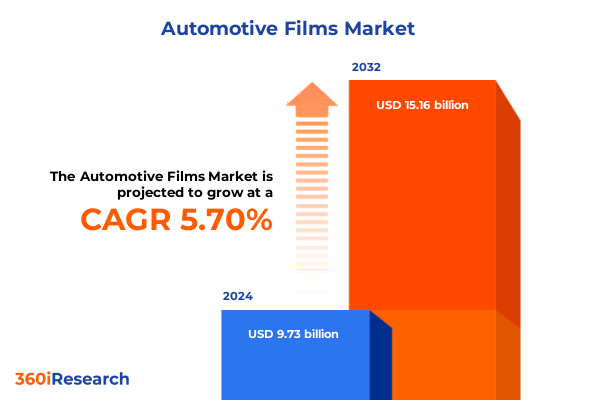

The Automotive Films Market size was estimated at USD 10.26 billion in 2025 and expected to reach USD 10.82 billion in 2026, at a CAGR of 5.74% to reach USD 15.16 billion by 2032.

Unveiling the Automotive Films Revolution: How Advanced Thin-Film Technologies Are Reshaping Vehicle Protection, Customization, and Industry Growth Trajectories

The automotive films industry stands at a pivotal juncture, as advanced polymer films redefine vehicle protection, customization, and safety standards across global markets. Over the past decade, innovations in thin-film materials have evolved from simple tinted window applications to multifunctional solutions that enhance scratch resistance, self-healing capabilities, and UV protection. This transformation is driven by rising consumer demand for personalized vehicle aesthetics and growing regulatory emphasis on occupant safety and environmental sustainability. As electric and autonomous vehicles gain momentum, the role of lightweight, durable films in weight reduction and interior comfort has become increasingly significant.

Simultaneously, the aftermarket sector has flourished, with professional installers deploying sophisticated pattern-mapping software and premium film products to meet diverse customer preferences. Meanwhile, original equipment manufacturers are integrating films during assembly to improve production efficiency and quality control. Transitioning seamlessly from traditional tinting services to holistic protective and decorative film offerings, industry stakeholders are forging new value chains that span raw material suppliers, technology innovators, and service providers.

Given these dynamics, understanding the interplay between material science breakthroughs, evolving regulatory landscapes, and shifting consumer behaviors is paramount for decision-makers. This executive summary outlines the transformative shifts, segmentation insights, regional nuances, and strategic imperatives shaping the automotive films sector today.

Navigating Shifting Currents: How Electrification, Digital Customization, Sustainability Trends, and Evolving OEM Approaches Redefine Automotive Film Applications

Emerging technologies and market forces are fundamentally redefining the automotive films landscape, ushering in a new era of innovation and application diversity. The rapid adoption of electric vehicles has accelerated demand for films that not only protect paint surfaces but also manage thermal loads on battery packs and glazing components. As a result, manufacturers are developing advanced ceramic and nanocomposite films to optimize heat rejection and enhance cabin efficiency.

Meanwhile, digital transformation has empowered installers with cloud-based pattern repositories and cutting-edge plotting software that streamline workflow and minimize waste. For instance, 3M’s Pattern Marketplace leverages a vast database of over 5,500 precision-tested film patterns accessible via a cloud interface, enabling installers to expedite installations with unparalleled accuracy and consistency. This development exemplifies how software-driven tools are converging with material innovations to elevate service quality and operational agility.

Sustainability concerns are likewise influencing material selection and manufacturing practices. OEMs and aftermarket players are prioritizing films free of harmful chemistries, aligning product portfolios with stringent global regulations. Avery Dennison’s new nanoceramic window film portfolio, featuring metal-free constructions that block up to 93% of infrared radiation, exemplifies this shift toward high-performance, eco-compliant solutions designed for next-generation vehicles.

Collectively, these transformative shifts underscore the importance of integrating material science, digital innovation, and sustainability imperatives to capture emerging growth opportunities and maintain competitive differentiation.

