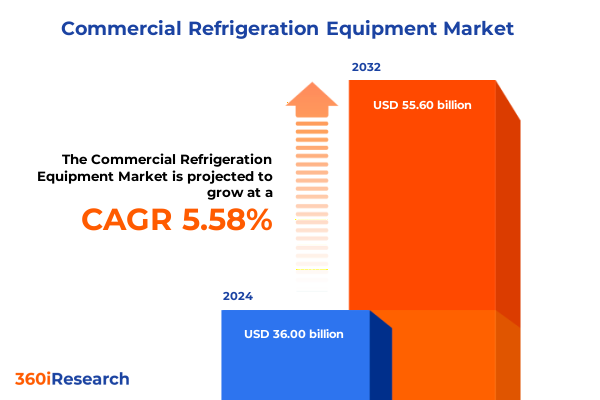

The Commercial Refrigeration Equipment Market size was estimated at USD 37.93 billion in 2025 and expected to reach USD 39.99 billion in 2026, at a CAGR of 5.61% to reach USD 55.60 billion by 2032.

Setting the Stage for Tomorrow’s Commercial Refrigeration Landscape Bridging Emerging Technologies with Evolving Market Demands

Commercial refrigeration equipment stands at the intersection of technological innovation, sustainability mandates and shifting end-user expectations. As global industries-from retail and hospitality to healthcare and logistics-increasingly rely on advanced cooling solutions to preserve perishables, pharmaceuticals and research materials, the landscape demands more from manufacturers and suppliers than ever before.

Emerging digital capabilities have begun to redefine expectations around energy efficiency, remote monitoring and predictive maintenance. At the same time, tighter environmental regulations are driving the adoption of low-impact refrigerants and novel cooling architectures. Against this backdrop, market participants are under pressure to balance cost optimization with rapid innovation cycles and rigorous compliance requirements.

This executive summary offers a concise yet comprehensive view of the forces that will shape the future of commercial refrigeration equipment. By illuminating the most consequential trends, tariff developments, segmentation insights and regional dynamics, it provides strategic leaders with a clear understanding of where to focus investments and how to adapt to a rapidly transforming marketplace.

How Digitalization, Sustainability Mandates and Technological Breakthroughs Are Driving Transformative Shifts in Commercial Refrigeration

In recent years, transformative technologies such as the Internet of Things, artificial intelligence and edge computing have fundamentally altered how commercial refrigeration equipment is designed, deployed and serviced. Intelligent sensors now furnish real-time data on temperature fluctuations, energy consumption and system health, enabling predictive analytics that shift maintenance from reactive to proactive. This digital pivot is enhancing uptime while optimizing lifecycle costs.

Concurrently, sustainability mandates have accelerated the transition away from high-global-warming-potential refrigerants toward hydrofluoroolefins and natural alternatives like ammonia and carbon dioxide. Manufacturers are responding with novel system architectures and retrofit solutions that comply with evolving environmental regulations while meeting performance expectations in demanding end-use scenarios.

The convergence of these digital and green imperatives is prompting equipment providers to forge new partnerships across technology and service ecosystems. Strategic alliances with software developers, component suppliers and service specialists are becoming critical to deliver integrated solutions that address the twin imperatives of operational efficiency and environmental stewardship.

Assessing the Multi-Dimensional Effects of 2025 United States Tariffs on Cost Structures, Supply Chains and Competitive Dynamics in Refrigeration

The implementation of increased tariffs on imported commercial refrigeration equipment and related components in 2025 has introduced significant cost pressures throughout the supply chain. Many manufacturers have confronted higher input costs for steel, aluminum and compressor assemblies sourced from key export markets. As a result, equipment pricing strategies have required swift recalibration to maintain margins while preserving competitive positioning.

Beyond cost considerations, the tariffs have prompted a reexamination of global sourcing networks. Equipment providers and distributors are exploring near-shoring opportunities in North America and diversifying component procurement to mitigate the risk of sudden policy shifts. Some industry leaders have accelerated investments in regional manufacturing footprints, leveraging incentives and trade agreements to offset duty impacts and minimize lead times.

On the downstream side, end users have become more selective in supplier negotiations, placing greater emphasis on total cost of ownership metrics. This has elevated the importance of lifecycle support services and energy-efficiency guarantees. To navigate these evolving dynamics, companies that can demonstrate resilient supply chains, transparent pricing models and robust service capabilities are gaining a clear competitive edge.

Understanding Diverse Segmentation Dynamics Across Product Types, Cooling Technologies, Refrigerants, Equipment Designs, Channels and End Users

Commercial refrigeration demand is shaped by a rich tapestry of product types, beginning with ice machines and extending into specialized medical refrigeration equipment-which itself encompasses blood bank refrigerators, laboratory refrigerators and freezers, as well as vaccine storage units. Merchandising and display refrigeration units address the visual merchandising needs of retail environments, while transport refrigeration units span container refrigeration, trailer refrigeration, truck refrigeration and van refrigeration solutions that support cold-chain logistics.

