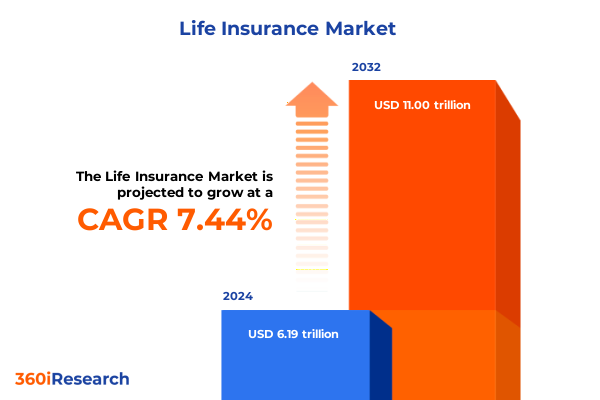

The Life Insurance Market size was estimated at USD 6.64 trillion in 2025 and expected to reach USD 7.13 trillion in 2026, at a CAGR of 7.47% to reach USD 11.00 trillion by 2032.

Navigating Complexity in Life Insurance Today with Insight into Market Drivers, Emerging Technologies, and Evolving Consumer Expectations

The life insurance industry stands at a crossroads, shaped by an intricate interplay of demographic shifts, technological innovation, and evolving consumer expectations. Recent decades have witnessed a surge in longevity, accompanied by heightened awareness of financial security and legacy planning. Meanwhile, advancements in data analytics and artificial intelligence are revolutionizing risk assessment and underwriting practices. As a result, insurers are grappling with both unprecedented opportunities and complex challenges as they strive to balance growth with sustainable profitability.

Against this backdrop, market participants must navigate an increasingly sophisticated regulatory environment that demands transparency, consumer protection, and robust capital adequacy. Additionally, a competitive landscape fueled by nimble insurtech newcomers is exerting pressure on established carriers to accelerate digital transformation. With consumers now expecting seamless digital experiences akin to other financial services, legacy systems and traditional distribution models risk obsolescence if they fail to adapt.

In light of these dynamics, understanding the core trends driving the life insurance sector is essential for executive decision makers. This introduction offers a foundation for exploring how shifting macroeconomic forces, regulatory changes, and technological advancements are collectively reshaping the market. By examining these developments, industry leaders can better anticipate future trajectories and position their organizations to thrive in an environment defined by both disruption and innovation.

Examining the Wave of Transformation Changing the Life Insurance Industry through Digital Innovation and Behavioral Data Integration

A wave of transformative change is sweeping through the life insurance industry, propelled by digital innovation, advanced analytics, and evolving regulatory standards. Insurtech entrants have disrupted traditional value chains, introducing automated underwriting processes and direct-to-consumer platforms. This acceleration of digital adoption is prompting incumbents to reevaluate legacy infrastructure, with many investing heavily in cloud migration, API integration, and digital policy administration systems. Consequently, the boundary between conventional insurers and technology firms is becoming increasingly blurred.

Simultaneously, consumer behavior is shifting toward personalized, usage-based products, driven by real-time data from wearable devices and telematics. Insurers are leveraging these data streams to refine risk pooling and to design dynamic premium structures that reflect individual lifestyle factors. This pivot toward personalization enhances customer engagement and loyalty, but it also raises new questions regarding data privacy, ethical underwriting, and the management of algorithmic bias.

Moreover, sustainability considerations and environmental, social, and governance (ESG) mandates are emerging as critical factors in investment strategies and product offerings. Insurers are increasingly integrating ESG criteria into asset allocation decisions and exploring green insurance products that support renewable energy projects and climate resilience. These shifts underscore the need for business models that are both financially robust and socially responsible, ultimately setting the stage for a more resilient industry in the years ahead.

Evaluating the Cumulative Effects of 2025 United States Tariff Policies on Insurance Cost Structures, Risk Assessment, and Premium Volatility

Recent tariff policies enacted by the United States government in 2025 are having a cascading impact on the broader insurance landscape, indirectly influencing life insurers through operational cost pressures and market volatility. While life insurance products are not directly subject to import duties, carriers are grappling with rising expenses in ancillary lines such as homeowners’ and auto insurance, which in turn affects their overall expense management strategies. According to industry researchers, tariffs on construction materials and vehicle components have increased repair and replacement costs, with potential downstream effects on carrier operating ratios and capital allocation decisions.