Assessing the 2025 Tariff Wave: Cumulative Effects of Section 232 and Section 301 Levies on Raw Materials, Components, and Operational Costs in US Automotive Film Production

In 2025, sweeping U.S. tariff policies have imposed significant cost pressures on both raw materials and finished components within the automotive films supply chain. Under Section 232 of the Trade Expansion Act, the administration enacted a 25% tariff on imported automobiles and light trucks effective April 3, 2025, later extending the levy to certain automotive parts, including specialized films used for paint protection and window tinting. Although USMCA provisions allow deductions for North American content, many film products imported from third-country markets now incur elevated duties that translate into higher input costs for manufacturers and installers.

Concurrently, potential tariffs on chemical feedstocks have created upstream disruptions. Industry analysis indicates that proposed levies of 25% on resin imports from Canada and Mexico, along with a 10% duties on resins sourced from China, could introduce volatility in pricing and supply continuity for key polymers such as PET, PVC, and TPU, which form the backbone of paint protection and wrap films. While these tariff measures aim to bolster domestic production, they have also prompted stakeholders to seek alternative sourcing strategies, including strategic stockpiling, nearshoring, and investment in local manufacturing capacities.

Overall, the cumulative impact of U.S. tariffs in 2025 underscores the need for supply chain resilience. Firms are reevaluating procurement strategies, engaging in proactive trade negotiations, and leveraging bilateral trade agreements to mitigate duty exposure and preserve margin stability.

Dissecting Diverse Market Segments: Comprehensive Product, Vehicle, Application, End-User, and Sales Channel Perspectives Shaping Automotive Film Demand Dynamics

Automotive films demand varies significantly across product categories and material compositions, reflecting diverse performance criteria and customer preferences. Paint protection films, for example, are segmented into polyester (PET), polyvinyl chloride (PVC), and thermoplastic polyurethane (TPU) variants, each offering distinct durability and self-healing attributes. Vehicle wraps, by contrast, prioritize color customization and brand messaging, leveraging high-tensile vinyl substrates. Window films are further differentiated into ceramic, dyed, and metallized options, addressing thermal control, glare reduction, and privacy needs.

Moreover, vehicle type exerts a defining influence on product adoption. Heavy and light commercial vehicles often require robust protective films to safeguard fleet assets, whereas passenger cars-ranging from hatchbacks and sedans to SUVs-drive substantial aftermarket customization under consumer preferences and lifestyle trends. Applications span exterior and interior domains, from full-body protection to dashboard, console, and door panel enhancements designed to provide UV protection and aesthetic refinement.

End-user segmentation reveals a balanced interplay between aftermarket channels-dominated by specialist installers and regional service networks-and original equipment manufacturers, which increasingly integrate films during assembly to streamline production processes. Sales channels encompass offline distribution through authorized dealerships and regional distributors as well as online platforms where end-users can order films directly for professional or DIY installation.

By understanding these segmentation dimensions, stakeholders can align product portfolios, marketing strategies, and service offerings to target high-growth niches and optimize resource allocation.

This comprehensive research report categorizes the Automotive Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Vehicle Type

- Application

- End-User

- Sales Channel

Unpacking Regional Variations: How the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets Drive Distinct Automotive Film Adoption and Growth Patterns

The Americas represent a dynamic landscape for automotive films, driven by robust aftermarket activity in the United States and Canada alongside growing demand in Latin American markets. In North America, strict protective regulations, coupled with high vehicle turnover, underpin a thriving paint protection and window tinting ecosystem, supported by a mature network of distributors and professional installers.

In Europe, Middle East & Africa (EMEA), regulatory frameworks governing vehicle safety and solar compliance-especially within the European Union-have prompted widescale adoption of high-performance films that meet stringent UV and thermal control standards. Meanwhile, Gulf Cooperation Council markets are witnessing escalating interest in premium ceramic window films to combat extreme heat, while South Africa and North Africa explore cost-effective dyed film solutions to balance performance and affordability.

Asia-Pacific continues to lead in production volume, with China, Japan, India, and Southeast Asian economies rapidly expanding both OEM and aftermarket segments. China’s automotive films industry benefits from integrated manufacturing clusters and low-cost resin inputs, while Japan and South Korea drive innovation in nano-ceramic and self-healing technologies. India and ASEAN countries are experiencing accelerating aftermarket penetration as consumer disposable incomes rise and vehicle customization gains mainstream appeal.