Cooling technology choices further diversify the market, ranging from absorption cooling systems prized for their quiet operation and use in facilities with waste heat sources, to mechanical compression designs that dominate mainstream applications, and thermoelectric cooling modules favored in niche, noise-sensitive contexts. Refrigerant type is a defining criterion, with hydrocarbon, hydrofluorocarbon and hydrofluoroolefin options coexisting alongside natural refrigerants such as ammonia (R717) and carbon dioxide (R744), each presenting distinct environmental and safety trade-offs.

Equipment design type segmentation highlights the importance of application context, from compact countertop units serving café-style establishments to reach-in and under-counter formats for commercial kitchens, up to large-scale walk-in cold rooms for industrial and food service operations. Distribution channels navigate between offline channels rooted in long-standing dealer networks and emerging online platforms that offer digital procurement workflows. End-use sectors span healthcare and medical environments-encompassing blood banks, hospitals, clinics and pharmacies-to industrial settings such as chemical processing plants and food and beverage facilities, research and laboratory applications in academic institutions, diagnostic labs and government research centers, diversified retail landscapes from convenience stores and specialty food shops to supermarkets and hypermarkets, and the broader transportation and logistics networks that rely on robust thermal management to maintain product integrity.

This comprehensive research report categorizes the Commercial Refrigeration Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Storage Volume

- Refrigerant Type

- Refrigeration System

- Price Tier

- Control Type

- Temperature Class

- Placement

- Distribution Channel

- End User

Unveiling Regional Nuances in Commercial Refrigeration Demand and Innovation Across the Americas, Europe Middle East Africa and Asia-Pacific Markets

Across the Americas, the United States and Canada lead advanced refrigeration adoption driven by stringent energy efficiency standards and incentives that reward low-global-warming-potential refrigerants. Latin American markets are witnessing a gradual modernization of cold-chain infrastructure, particularly in food distribution and pharmaceutical logistics, as private and public sectors invest in temperature-controlled facilities to reduce spoilage.

Within Europe, Middle East and Africa, European Union F-Gas regulations continue to phase down high-emission refrigerants, elevating demand for low-GWP alternatives and retrofit solutions. The Middle East’s investment in Cold Chain as a Service platforms for food imports and healthcare is catalyzing demand for containerized and modular refrigeration. In Africa, emerging retail formats and a growing pharmaceutical sector are generating nascent interest in both small-scale and industrial cold storage solutions while grappling with power reliability.

The Asia-Pacific region remains a growth engine buoyed by rapid retail expansion, burgeoning e-commerce penetration and government initiatives to bolster cold-chain networks for agricultural exports. In China and India, manufacturers are scaling local production of compressors and heat exchangers to serve both domestic and export markets, while Southeast Asian hubs are becoming strategic assembly bases for global refrigeration equipment OEMs.

This comprehensive research report examines key regions that drive the evolution of the Commercial Refrigeration Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants and Their Strategic Imperatives in Innovation, Partnerships and Competitive Positioning within Commercial Refrigeration

Leading companies in the commercial refrigeration equipment domain are navigating a landscape defined by rapid technological evolution and shifting regulatory frameworks. Global HVAC stalwarts and industrial refrigeration manufacturers are doubling down on software-driven solutions, embedding remote monitoring platforms and predictive maintenance capabilities into core product offerings to differentiate on total cost of ownership.

Strategic mergers and acquisitions have become a hallmark of competitive positioning, as firms seek to fill gaps in their product portfolios-whether by integrating low-GWP refrigerant technologies, expanding modular cold-room solutions or acquiring specialist service providers to reinforce aftermarket support. Partnerships with IoT and analytics providers are also on the rise, enabling real-time performance optimization and data visualization tools that empower end users to manage energy consumption and compliance reporting more effectively.

Innovation investment remains concentrated on sustainable refrigerant development and energy-efficient system architectures, supported by pilot projects that demonstrate the viability of ammonia-based chillers and novel compressor designs. In parallel, several companies are forging alliances with logistics and food service giants to co-create modular transport refrigeration units that balance thermal performance with weight and aerodynamic constraints.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Refrigeration Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Barr, Inc.

- Blue Star Limited

- Copeland LP

- Daikin Industries, Ltd.

- Danfoss A/S

- Dover Corporation

- Electrolux Professional AB

- Epta Group

- EVAPCO, Inc

- Frigoglass S.A.

- Fujimak Corporation

- Guangzhou Boaosi Appliance Co.,Ltd

- HABCO Manufacturing Inc.

- Haier Group

- Hettich Group

- Hoshizaki Corporation

- Imbera S.A. de C.V.

- Iron Mountain Refrigeration & Equipment, LLC

- ITW Food Equipment Group LLC

- Johnson Controls International plc

- KeepRite Refrigeration

- Kelvion Holding GmbH

- Master-Bilt Products, LLC

- Minus40

- MODINE MANUFACTURING COMPANY

- Panasonic Holdings Corporation

- ProCool

- Rivacold S.r.l

- Thermofin GmbH

- True Manufacturing Co., Inc.

