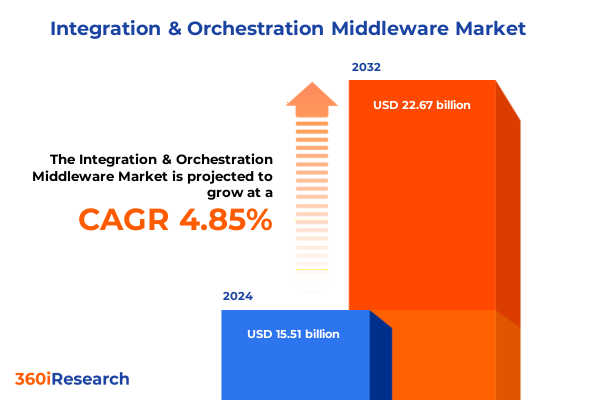

The Integration & Orchestration Middleware Market size was estimated at USD 16.26 billion in 2025 and expected to reach USD 17.05 billion in 2026, at a CAGR of 4.86% to reach USD 22.67 billion by 2032.

Unveiling the Imperatives and Core Drivers Shaping Integration and Orchestration Middleware in Today’s Dynamic Digital Ecosystem for Strategic Advantage

Amid the accelerating pace of digital transformation initiatives, organizations of all sizes are confronted with a complex technology ecosystem where data silos and disparate applications impede innovation and operational agility. Integration and orchestration middleware has emerged as the critical fabric that binds together APIs, messaging platforms, data pipelines, and legacy systems to deliver seamless workflows and real-time insights. By orchestrating data and services across on-premises infrastructures and multi-cloud environments, these middleware solutions empower enterprises to rapidly adapt to shifting market demands and maintain competitive differentiation.

As digital ecosystems burgeon with microservices architectures, event-driven processes, and AI-infused automations, middleware is evolving from a mere connectivity enabler into an intelligent layer that governs, secures, and monitors interactions across the enterprise. This transformational shift underscores the imperative for strategic middleware adoption as businesses seek to streamline operational complexities, accelerate time to market, and derive actionable intelligence from distributed data assets. In this context, it becomes essential to comprehend both the foundational drivers and emerging inflection points shaping the integration and orchestration middleware landscape

Navigating the Paradigm Shift as Organizations Embrace Cloud-Native Architectures Event-Driven Models and API-First Approaches for Seamless Connectivity

The integration and orchestration middleware market is witnessing a substantial paradigm shift driven by the migration to cloud-native architectures and the widespread adoption of containerization and microservices. Traditional monolithic service buses are increasingly supplemented or replaced by lightweight, event-driven platforms that facilitate asynchronous communication between decoupled services, thereby enhancing scalability and resilience. Concurrently, organizations are embracing API-first strategies to expose critical data and capabilities as reusable services, enabling ecosystem expansion through partner integrations and developer communities.

In tandem with these developments, the rise of low-code and no-code integration tools is democratizing access to middleware capabilities, allowing business analysts and citizen integrators to automate routine processes and construct composite applications with minimal coding expertise. Furthermore, orchestration engines are evolving to incorporate AI-driven insights that optimize workflow execution paths, predict performance bottlenecks, and recommend remedial actions. As a result, enterprises are pursuing composable architecture models that fuse integration, orchestration, and intelligent automation into cohesive platforms capable of driving continuous innovation

Assessing the Cumulative Effects of United States Tariff Measures Implemented in 2025 on Supply Chains Costs and Strategic Middleware Deployments

In 2025, a series of tariff adjustments by the United States government targeting critical technology imports has introduced new cost variables and supply chain complexities for middleware vendors and end users alike. Increased duties on semiconductor components have elevated hardware acquisition costs, indirectly impacting the total cost of ownership for on-premises middleware appliances and network infrastructure. These cost pressures have reinforced the value proposition of cloud-based and subscription-based middleware delivery models, which offer greater financial flexibility and mitigate upfront capital expenditures.

Beyond hardware pricing, service providers have experienced logistical bottlenecks and longer lead times for specialized networking equipment, prompting strategic shifts toward localized sourcing and diversified vendor contracts. Organizations with global footprints are proactively reevaluating their integration roadmaps to balance compliance with cost optimization, exploring risk mitigation through multi-region deployment strategies and vendor-neutral architectures. Consequently, middleware decision-makers are prioritizing agility and modularity to buffer against future tariff fluctuations and geopolitical uncertainties

Deriving Actionable Insights from Market Segmentation Across Solution Types Deployment Modes End User Industries Organization Sizes and Component Offerings

Diving into solution type reveals a broad spectrum of middleware offerings where API management, encompassing API gateways and developer platforms, spearheads the drive for secure and scalable service exposure. Legacy enterprise service buses remain entrenched in traditional on-premises environments, yet next-generation ESBs with lightweight, cloud-native capabilities are gaining ground by facilitating microservices integration. In parallel, ETL tools have bifurcated into cloud-centric ETL services optimized for dynamic scaling and traditional ETL suites that continue to support complex batch processing scenarios. Integration Platform as a Service platforms have expanded their footprints through advanced, core, and data integration variants that cater to diverse orchestration requirements, while middleware tools span database middleware for optimized data access and messaging middleware for robust event routing.