Beyond property and casualty segments, the cumulative effect of these tariffs is contributing to a more volatile investment backdrop. Swiss Re Institute analysis indicates that U.S. tariff measures have tempered global economic growth, with world GDP expansion projected to slow to 2.3% in 2025 from 2.8% in 2024, thereby weakening premium growth momentum across both life and non-life lines. For life insurers with significant exposure to equity markets, heightened trade tensions introduce additional risks in asset-liability matching, particularly for products with equity-linked features.

Furthermore, equity-linked policy portfolios and universal life products reliant on market performance may experience wider persistency fluctuations as policyholders reassess their financial commitments amid economic uncertainty. Commentators at JP Morgan highlight that although life insurers are relatively insulated from immediate cost hikes, prolonged trade tensions and associated currency volatility could affect reinsurance arrangements and cost of capital for jumbo blocks of business. Consequently, leading life insurers are reexamining their risk management frameworks to ensure resilience against a landscape marked by fragmented trade policies and macroeconomic headwinds.

Uncovering Strategic Customer and Product Segmentation Insights Driving Tailored Life Insurance Solutions across Diverse Market Segments

In today’s life insurance market, product offerings span a spectrum that includes endowment plans designed for savings and legacy planning, term life coverages tailored for duration-based protection needs, flexible universal life policies that adjust death benefits and cash values, variable life solutions linked to investment subaccounts, and traditional whole life contracts that emphasize guaranteed growth. Distribution channels have likewise evolved, encompassing agency models that deploy both captive and independent agents, bancassurance partnerships through bank branches and universal banking networks, broker networks, direct sales teams, and digital platforms accessible via mobile applications and websites.

Payment flexibility is also a pivotal factor shaping consumer choices, with regular premium structures allowing annual, monthly, or quarterly contributions, and single premium options serving those seeking immediate policy funding. Meanwhile, policy frameworks differentiate between group coverage, typically offered through employers and affinity associations, and individual policies that are underwritten on a one-to-one basis. Demographic segmentation further refines market focus, as insurers calibrate product design and marketing strategies for policyholders aged 25–34, who often prioritize cost efficiency and digital access; age cohorts 35–44 and 45–54, which balance wealth accumulation with coverage adequacy; the 55–64 bracket, concerned with retirement and legacy; and the 65-plus segment, focused on estate planning and estate tax mitigation.

By integrating these segmentation dimensions-product type, distribution channel, premium payment mode, policy type, and age group-insurers can develop targeted value propositions that resonate with distinct customer profiles. This approach not only enhances underwriting precision and customer satisfaction but also supports strategic portfolio diversification, enabling carriers to manage risk across multiple lines and demographic cohorts.

This comprehensive research report categorizes the Life Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Payment Mode

- Policy Type

- Coverage Duration

- Distribution Channel

Exploring Distinct Regional Dynamics Shaping Life Insurance Uptake and Innovation across the Americas, EMEA, and Asia-Pacific Markets

The Americas region exhibits mature life insurance markets characterized by high penetration rates, sophisticated regulatory frameworks, and robust distribution infrastructures. The United States leads with a diverse ecosystem of legacy carriers, digital innovators, and niche providers offering a wide array of product options. Meanwhile, markets in Canada and Latin America are experiencing divergent growth trajectories; Canada’s regulatory emphasis on consumer protection fosters greater transparency and policyholder confidence, while Latin American markets continue to grow from a lower base, driven by rising middle-class demand and increased financial inclusion.

In Europe, Middle East, and Africa, life insurance dynamics are shaped by regulatory harmonization efforts, such as Solvency II in Europe, and ongoing digital transformation across both traditional and frontier markets. Western European countries face the dual challenge of aging populations and low interest rate environments, prompting a shift toward unit-linked products and fee-based advisory models. In the Middle East, regulatory reforms and sovereign wealth fund activities are catalyzing demand for Sharia-compliant Takaful solutions, while African markets display significant underpenetration, with insurable events often covered through microinsurance and community-based mechanisms.

