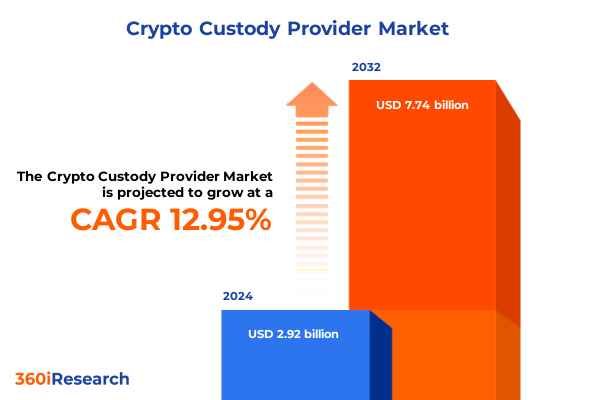

The Crypto Custody Provider Market size was estimated at USD 3.28 billion in 2025 and expected to reach USD 3.69 billion in 2026, at a CAGR of 13.05% to reach USD 7.74 billion by 2032.

Crafting a Compelling Overview That Illuminates the Strategic Importance and Rapid Evolution of Cryptocurrency Custody within the Modern Financial Ecosystem

The cryptocurrency market’s maturation has elevated custody solutions from niche technical offerings to core infrastructure components essential for institutional and retail confidence. As digital assets continue to gain mainstream acceptance, the role of secure custody has shifted from a back-office convenience to a strategic imperative for organizations managing significant holdings. This introduction outlines the broader context within which modern custody providers operate, setting the stage for an exploration of transformative forces reshaping the landscape.

Against a backdrop of growing regulatory scrutiny, technological innovation, and increasing demand from institutional investors, the custody market stands at a critical juncture. The following summary presents a holistic view of the current environment, emphasizing the drivers of change and key challenges. By understanding the foundational trends and forces at play, stakeholders can better navigate the complexities of selecting, implementing, and optimizing custody solutions that meet their security, compliance, and operational requirements.

Uncovering the Key Transformations and Technological Advances Reshaping the Future of Custody Security and Compliance

The past few years have witnessed seismic shifts in the custody landscape as firms navigate emerging threats and opportunities. Breakthroughs in secure enclave technology, such as hardware security modules and multi-party computation, have significantly strengthened the resilience of self-custody and third-party solutions alike. These advances have not only mitigated risk but also opened the door to new service models that blend on-chain isolation with real-time operational flexibility.

Concurrently, the convergence of regulatory frameworks across major jurisdictions has compelled custody providers to adopt more sophisticated compliance and reporting tools. The integration of blockchain analytics and real-time monitoring systems has become a baseline expectation, enabling seamless auditing and reinforcing trust with regulators and clients. Moreover, strategic partnerships between custodians and digital asset managers have facilitated bundled service offerings that address the full lifecycle of custody, from onboarding and tokenization to settlement and reconciliation.

Analyzing the Multifaceted Consequences of Recent United States Tariff Policies on Crypto Custody Operations and Supply Chain Dynamics

In 2025, new tariff measures introduced by the United States government targeting imported crypto mining and storage hardware have created significant cost pressures for custody operations. The imposition of additional duties on processing units, secure hardware modules, and specialized cold storage components has compelled providers to reassess supply chains and procurement strategies. In many cases, firms have accelerated efforts to qualify domestic suppliers or to redesign systems to minimize reliance on tariff-affected imports.

While the immediate impact has been an uptick in operational expenses, forward-looking custodians view this challenge as an opportunity to reinforce local manufacturing capabilities and to deepen collaboration with hardware innovators based within the country. By investing in research partnerships and co-development programs, several leading providers are working to deliver next-generation secure storage that aligns with evolving tariff regimes and long-term strategic autonomy goals.

Leveraging Comprehensive Multi-Dimensional Segmentation Analysis to Illuminate the Diverse Needs and Preferences of Custody Solution Users

Understanding the market through multiple segmentation lenses reveals nuanced insights into the needs and preferences of different client cohorts. Custody type segmentation highlights the growing momentum behind third-party custody as institutions seek robust cold custody, hot custody, and hybrid models that balance security with accessibility. Within this framework, cold custody solutions continue to dominate for high-value holdings, while hot custody gains traction for use cases requiring rapid settlement.