When observing deployment modes, cloud adoption continues its upward trajectory as hybrid cloud architectures blend private cloud environments for compliance-sensitive workloads with public cloud platforms that deliver elasticity and on-demand provisioning. Pure private cloud deployments serve regulated industries requiring stringent data residency controls, while public clouds appeal to fast-growing digital-native enterprises seeking rapid global expansion. This coexistence of deployment modes underscores the importance of middleware solutions capable of bridging heterogeneous environments.

Evaluating end user industries highlights differential adoption curves across sectors. Banking and insurance entities leverage high-throughput API gateways and core data integration to support digital channel expansion, whereas healthcare payers and providers prioritize interoperability frameworks that align with regulatory mandates. IT services firms and telecom operators exploit messaging middleware to underpin network function virtualization and service orchestration, while discrete and process manufacturing enterprises harness ETL and ESB integrations for production line automation. Retail operations, spanning brick and mortar and e-commerce, rely on database middleware and API management to deliver frictionless omnichannel experiences.

The segmentation by organization size further refines the middleware narrative. Large enterprises command comprehensive integration portfolios that span on-premises and multi-cloud landscapes, while upper and lower medium enterprises navigate a delicate balance between cost-efficiency and architectural sophistication. Micro enterprises often gravitate toward turnkey, SaaS-based middleware solutions to bootstrap digital capabilities with minimal overhead. Lastly, the component perspective divides the market between services-encompassing professional services and support and maintenance-and solutions, which include software and tools designed for rapid deployment and continuous enhancement

This comprehensive research report categorizes the Integration & Orchestration Middleware market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Solution Type

- Deployment Mode

- End User Industry

Examining Regional Adoption Patterns and Growth Dynamics Spanning Americas Europe Middle East Africa and Asia-Pacific in Integration Middleware Demand

In the Americas region, integration and orchestration middleware is characterized by rapid cloud adoption and a strong focus on API-driven digital ecosystems. North American enterprises emphasize security, compliance, and developer experience, driving investments in advanced API gateways, developer portals, and event mesh architectures. Latin American organizations, while navigating variability in digital infrastructure maturity, are increasingly leveraging cloud-based middleware to modernize legacy applications and accelerate e-commerce initiatives.

Europe, the Middle East, and Africa present a tapestry of regulatory frameworks and digital transformation priorities. Western European nations advance toward stringent data protection regimes and open banking standards, fostering robust adoption of middleware solutions with built-in security and governance capabilities. In the Middle East, strategic national initiatives fuel cloud-first integration strategies to support smart city and digital government programs, while Africa’s emerging markets capitalize on platform-as-a-service offerings to leapfrog traditional IT infrastructure constraints.

Across Asia-Pacific, diverse technology landscapes manifest in both mature and fast-growing markets. Developed economies in the region showcase high penetration of next-generation ESBs and enterprise-grade API management, whereas emerging markets in Southeast Asia and India are driving middleware deployments through mobile-first use cases and fintech innovations. Throughout the region, hybrid cloud architectures are pivotal in balancing global collaboration with local data residency requirements, reinforcing the need for middleware platforms that offer flexible deployment options and comprehensive governance frameworks

This comprehensive research report examines key regions that drive the evolution of the Integration & Orchestration Middleware market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Emerging Contenders Driving Competitive Differentiation through Platform Capabilities Partnerships and Strategic Investments

A cohort of established technology providers continues to dominate the middleware sphere through strategic platform expansions, strategic acquisitions, and deep partner ecosystems. Global software powerhouses differentiate their offerings by embedding artificial intelligence and analytics features for proactive issue detection and performance optimization, while leveraging extensive professional services networks to guide large-scale implementations and custom integrations.

Simultaneously, a vibrant ecosystem of emerging contenders is reshaping competitive dynamics. Agile iPaaS specialists emphasize rapid time to value and user-friendly interfaces that empower citizen integrators. Open source communities champion lightweight messaging and event streaming frameworks that attract developer adoption and foster extensibility. Collaboration between platform vendors and managed service providers is intensifying, with joint offerings that package hosted middleware services alongside consulting and managed operations, thereby democratizing advanced integration capabilities for mid-market and growth-oriented organizations

This comprehensive research report delivers an in-depth overview of the principal market players in the Integration & Orchestration Middleware market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACI Worldwide

- Axway Inc.

