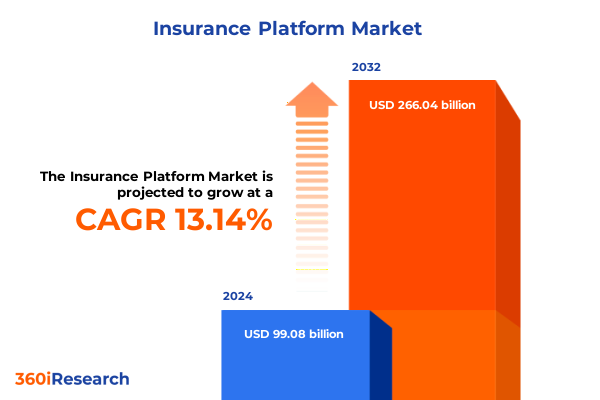

The Insurance Platform Market size was estimated at USD 111.88 billion in 2025 and expected to reach USD 126.34 billion in 2026, at a CAGR of 13.17% to reach USD 266.04 billion by 2032.

Harnessing Digital Transformation, Customer-Centric Innovations, and Regulatory Agility to Thrive in Today’s Competitive Insurance Ecosystem

The insurance platform landscape is undergoing a rapid evolution driven by the convergence of technological innovation, shifting consumer expectations, and a complex regulatory environment. Organizations that once relied on legacy systems are facing mounting pressure to modernize their operations, enhance customer engagement, and harness data more effectively. In this context, insurers are increasingly seeking solutions that deliver seamless digital experiences, robust analytics, and scalable architectures that can adapt to future challenges.

Navigating this dynamic market requires a clear understanding of the forces shaping industry priorities. On one hand, regulatory bodies continue to introduce new compliance requirements aimed at protecting consumers and ensuring market stability. On the other hand, end-users-whether individuals or enterprises-demand personalized, on-demand access to insurance services that mirror the effortless interactions they experience in other digital sectors. This dual imperative has elevated the role of integrated platform solutions as essential enablers of both compliance and customer satisfaction.

Against this backdrop, carriers and technology providers are forging partnerships to co-develop next-generation offerings that leverage cloud-native architectures, modular design, and open APIs. These collaborations are designed to accelerate time-to-market for innovative products, streamline claims processing, and improve risk assessment through real-time data insights. As a result, incumbents and new entrants alike are positioning themselves to capitalize on emerging growth opportunities while strengthening their resilience against competitive and operational risks.

Driving Industry Evolution Through Technological Breakthroughs, Data-Driven Insights, and Risk Management Redefinitions

The insurance sector is witnessing a profound shift as technological breakthroughs and changing risk landscapes drive new business models and service paradigms. Artificial intelligence and machine learning have moved beyond proof-of-concept, empowering carriers to automate routine tasks, personalize policy offerings, and detect fraud with unprecedented accuracy. These capabilities, once the domain of Silicon Valley start-ups, are now integral components of enterprise-grade platforms.

Simultaneously, embedded insurance models are redefining distribution channels by integrating coverage offers into everyday digital transactions. Whether purchasing travel tickets, renting vehicles, or buying consumer electronics, customers increasingly encounter insurance options at the point of purchase. This seamless integration is not only enhancing convenience but also expanding market reach through strategic partnerships with e-commerce platforms, mobility providers, and fintech innovators.

Moreover, climate change and catastrophic risk events are prompting carriers to adopt advanced analytics and scenario modeling to price products more accurately and bolster capital planning. The ongoing pandemic has underscored the value of flexible policy structures and usage-based pricing, accelerating the development of on-demand and parametric solutions that align premiums with real-time exposures. As a result, insurers are transforming from risk bearers to risk managers, offering holistic advisory services that encompass prevention, mitigation, and rapid response.

These transformative shifts are fostering an ecosystem where agility, data-driven intelligence, and strategic collaboration determine market leadership. Insurers that embrace cloud scalability, invest in talent with digital expertise, and cultivate an innovation mindset are best positioned to capture the value unlocked by these sweeping industry changes.

Assessing the Collective Economic and Operational Consequences of 2025 U.S. Tariffs on Insurance Cost Dynamics

The cumulative imposition of U.S. tariffs throughout 2025 has exerted significant pressure on operational costs and macroeconomic variables that directly influence insurance underwriting and premium structures. Research indicates that the average effective tariff rate could rise from roughly 1.7 percent to nearly 17 percent when accounting for both newly announced measures and existing Section 301 and Section 232 levies, triggering ripple effects across supply chains and inflation metrics. This escalation is projected to translate into higher input costs for vendors of vehicles, construction materials, and industrial equipment, thereby elevating replacement cost estimates and claim severity models for property and casualty carriers.

