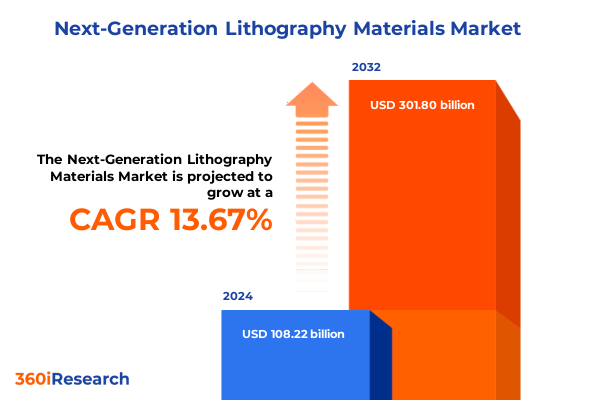

The Next-Generation Lithography Materials Market size was estimated at USD 122.32 billion in 2025 and expected to reach USD 138.27 billion in 2026, at a CAGR of 13.77% to reach USD 301.80 billion by 2032.

Driving the Semiconductor Revolution with Next-Generation Lithography Materials for Precision, Scalability, and Enhanced Device Performance

The landscape of semiconductor manufacturing has been fundamentally transformed by the advent of next-generation lithography materials, which serve as the foundation for fabricating ever-smaller, higher-performance devices. Innovations in photoresists and antireflective coatings now enable patterning at extreme ultraviolet wavelengths, breaking through the limitations of traditional deep ultraviolet processes. This evolution of materials science not only drives enhanced resolution and throughput but also underpins the cost efficiencies demanded by a competitive global market.

As device geometries shrink into the single-digit nanometer regime, the precision and defect control afforded by advanced resist chemistries become indispensable. Concurrently, novel coating formulations mitigate flare and standing wave effects, delivering sharper feature edges and consistent critical dimensions. In this context, material suppliers are collaborating closely with equipment manufacturers to co-optimize formulations for high-throughput tools, ensuring seamless adaptation across diverse lithographic platforms. Ultimately, these next-generation materials chart the path for continued innovation in logic, memory, and emerging photonic applications.

Unprecedented Technological Breakthroughs and Collaborative Ecosystems Rapidly Reshaping the Next-Generation Lithography Materials Frontier Globally

A wave of transformative shifts is redefining the lithography materials ecosystem, driven by breakthroughs in both chemistry and patterning strategies. The maturation of extreme ultraviolet platforms has catalyzed the development of chemically amplified resists capable of absorbing high-energy photons while maintaining low line-edge roughness. Parallel to this, directed self-assembly techniques are gaining traction as a complementary approach to achieve sub-10 nanometer features, leveraging block copolymer alignment to refine pattern fidelity. These technological advances are further complemented by the resurgence of nanoimprint lithography, which offers maskless patterning for specialized applications and rapid prototyping.

Equally important, multiple patterning methods continue to extend the life of existing deep ultraviolet infrastructure, enabling finer pitches through sequential exposure and etch steps. Electron beam lithography and ion beam techniques provide mask inspection and defect repair at the wafer scale, reinforcing yield in advanced nodes. Together, these shifts underscore a collaborative, multi-faceted approach to lithography that balances capital intensity with innovation, ensuring that the semiconductor industry can meet soaring demand for high-performance computing, connectivity, and sensing.

Assessing the Far-Reaching Cumulative Effects of 2025 United States Tariff Policies on Advanced Lithography Materials Supply Chains

The United States Trade Representative’s Section 301 tariff increases, effective January 1, 2025, impose duties of 50 percent on wafers and polysilicon and 25 percent on tungsten products imported from China. These measures directly affect key raw materials used in the production of antireflective coatings and resist precursor compounds, driving up input costs for domestic chemical suppliers and downstream toolmakers.

Simultaneously, a 20 percent import tax on advanced lithography tools from Dutch manufacturer ASML and 24 percent tariffs on Japanese equipment from firms such as Tokyo Electron and Screen Holdings elevate the capital expenditure for deep ultraviolet, low-NA and high-NA extreme ultraviolet systems by tens of millions of dollars per tool. The increased cost burden threatens to delay fab modernization projects, as surging equipment prices are passed through to integrated device manufacturers seeking to scale next-generation nodes.