Across the Asia-Pacific corridor, rapid economic expansion and digital adoption are redefining life insurance distribution. Urban centers in China, India, and Southeast Asia witness accelerated uptake of mobile-first insurance services, leveraging e-commerce ecosystems and fintech partnerships. Regulatory bodies in several jurisdictions are encouraging open-data initiatives and digital licensing, facilitating quicker product approvals and broader market access. As such, Asia-Pacific stands out as the fastest-growing region, with incumbents and new entrants alike vying for leadership in next-generation insurance solutions.

This comprehensive research report examines key regions that drive the evolution of the Life Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Life Insurers and Their Strategic Moves to Navigate Competitive Pressures, Technological Disruption, and Regulatory Changes

Across the competitive landscape, leading insurers are pursuing differentiated strategies to capture market share and reinforce their market positioning. Established global players are doubling down on digital transformation roadmaps-integrating advanced analytics and customer relationship management platforms to deliver more personalized offerings. In addition, several large carriers are forging alliances with insurtech firms to enhance agility and to introduce modular, white-label solutions that can be rapidly deployed through partner ecosystems.

Simultaneously, mid-tier and regional specialists are carving out niche segments, such as wealth-management-oriented life policies for high-net-worth individuals, parametric insurance products for emerging market risks, and wellness-linked rider options that reward healthy behaviors. These targeted approaches often involve strategic partnerships with healthcare providers, fitness platform operators, and digital wellness startups, enabling insurers to create holistic value propositions that extend beyond financial protection.

Moreover, many of the top companies are reassessing reinsurance strategies to optimize capital efficiency and to address volatility introduced by new trade policies and macroeconomic uncertainty. By leveraging alternative capital solutions-such as insurance-linked securities and captive arrangements-insurers are diversifying risk transfers and improving resilience. This trend underscores a broader emphasis on building robust risk management frameworks capable of withstanding external shocks while supporting long-term strategic objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Life Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aetna Inc. by CVS Health

- AIA Group Limited

- Allianz SE

- American International Group, Inc.

- Assicurazioni Generali S.p.A.

- AXA S.A.

- Berkshire Hathaway Inc.

- Brighthouse Financial, Inc.

- Centene Corporation

- China Life Insurance Group

- China Pacific Insurance Co., Ltd.

- Chubb Limited

- Cigna Group

- Dai-ichi Life Holdings, Inc.

- Elevance Health, Inc.

- Guardian Life Insurance Company of America

- Humana Inc.

- Life Insurance Corporation of India

- Lincoln National Corporation

- Manulife Financial Corporation

- MetLife Services and Solutions, LLC

- MS&AD Insurance Group Holdings, Inc.

- Munich Reinsurance Company

- Nippon Life Insurance Company

- Ping An Insurance Company of China, Ltd.

- Prudential Financial, Inc.

- State Farm Group

- Tokio Marine Holdings, Inc.

- UnitedHealth Group Incorporated

- Unum Group

- Zurich Insurance Group AG

Actionable Recommendations for Life Insurance Leaders to Enhance Competitiveness through Digital Transformation, Customer Centricity, and Operational Agility

Industry leaders seeking sustained growth and resilience should prioritize digital enablement across the entire customer journey, investing in end-to-end platforms that automate underwriting, claims, and policy servicing. By harnessing machine learning and predictive analytics, carriers can streamline risk selection, reduce manual intervention, and improve speed to market. Furthermore, embedding digital self-service capabilities and API-driven integrations will elevate the customer experience, fostering greater engagement and retention.

To enhance portfolio performance, insurers should embrace data-driven product innovation, leveraging behavioral insights and telematics data to develop usage-based and wellness-aligned life policies. Strategic collaborations with health tech and wellness ecosystem partners can unlock new value streams while promoting healthier lifestyles among policyholders. Concurrently, embedding ESG considerations into investment mandates and product design will align insurers with growing stakeholder expectations around sustainability and social responsibility.