Examining provider types uncovers an increasingly competitive landscape. Crypto exchanges offering integrated custody services are vying with traditional custodial banks that leverage existing trust relationships. Dedicated crypto custodians differentiate through specialized security architectures, whereas digital asset managers and wallet infrastructure providers introduce innovative platforms that cater to niche requirements, such as decentralized finance use cases and tokenization support.

When assessing supported asset classes, it becomes clear that custodians are expanding beyond core cryptocurrencies to encompass NFTs and varied token categories. Altcoins, Bitcoin, Ethereum, and stablecoins constitute the bulk of traditional holdings, yet art, gaming, and metaverse NFTs are driving new demand for provenance and identity verification features. Governance, payment, security, and utility tokens each introduce custom requirements for key management and transaction workflows.

Functional segmentation underscores the holistic services now expected from custody providers. Compliance and reporting tools have been elevated to mission-critical status, while disaster recovery and backup solutions serve as vital risk management pillars. Key management protocols and secure asset storage remain foundational, complemented by tokenization support and transaction management platforms that facilitate seamless integration with trading and staking environments.

Finally, end-user segmentation highlights the broadening appeal of custody services. Corporate treasuries are exploring digital assets as capital management tools, crypto exchanges require robust settlement infrastructure, and native firms depend on integrated platforms to support product roadmaps. Meanwhile, government and regulatory bodies have turned to custodians for reliable auditing data, institutional investors demand enterprise-grade controls, and retail investors increasingly expect user-friendly custody interfaces.

This comprehensive research report categorizes the Crypto Custody Provider market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Custody Type

- Provider Type

- Supported Asset Classes

- Technology

- Access & Integration Modes

- Storage Method

- Application

- End-User

Exploring Regional Divergences in Regulatory Frameworks and Adoption Trends Impacting Crypto Custody Services Across Key Global Markets

Regional dynamics are shaping the custody market in distinct ways across the Americas, Europe, Middle East & Africa, and Asia-Pacific regions. In the Americas, regulatory clarity in key jurisdictions has fostered institutional adoption, driving demand for fully compliant, insured custody solutions. The United States remains a focal point, with continuing legislative debates around digital asset classification and custody licensing requirements.

Across Europe, Middle East & Africa, evolving frameworks such as MiCA in the European Union and sandbox initiatives in Gulf states are accelerating service expansion, enabling providers to pilot next-generation custody offerings under controlled regulatory oversight. Demand in major financial centers is driven by cross-border tokenization use cases and collaboration with traditional financial institutions.

In the Asia-Pacific region, a mosaic of regulatory stances is driving innovation in custody. Robust blockchain ecosystems in East Asia promote the integration of secure asset storage with decentralized finance applications, while Southeast Asian nations are positioning themselves as regional hubs by combining favorable tax regimes with progressive digital asset policies. Australia and New Zealand continue to advance licensing standards that prioritize operational resilience and client protection.

This comprehensive research report examines key regions that drive the evolution of the Crypto Custody Provider market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategies and Differentiators of Top Providers Defining Market Leadership in Crypto Custody Solutions

Leading incumbents in the custody sphere have solidified their positions through differentiated security architectures and strategic alliances. Crypto exchanges with custody arms are leveraging high-frequency trading platforms to offer seamless asset management, whereas specialized custodial banks capitalize on existing institutional relationships to cross-sell digital custody to treasury clients. Dedicated crypto custodians distinguish themselves through state-of-the-art secure enclaves and comprehensive insurance programs.

Digital asset managers are partnering with custody providers to deliver co-branded storage solutions that integrate directly into investment platforms. Meanwhile, wallet infrastructure firms are expanding their footprints by offering white-label custody modules that embed into third-party applications. Collaborative ecosystems are forming, bringing together technology vendors, compliance specialists, and insurance underwriters to create turnkey custody services tailored to specific verticals such as decentralized finance and tokenized securities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Crypto Custody Provider market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anchor Labs, Inc.

- Bakkt Holdings, Inc.

- BCB Digital Ltd

- Bitcoin Suisse AG

- BitGo Financial Services, Inc

- Circle Internet Group, Inc.

- Cobo

- Coinbase Global, Inc.

- CoKeeps Sdn Bhd

- Copper Markets (Switzerland) AG

- Custonomy

- Deutsche Börse AG

- Fidelity Digital Asset Services, LLC

- Fireblocks Inc.