These regional dynamics highlight the importance of tailoring product strategies, distribution models, and regulatory compliance measures to local market conditions, ensuring that offerings resonate with regional performance expectations, climatic demands, and consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Automotive Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Industry Titans and Innovators: How Leading Players Are Driving Innovation, Partnerships, and Competitive Differentiation in the Automotive Films Arena

Leading industry players continue to advance automotive films through strategic innovation, partnerships, and targeted channel expansions. 3M, for instance, showcased its new Scotchgard™ Paint Protection Film Pro Series 200 and the forthcoming Series 150 Gloss at FESPA 2025, underscoring its commitment to installer-friendly adhesives, self-healing polymers, and a 10-year warranty to meet professional performance standards. Additionally, its cloud-based Pattern Marketplace offers over 5,500 verified patterns, reinforcing operational efficiency.

Avery Dennison has similarly elevated the automotive window film category with its new Encore™ portfolio, comprising three tiers-Encore™, Encore™ Supreme, and Encore™ Supreme IR-engineered with dye-free nanoceramic technology to repel up to 93% of infrared heat and block over 99% of UV rays. This metal-free design ensures seamless compatibility with electric vehicle electronics and enhances installer productivity through superior shrinkability and conformability.

XPEL has expanded its collaboration with Rivian, enabling Rivian R1T and R1S owners to order XPEL’s ULTIMATE PLUS™ Paint Protection Film and PRIME window film directly via Rivian’s Gear Shop, complete with a 5-year/60,000-mile warranty and certified installation network. This co-branded program exemplifies how leading providers are forging strategic alliances to enhance customer convenience and brand synergy in the aftermarket channel.

Eastman is driving operational transformation with Core, a comprehensive cloud software solution designed for paint protection and window film dealers. Core centralizes pattern management, VIN scanning, mobile weeding tables, and installation logging to streamline business processes and foster knowledge sharing across global networks, illustrating the convergence of software innovation and advanced materials.

Collectively, these initiatives by key companies are shaping competitive dynamics and setting new performance benchmarks in the automotive films market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADS Window Films Ltd.

- All Pro Window Films

- American Standard Window Film

- Avery Dennison Corporation

- Compagnie de Saint-Gobain S.A.

- Eastman Chemical Company

- Ergis SA

- FilmTack Pte Ltd

- FLEXcon Company, Inc.

- Garware Hi-Tech Films Ltd.

- Geoshield Window Films

- HEXIS S.A.S.

- Johnson Window Films, Inc.

- LINTEC Corporation

- Madico, Inc.

- Maxpro Window Films

- Nexfil USA

- Nitto Denko Corporation

- ORAFOL Europe GmbH

- POLIFILM GmbH

- SSA Europe Ges.m.b.H.

- StarTek, Inc.

- TORAY INDUSTRIES, INC.

- XPEL, Inc.

- Zeofilms

Strategic Imperatives for Success: Actionable Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Automotive Film Market Risks

To navigate the complexities of the automotive films market and capture emerging opportunities, industry leaders should prioritize several strategic imperatives. First, diversifying raw material sourcing across regions and leveraging bilateral trade agreements such as USMCA can reduce exposure to tariff volatility and enhance supply chain resilience. Investing in local manufacturing capabilities for critical polymers-particularly PET, TPU, and PVC-will further insulate operations from import duties and logistic disruptions.

Second, adopting digital workflow platforms and cloud-based pattern repositories will drive operational efficiency and support scalability. Firms should evaluate integration with advanced software tools that offer VIN-based pattern lookup, seamless order management, and real-time installation tracking. This technology stack not only accelerates delivery times but also elevates quality consistency and installer satisfaction.

Third, aligning product development with sustainability goals and regulatory compliance factors is essential. Companies should accelerate the transition to metal-free, nanoceramic formulations and invest in third-party certifications to meet increasingly stringent regional performance standards. Collaborating with OEMs on co-development initiatives will facilitate early adoption of innovative films in factory assembly, securing long-term contracts and driving volume growth.