Beyond direct equipment levies, broader semiconductor import tariffs are poised to ripple through the economy. A sustained 25 percent duty on chip imports has been projected to shrink U.S. GDP by 0.76 percent over a decade, equating to more than $1.4 trillion in cumulative output losses and eroding household purchasing power by over $4,000 per household by year ten. When combined, these policies risk undermining domestic manufacturing incentives, elevating costs across R&D, pilot lines, and full-scale production initiatives.

Strategic Insights into Market Segmentation That Illuminate Material Choices and Technological Pathways for Lithography Applications

Strategic insights into market segmentation reveal a nuanced landscape of material types, each optimized for distinct process requirements. Antireflective coatings are engineered to minimize reflections and improve imaging contrast, while photoresist chemistries are specialized for processes ranging from dry film applications to extreme ultraviolet exposure. Within the photoresist category, dry film resists maintain high thermal stability, EUV resists balance sensitivity with line-edge roughness control, and KrF formulations continue to provide cost-effective solutions for mature nodes.

From a technology standpoint, materials intersect with a spectrum of patterning platforms. Directed self-assembly brings block copolymer chemistry to the fore, enabling self-aligned pattern refinement, whereas electron beam lithography and ion beam methods facilitate maskless writing and inspection. Extreme ultraviolet lithography demands resists with exceptional photon absorption and radical diffusion control, even as multiple patterning sequences extend the capabilities of existing deep ultraviolet tools. Nanoimprint lithography further diversifies the toolkit, applying pressure and heat to transfer nanopatterns, ideal for both research-scale prototyping and certain high-volume applications.

Applications for these materials span traditional and emerging device classes. Coatings and resists are vital for fabricating LEDs and OLED displays with precise pixel geometries, as well as for manufacturing high-density MEMS and NEMS sensors that power next-generation IoT nodes. Photonic devices leverage advanced lithography for low-loss waveguides, while the semiconductor sector itself remains the core driver, encompassing integrated circuits, memory devices, and microprocessors that define performance benchmarks across computing and communications. These applications, in turn, serve a diverse set of end-use industries, from automotive electronics modules and infrastructure sensing in construction to consumer electronics, defense systems, medical devices, and telecommunications networks.

This comprehensive research report categorizes the Next-Generation Lithography Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Application

- End-Use Industry

Comparative Regional Dynamics Driving Lithography Material Adoption and Innovation Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics in the Americas are characterized by significant investments in localized R&D and nearshoring initiatives. Chemical suppliers and toolmakers in North America leverage strong government support for advanced manufacturing to bolster domestic capacity, particularly in photoresist formulation and coating services. Meanwhile, Latin American entities explore partnerships with North American fabs to establish regional supply chains, aiming to reduce logistics lead times and mitigate trade uncertainties.

Across Europe, the Middle East, and Africa, the interplay of stringent environmental regulations and robust aerospace and defense industries fosters innovation in low-VOC coating chemistries and high-reliability resist materials. European research consortia partner with global equipment vendors to co-develop formulations that meet rigorous safety standards while delivering performance at the cutting edge of extreme ultraviolet applications. In the Asia-Pacific region, domestic champions in China, South Korea, Japan, and Taiwan accelerate material development through integrated supply chains that unite resin producers, chemical engineering specialists, and advanced foundry operations, driving down costs and shortening development cycles.

This comprehensive research report examines key regions that drive the evolution of the Next-Generation Lithography Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Pioneers and Innovators Shaping the Next Wave of Lithography Material Solutions with Strategic Collaborations

A cohort of industry pioneers is steering the evolution of lithography materials through strategic collaborations and portfolio diversification. Leading equipment manufacturers collaborate closely with specialty chemical innovators to tailor resist and coating formulations for specific tool generations, ensuring optimal imaging performance and defect control. Concurrently, enterprises rooted in materials science are expanding into integrated solutions, bundling developer chemistries with process control tools to deliver turnkey offerings for advanced nodes.

In parallel, companies that historically focused on deposition and etch processes are forging alliances with photoresist suppliers to broaden their presence in the lithography workflow. These partnerships foster end-to-end process integration, reducing cycle times and enhancing yield. Meanwhile, emerging players specializing in organic-inorganic hybrid chemistries are attracting attention for their potential to deliver environmental sustainability and lower defectivity. Collectively, these efforts underscore a concerted push toward comprehensive, vertically integrated solutions that span material supply, process equipment, and metrology.

This comprehensive research report delivers an in-depth overview of the principal market players in the Next-Generation Lithography Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allresist GmbH

- Avantor, Inc.

- Brewer Science, Inc.

- DJ MicroLaminates, Inc.