Operational agility is also paramount. Leadership teams should adopt robust scenario-planning frameworks to anticipate geopolitical shifts, regulatory changes, and market disruptions, including trade policy fluctuations. Through dynamic capital management and flexible reinsurance arrangements, carriers can mitigate downside risks while preserving the capacity to pursue opportunistic investments during market dislocations. Ultimately, a concerted focus on innovation, customer centricity, and risk resilience will enable life insurance enterprises to thrive in an increasingly complex environment.

Comprehensive Research Methodology Combining Quantitative Analysis, Qualitative Expert Interviews, and Market Data Synthesis for Rigorous Insights

This research combines quantitative market data with qualitative insights gathered through a rigorous multi-stage process. Initially, a comprehensive review of public filings, annual reports, regulatory filings, and trade publications provided a foundational understanding of industry dynamics and financial performance trends. Complementing the secondary research, in-depth interviews were conducted with C-level executives, product leaders, and digital transformation specialists across major life insurance carriers and insurtech firms to capture first-hand perspectives on strategic priorities and operational challenges.

Advanced data analytics techniques were applied to proprietary datasets encompassing policy issuance, lapse rates, claims experience, and customer satisfaction metrics, enabling detailed segmentation and benchmarking. Macro-economic and trade policy impacts were assessed through scenario modeling, incorporating input from leading economic research institutions and think tanks. This scenario-based approach ensured robust stress-testing of revenue models and capital adequacy under varying tariff and market volatility assumptions.

Finally, the findings were validated through a peer review process involving industry experts and academic advisors, ensuring the credibility and relevance of the insights. Throughout the research, stringent data governance protocols and ethical standards were maintained to safeguard confidentiality and data integrity, delivering a holistic and actionable market intelligence report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Life Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Life Insurance Market, by Product Type

- Life Insurance Market, by Payment Mode

- Life Insurance Market, by Policy Type

- Life Insurance Market, by Coverage Duration

- Life Insurance Market, by Distribution Channel

- Life Insurance Market, by Region

- Life Insurance Market, by Group

- Life Insurance Market, by Country

- United States Life Insurance Market

- China Life Insurance Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesis of Key Findings Highlighting Strategic Imperatives for Life Insurance Stakeholders in a Dynamic and Evolving Market Environment

The analysis presented herein underscores the complex interplay of demographic trends, technological disruption, regulatory evolution, and trade policy developments shaping the life insurance landscape. From the rapid digitization of distribution channels to the rise of personalized and usage-based products, insurers are being called upon to redefine their operating paradigms. Moreover, the indirect effects of U.S. tariffs in 2025 highlight the importance of integrated risk management and capital allocation strategies that account for external economic shocks.

Segmentation insights reveal that multi-product portfolios, diversified distribution networks, and flexible premium modes are critical levers for capturing heterogeneous customer needs across age groups and policy types. Regional analysis further emphasizes that market maturity varies significantly, with established markets requiring optimization and emerging markets necessitating innovation and financial inclusion initiatives.

Key company profiles demonstrate that incumbents and challengers alike are investing in digital ecosystems, strategic partnerships, and alternative capital structures to bolster resilience and competitive advantage. Actionable recommendations focus on enhancing digital capabilities, fostering customer centricity, and strengthening operational agility. Collectively, these strategic imperatives chart a clear path forward for life insurers aiming to unlock growth and deliver sustainable value in a dynamic industry environment.

Engage with Ketan Rohom to Access the Full Life Insurance Market Research Report Tailored for Decision Makers Seeking Competitive Insight Now

To gain a strategic edge in a rapidly evolving life insurance market, decision makers are invited to explore the full depth of our research findings. Ketan Rohom, Associate Director of Sales & Marketing, is ready to guide you through tailored insights that address your specific business challenges and opportunities. By partnering with Ketan, you will receive personalized support in interpreting the data, benchmarking against competitors, and identifying actionable growth paths that align with your organizational priorities.

Engaging with Ketan ensures that you access a comprehensive suite of resources, including detailed market analysis, executive briefings, and competitive intelligence. Whether you are developing new product innovations, refining distribution strategies, or optimizing operational efficiencies, his expertise will help translate complex market dynamics into clear, impactful strategies. Reach out today to secure your copy of the full life insurance market research report and begin driving transformative outcomes within your organization.

- How big is the Life Insurance Market?

- What is the Life Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?