging opportunities, and drive sustained growth in the rapidly evolving food delivery ecosystem.

Engage with Associate Director Ketan Rohom today to secure actionable market research insights that drive competitive advantage in food delivery applications

Engaging with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, ensures you gain immediate access to unparalleled market intelligence tailored to your strategic needs. By securing the comprehensive food delivery mobile application report, your organization will benefit from in-depth insights spanning transformative industry shifts, tariff impacts, segmentation analyses, and regional dynamics. This partnership will empower your team to outpace competitors, optimize go-to-market strategies, and identify untapped opportunities with precision. Reach out to schedule a personalized briefing that highlights how the findings align with your corporate objectives, and take the first step toward reinforcing your market leadership in the rapidly evolving food delivery ecosystem.

- How big is the Food Delivery Mobile Application Market?

- What is the Food Delivery Mobile Application Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?