- Voltas Limited by Tata group

Translating Market Intelligence into Strategic Actionable Recommendations for Industry Leaders to Secure Competitive Advantage and Drive Sustainable Growth

Industry leaders should prioritize the deployment of integrated digital platforms that unify remote monitoring, predictive analytics and energy-optimization algorithms. By leveraging real-time performance data, operators can minimize unplanned downtime and enhance compliance with evolving environmental regulations. Developing comprehensive service offerings that include proactive maintenance contracts will further reinforce customer loyalty and stabilize recurring revenue streams.

Investing in research and pilot programs for natural refrigerant adoption can position companies at the forefront of sustainability compliance, especially in jurisdictions phasing down high-GWP chemistries. At the same time, strategically diversifying global supply chains-through near-shoring, alternate supplier qualification and manufacturing footprint expansion-will help mitigate exposure to trade policy fluctuations and raw material constraints.

Fostering cross-industry collaborations with technology vendors, component suppliers and end-users can accelerate co-development of next-generation refrigeration architectures. Equally important is cultivating a workforce skilled in digital service delivery and regulatory navigation, ensuring that personnel can seamlessly manage advanced systems and support end-user needs in a complex compliance environment.

Detailing Rigorous Research Methodologies and Analytical Frameworks That Underpin Comprehensive Insights into Commercial Refrigeration Dynamics

This research integrates primary and secondary data collection to ensure the robustness of insights. Primary inputs include in-depth interviews with OEM executives, facility managers and cold-chain logistics providers, supplemented by a structured survey of end users across healthcare, retail, industrial and research laboratory segments. These qualitative engagements uncover critical decision criteria, pain points and innovation priorities.

Secondary research encompasses comprehensive reviews of regulatory filings, industry association publications and available environmental standards documentation to map the trajectory of refrigerant phase-down schedules and energy efficiency requirements. Company press releases, patent databases and technology white papers provide additional context on strategic partnerships, product launches and emerging system architectures.

Data triangulation is achieved by cross-verifying interview findings with market activity indicators-such as trade flows, procurement trends and publicly announced infrastructure investments-to validate observed patterns. Finally, expert panel workshops refine and contextualize draft conclusions, ensuring the final analysis aligns with real-world technological feasibility and regulatory timelines.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Refrigeration Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Refrigeration Equipment Market, by Product Type

- Commercial Refrigeration Equipment Market, by Storage Volume

- Commercial Refrigeration Equipment Market, by Refrigerant Type

- Commercial Refrigeration Equipment Market, by Refrigeration System

- Commercial Refrigeration Equipment Market, by Price Tier

- Commercial Refrigeration Equipment Market, by Control Type

- Commercial Refrigeration Equipment Market, by Temperature Class

- Commercial Refrigeration Equipment Market, by Placement

- Commercial Refrigeration Equipment Market, by Distribution Channel

- Commercial Refrigeration Equipment Market, by End User

- Commercial Refrigeration Equipment Market, by Region

- Commercial Refrigeration Equipment Market, by Group

- Commercial Refrigeration Equipment Market, by Country

- United States Commercial Refrigeration Equipment Market

- China Commercial Refrigeration Equipment Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2544 ]

Synthesizing Key Insights and Future Outlook to Provide a Cohesive Understanding of Critical Trends Shaping Commercial Refrigeration

The commercial refrigeration equipment market is undergoing a profound transformation driven by the convergence of digitalization, sustainability imperatives and trade policy realignments. Intelligent monitoring and predictive maintenance are redefining service paradigms, while low-global-warming-potential refrigerants are reshaping system design and lifecycle management.

Tariff adjustments in 2025 have underscored the importance of supply chain resilience and regional manufacturing strategies. At the same time, segmentation analysis highlights that growth pockets will emerge not only in traditional retail and food service but also in medical and laboratory applications requiring specialized temperature control solutions. Regionally, differentiated regulatory frameworks and infrastructure maturity continue to steer investment priorities-from advanced retrofits in North America and Europe to capacity expansions in Asia-Pacific and modernization projects in Latin America and the Middle East.

As leading companies intensify efforts around sustainable refrigerants, digital integration and aftermarket services, the competitive landscape will favor those who can deliver holistic solutions that address total cost of ownership, environmental compliance and operational reliability in equal measure.

Empowering Decision Makers to Take the Next Step Contact Ketan Rohom to Secure the Comprehensive Commercial Refrigeration Equipment Research Report Today

If you’re ready to elevate your strategic decision making with deep industry intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive commercial refrigeration equipment research report tailored to your needs. His expertise will guide you through the report’s detailed insights on technology adoption, tariff impacts, segmentation dynamics, regional nuances and competitive landscapes, enabling you to act decisively in a rapidly evolving environment.

By acquiring this report, you will gain a holistic understanding of the market’s transformative shifts, actionable recommendations for supply chain resilience, and clear perspectives on emerging opportunities across diverse end-use sectors. Contact Ketan Rohom to unlock the full suite of findings and position your organization to capitalize on sustainability mandates, digitalization trends and tariff-driven supply chain realignments. Step into the future of commercial refrigeration with the intelligence you need to stay ahead of the curve.

- How big is the Commercial Refrigeration Equipment Market?

- What is the Commercial Refrigeration Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?