- Boomi, LP

- Covisint Corp.

- elastic.io GmbH

- Infor Inc.

- Informatica Inc.

- International Business Machines Corporation

- Jitterbit, Inc.

- Microsoft Corporation

- OpenText Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- SnapLogic Inc.

- SPS Commerce, Inc.

- SWIFT

- TIBCO Software, Inc.

- Truebyl by Eppix eSolution Limited

- Workato, Inc.

Providing Pragmatic Actionable Recommendations to Industry Leaders for Optimizing Middleware Investments and Accelerating Digital Transformation Initiatives

Industry leaders should prioritize investment in cloud-native middleware platforms that support container orchestration and serverless functions, thereby delivering unmatched scalability and deployment agility. By adopting API-first governance frameworks and standardizing on event-driven patterns, organizations can accelerate the creation of composable digital services while minimizing integration debt. Additionally, establishing a centralized middleware center of excellence staffed by cross-functional experts ensures adherence to best practices, promotes reusable assets, and fosters mobile DevOps alignment.

To mitigate the impact of tariff-induced cost variances and supply chain disruptions, procurement teams must cultivate strategic relationships with multiple hardware and software vendors, negotiate cloud service credits, and explore localized deployments that reduce reliance on imported equipment. Embracing automated monitoring and AI-driven self-healing capabilities within middleware environments not only enhances system reliability but also frees valuable IT resources to focus on innovation. Finally, fostering continuous learning programs and certification pathways for integration professionals will bolster organizational resilience and support sustained digital transformation journeys

Outlining a Rigorous Research Methodology Encompassing Primary Expert Interviews Secondary Data Analysis and Validation through Industry Benchmarks

This research draws upon a comprehensive primary research framework, commencing with in-depth interviews and workshops involving C-level executives, integration architects, and IT operations leaders across diverse industries and geographies. These qualitative insights were complemented by detailed surveys that captured technology adoption patterns, deployment preferences, and strategic priorities directly from practitioners driving integration initiatives.

Secondary data sources encompass publicly available vendor documentation, technical white papers, patent filings, and cloud platform usage reports. These resources were meticulously analyzed to validate platform capabilities, roadmap trajectories, and competitive landscapes. The findings underwent rigorous validation through an advisory board comprised of industry analysts, integration experts, and veteran practitioners to ensure objectivity, relevance, and alignment with real-world deployment scenarios

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Integration & Orchestration Middleware market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Integration & Orchestration Middleware Market, by Component

- Integration & Orchestration Middleware Market, by Solution Type

- Integration & Orchestration Middleware Market, by Deployment Mode

- Integration & Orchestration Middleware Market, by End User Industry

- Integration & Orchestration Middleware Market, by Region

- Integration & Orchestration Middleware Market, by Group

- Integration & Orchestration Middleware Market, by Country

- United States Integration & Orchestration Middleware Market

- China Integration & Orchestration Middleware Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Core Findings to Illuminate the Future Trajectory of Integration Orchestration Middleware and Its Role in Enabling Business Agility

Integration and orchestration middleware stands at the nexus of enterprise modernization, empowering organizations to dismantle silos, accelerate innovation, and derive strategic value from their digital investments. The convergence of cloud-native architectures, API-first paradigms, and intelligent automation heralds a new era in which composable, resilient, and self-optimizing integration platforms become indispensable. As the landscape continues to evolve under the influence of regulatory shifts, geopolitical developments, and emerging technologies, decision-makers must adopt a proactive posture, continuously refining their middleware strategies to sustain competitive resilience and operational excellence.

Looking forward, the trajectory of middleware is poised to intersect with emerging trends such as edge computing, blockchain-enabled integration, and AI-driven decision orchestration, unlocking novel use cases and revenue streams. Organizations that harness these developments with strategic foresight and robust governance frameworks will be best positioned to steer their digital transformation journeys toward enduring success

Engage with Ketan Rohom to Access In-Depth Market Insights Gain Strategic Clarity and Propel Your Integration Orchestration Middleware Decisions

To gain unprecedented clarity into the evolving integration and orchestration middleware landscape and to secure a comprehensive competitive advantage, you are invited to connect with Ketan Rohom, the Associate Director of Sales & Marketing. Through this collaboration, you will receive personalized guidance on how this market research report can align with your strategic priorities and drive accelerated decision making.

Engaging directly with Ketan ensures that you can delve into customized insights, discuss tailored licensing options, and explore value-added services designed to maximize your return on investment. Take the next step toward informed technology leadership by reaching out to Ketan Rohom and unlocking the full potential of your middleware strategies today

- How big is the Integration & Orchestration Middleware Market?

- What is the Integration & Orchestration Middleware Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?