Lastly, cultivating strategic partnerships with leading vehicle OEMs, leading fleet operators, and technology providers can unlock new market segments. Co-branding programs, such as customized PPF and window film offerings, serve as effective growth levers by enhancing brand recognition and customer loyalty. By integrating these actionable recommendations, organizations can fortify competitive positioning and drive sustainable growth in the evolving automotive films landscape.

Rigorous Research Methodology Explained: Integrating Desk Analysis, Primary Interviews, Data Triangulation, and Expert Validation to Ensure Comprehensive Market Insights

This research draws upon a rigorous, multi-faceted methodology designed to deliver robust and reliable market insights. We conducted extensive secondary analysis of industry publications, technical journals, and regulatory filings to identify macro-level trends in materials, tariffs, and regional regulations. Primary interviews were held with system integrators, professional installers, OEM procurement executives, and materials scientists to validate desk research findings and capture firsthand perspectives on market dynamics.

Data triangulation was applied by cross-referencing sales channel intelligence, materials procurement statistics, and installation service volume reports to ensure consistency and accuracy. Segmentation frameworks were tested through a combination of in-depth discussion guides and structured surveys administered to a representative sample of aftermarket installers and OEM suppliers. This approach enabled precise delineation of product, vehicle, application, end-user, and distribution channel perspectives.

Quantitative analysis focused on historical import‐export data, tariff schedules, and pricing benchmarks, while qualitative assessments explored the impact of technology innovations and strategic partnerships. Expert validation workshops were hosted with leading subject-matter experts from materials science, automotive engineering, and trade policy to refine assumptions and scenarios. Each step of the research process adhered to rigorous quality controls, ensuring that findings reflect current market realities and anticipate future inflection points.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Films Market, by Product Type

- Automotive Films Market, by Vehicle Type

- Automotive Films Market, by Application

- Automotive Films Market, by End-User

- Automotive Films Market, by Sales Channel

- Automotive Films Market, by Region

- Automotive Films Market, by Group

- Automotive Films Market, by Country

- United States Automotive Films Market

- China Automotive Films Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Conclusion and Market Outlook: Synthesizing Critical Automotive Film Insights to Guide Strategic Decision-Making and Future Investment Priorities

The automotive films industry is poised for sustained evolution, driven by intersecting forces of technological innovation, regulatory shifts, and changing consumer preferences. Advanced material formulations and digital workflow tools are elevating product performance and installation efficiencies, while sustainability imperatives are reshaping film chemistries and manufacturing practices. Regional variations underscore the need for localized strategies, as markets in the Americas, EMEA, and Asia-Pacific exhibit distinct climatic, regulatory, and consumer drivers.

Key players such as 3M, Avery Dennison, XPEL, and Eastman are setting new benchmarks through product innovation, strategic partnerships, and operational digitalization. These initiatives underscore the criticality of aligning R&D investments with emerging vehicle architectures-particularly electric and autonomous platforms-where lightweight, multifunctional films will play an increasingly vital role.

Actionable recommendations highlight the importance of supply chain diversification, digital integration, sustainability alignment, and collaborative co-development models. By adopting these strategic imperatives, organizations can mitigate tariff exposures, enhance supply continuity, and capture high-value market segments.

As the sector continues to expand and diversify, stakeholders who embrace technological foresight and operational agility will be best positioned to thrive. The convergence of advanced polymers, software solutions, and global trade dynamics heralds a new chapter in automotive films, one defined by resilience, innovation, and sustainable growth.

Secure Your Competitive Edge Today: Contact Ketan Rohom, Associate Director of Sales & Marketing, for Exclusive Access to the Definitive Automotive Films Market Research Report

Ready to elevate your organization’s strategic capabilities with in-depth intelligence on the automotive films sector? Take the next step toward gaining a competitive edge by securing the full market research report. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who can provide customized guidance, tailored pricing, and detailed sample chapters to address your specific business needs. Engage with an expert to understand the critical insights, robust data analyses, and forward-looking perspectives needed to inform your strategic decisions. Don’t miss the opportunity to transform uncertainty into actionable intelligence and accelerate your growth trajectory in the automotive films landscape; connect with Ketan Rohom today to initiate your comprehensive research journey.

- How big is the Automotive Films Market?

- What is the Automotive Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?