- FORTRIS GLOBAL LTD

- Gemini Trust Company, LLC

- International Business Machines Corporation

- Ledger SAS

- Matrixport Technologies Ltd.

- New York Digital Investment Group LLC

- Orbitos

- Paxos Trust Company, LLC

- Riddle&Code

- Tangany GmbH

- The Bank of New York Mellon Corporation

- Tokensoft Inc.

- Venly NV

Defining a Strategic Blueprint for Custody Providers to Foster Innovation, Regulatory Cooperation, and Modular Client-Centric Solutions

Industry leaders must prioritize a strategic approach that balances security innovation with regulatory alignment. First, forging partnerships with hardware manufacturers and cryptographic research institutions will accelerate the development of secure, tariff-resilient custody architectures. At the same time, proactive engagement with regulators and participation in policy forums will ensure alignment with emerging licensing and reporting requirements.

Moreover, providers should focus on modular service offerings that cater to diverse customer segments. By architecting custody platforms with configurable compliance, backup, and key management modules, firms can address the specific needs of corporate treasuries, institutional investors, and retail users without sacrificing operational efficiency. Finally, advancing interoperability standards and API-driven integrations will position custodians as central nodes in the broader tokenization and digital asset ecosystem, driving stickiness and opening new revenue streams.

Ensuring Robustness Through a Multi-Layered Research Approach Combining Expert Interviews, Surveys, and Comprehensive Secondary Analysis

This analysis is grounded in a rigorous, multi-tiered research methodology encompassing primary and secondary data collection. Primary insights were obtained through interviews with senior executives at leading custody firms, hardware vendors, and regulatory bodies, ensuring firsthand perspectives on security innovations, compliance strategies, and operational challenges. Supplemental survey data captured sentiment and adoption patterns across diverse end-user groups.

Secondary research involved systematic review of regulatory filings, policy frameworks, technical white papers, and open-source blockchain analytics. Proprietary databases were leveraged to map partnerships, funding rounds, and product launches among custody providers. Quantitative analyses were conducted to validate thematic findings and to trace the evolution of technology and service models. All research activities were subject to stringent quality controls, including cross-validation of primary responses and triangulation against independent sources.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Crypto Custody Provider market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Crypto Custody Provider Market, by Custody Type

- Crypto Custody Provider Market, by Provider Type

- Crypto Custody Provider Market, by Supported Asset Classes

- Crypto Custody Provider Market, by Technology

- Crypto Custody Provider Market, by Access & Integration Modes

- Crypto Custody Provider Market, by Storage Method

- Crypto Custody Provider Market, by Application

- Crypto Custody Provider Market, by End-User

- Crypto Custody Provider Market, by Region

- Crypto Custody Provider Market, by Group

- Crypto Custody Provider Market, by Country

- United States Crypto Custody Provider Market

- China Crypto Custody Provider Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing the Imperatives of Security, Compliance, and Innovation to Define the Future Trajectory of Crypto Custody Solutions

The custody market stands at the confluence of security, compliance, and innovation. As institutional and retail adoption accelerates, providers that successfully navigate regulatory complexity, leverage advanced security protocols, and deliver tailored service modules will emerge as market leaders. The cumulative impact of evolving tariff policies underscores the importance of supply chain resilience and domestic collaboration in hardware development.

Looking ahead, the integration of custody services with tokenization ecosystems and decentralized finance platforms will unlock new opportunities for revenue growth and client engagement. Providers that invest in modular, API-first architectures and cultivate strong partnerships will be best positioned to capture the next wave of digital asset adoption. Ultimately, the custodial landscape will continue to mature, driven by technological advancements, regulatory clarity, and the expanding universe of digital asset use cases.

Take the Next Strategic Leap with Expert Guidance and Secure Your Access to the Complete Crypto Custody Market Research Report

We appreciate your interest in this comprehensive market research report. To secure access to the full document and unlock in-depth analysis on the evolving crypto custody landscape, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Connect with Ketan to discuss licensing options and receive a tailored package that aligns with your strategic priorities. Take the next step toward informed decision-making and empower your organization with actionable intelligence by contacting Ketan today

- How big is the Crypto Custody Provider Market?

- What is the Crypto Custody Provider Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?