- Dongjin Semichem Co. Ltd.

- DuPont de Nemours, Inc.

- Entegris, Inc.

- Fujifilm Holdings Corporation

- Irresistible Materials Ltd.

- JSR Corporation by JICC-02 Co., Ltd.

- Kayaku Advanced Materials, Inc. by Nippon Kayaku Co.,Ltd.

- KemLab Inc.

- Lam Research Corporation

- Merck KGaA

- micro resist technology GmbH

- Micron Technology, Inc.

- SACHEM, INC.

- Shin-Etsu Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Tokyo Ohka Kogyo Co., Ltd.

- Toppan Printing Co., Ltd

- Weifang Xingtaike Microelectronic Materials Co., Ltd.

Actionable Strategies and Practical Recommendations for Industry Leaders to Navigate Evolving Lithography Material Challenges and Opportunities

Industry leaders should prioritize R&D investments in resist chemistries that balance sensitivity with line-edge roughness, partnering with equipment vendors to accelerate co-development and validation cycles. In parallel, establishing cross-functional working groups that include material scientists, process engineers, and supply chain experts can streamline adoption and qualify materials across diverse toolsets. By embracing open innovation models, organizations can tap into external expertise while safeguarding core intellectual property.

Moreover, mitigating supply chain risk through strategic sourcing from multiple geographic regions will prove essential. Companies can leverage free trade agreements and bonded logistics zones to optimize inventory management, reducing exposure to sudden tariff changes or export restrictions. Finally, instituting continuous learning programs that upskill process engineers in the latest material handling and environmental, health, and safety protocols will enhance operational resilience and ensure compliance with evolving regulatory landscapes.

Robust Research Methodology Combining Primary Expert Interviews and Comprehensive Secondary Data Analysis to Ensure Unbiased Insights

This research employs a twin-track methodology combining comprehensive secondary data analysis with primary expert interviews. Secondary research sources include peer-reviewed journals, patent filings, technology roadmaps published by industry consortia, and regulatory filings from trade authorities. These insights have been triangulated to identify prevailing material trends, process bottlenecks, and emerging application domains.

To enrich quantitative findings, a series of in-depth interviews was conducted with senior technologists, process engineers, and supply chain leaders across semiconductor fabs, equipment suppliers, and specialty chemical vendors. Responses were validated through follow-up questionnaires and cross-referenced against field data, ensuring the reliability of qualitative inputs. This layered approach delivers a balanced perspective that captures both high-level market dynamics and ground-level operational realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Next-Generation Lithography Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Next-Generation Lithography Materials Market, by Type

- Next-Generation Lithography Materials Market, by Technology

- Next-Generation Lithography Materials Market, by Application

- Next-Generation Lithography Materials Market, by End-Use Industry

- Next-Generation Lithography Materials Market, by Region

- Next-Generation Lithography Materials Market, by Group

- Next-Generation Lithography Materials Market, by Country

- United States Next-Generation Lithography Materials Market

- China Next-Generation Lithography Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesis of Key Findings Emphasizing the Strategic Imperative of Adopting Next-Generation Lithography Materials for Future-Ready Manufacturing

The synthesis of technical breakthroughs, segmentation nuances, and regional dynamics underscores the strategic imperative of next-generation lithography materials in shaping the future of semiconductor manufacturing. As supply chain configurations evolve and tariff environments shift, organizations that align material innovation with process integration will secure leadership in high-value device segments.

Ultimately, the convergence of advanced chemistries, co-optimized equipment partnerships, and adaptive sourcing strategies will define competitive advantage. Decision-makers who embrace a holistic view-spanning R&D investment, regulatory foresight, and operational agility-will be best positioned to capitalize on the transformative potential of next-generation lithography materials.

Compelling Call to Engage with Ketan Rohom to Secure Comprehensive Market Intelligence for Next-Generation Lithography Material Innovations

I invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to gain unparalleled access to tailored insights that will empower strategic decision-making in next-generation lithography materials. His expertise in market dynamics and material innovation will guide you through the complexities of emerging technologies, ensuring that you secure competitive advantage through informed investments and partnerships.

By engaging with Ketan, you will obtain a comprehensive understanding of critical supply chain considerations, regulatory impacts, and technological breakthroughs. Reach out today to explore how this in-depth analysis can support your organization’s roadmap for seamless integration of advanced lithography materials and drive sustainable growth.

- How big is the Next-Generation Lithography Materials Market?

- What is the Next-Generation Lithography Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?