Empirical analysis suggests that these tariff actions may contribute to a short-run increase in consumer prices of approximately 7.1 percent, as importers pass on added tax burdens to end consumers. Moreover, comprehensive studies by the Yale Budget Lab project that the aggregate price level for households could experience a 3.0 percent rise in the immediate term, with a post-substitution adjustment settling at 1.6 percent, equating to an average purchasing power loss of $2,600 per U.S. household. These inflationary dynamics have contributed to a recalibration of Federal Reserve projections, with core PCE forecasts being adjusted upward to reflect potential spillovers from elevated import levies.

On the growth front, modeling exercises estimate that the full suite of 2025 tariffs and related trade partner retaliation could shave between 0.8 and 1.1 percentage points off U.S. real GDP growth over the calendar year. The contractionary impact extends to labor markets, where some analyses forecast an increase in unemployment rates by up to 0.57 percentage points and a reduction in payroll employment by roughly 770,000 positions by year-end. These macroeconomic headwinds are influencing insurer capital allocation decisions, reserving strategies, and hedging activities as carriers prepare for heightened volatility in credit markets and currency fluctuations.

In response, executive teams are revisiting scenario-based stress tests and adjusting profitability targets to account for potential premium pressures and claim frequency shifts tied to trade-driven cost inflation. The intersection of tariff-induced price dynamics and complex risk exposures underscores the necessity for sophisticated actuarial modeling and proactive strategic planning to preserve underwriting margins and maintain solvency metrics.

Unveiling Critical Segmentation Trends Across Product Lines, Distribution Methods, Customer Profiles, and Deployment Models

A nuanced examination of product segmentation reveals that the insurance platform market extends across four primary categories, each characterized by distinct growth drivers and customer demands. Health insurance remains a critical pillar, with group coverage solutions tailored to employer-sponsored plans balancing risk pools and cost containment, while individual policies continue to adapt to demographic shifts and care delivery innovations. Within the life insurance domain, endowment policies blend savings and protection components, term life offerings provide cost-effective risk transfer, and universal and whole life plans support long-term financial planning and estate strategies. Property and casualty coverage addresses exposures ranging from personal auto insurance impacted by telematics adoption to commercial property policies that incorporate parametric triggers for weather-related losses and homeowners programs integrating smart-home prevention tools. On the travel insurance front, domestic products have evolved to include trip interruption and cancellation guarantees tied to localized events, whereas international offerings increasingly embed global emergency services and health advisories.

Turning to distribution, traditional bank-channel partnerships leverage established customer relationships to bundle insurance with banking services, while broker networks offer consultative brokerage expertise, particularly for complex commercial placements. Direct sales models maintain relevance for mid-market segments, supported by call center and agent networks that combine human interaction with digital workflows. Conversely, web-based portals and mobile applications drive self-service engagement, enabling instant quotes, policy management, and claims submissions directly through intuitive interfaces designed for a digital-first clientele.

Customer type segmentation underscores diverging requirements across individuals seeking streamlined purchase journeys and transparent coverage terms, large enterprises pursuing enterprise-grade platforms with API integration and bespoke analytics, and small to medium businesses balancing affordability with modular policy constructs that scale with evolving operational footprints.

Finally, deployment models distinguish providers that deliver cloud-hosted, multi-tenant environments offering rapid feature rollouts and elastic scalability from those maintaining on-premise installations prized for data sovereignty and deep integration with legacy systems. This dual architecture landscape reflects a continuum of preferences shaped by regulatory mandates, IT governance frameworks, and strategic roadmaps for digital modernization.

This comprehensive research report categorizes the Insurance Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Customer Type

- Distribution Channel

- Deployment Model

Comparative Regional Dynamics Revealing Growth Drivers and Market Nuances Across Americas, EMEA, and Asia-Pacific

Regional market dynamics exhibit distinct trajectories driven by local regulation, technological infrastructure, and economic maturity. The Americas region features a highly consolidated carrier environment with advanced digital ecosystems underpinned by widespread broadband and mobile penetration. Here, incumbents and insurtech challengers alike compete on customer experience enhancements, leveraging predictive analytics for personalized pricing and telematics-enabled underwriting. Regulatory sandboxes in certain U.S. states have accelerated innovation pilots in areas such as peer-to-peer insurance and usage-based auto coverage, creating fertile ground for agile platform deployments.

In Europe, Middle East & Africa, a mosaic of regulatory regimes and market structures defines the landscape. The European Union’s stringent data privacy and solvency frameworks establish high compliance thresholds, while regional trade blocs in the Middle East are catalyzing infrastructure development and insurance penetration. African markets present underinsurance opportunities, with digital-first mobile insurance solutions integrating micro-insurance to serve SME and informal sector clients. Across EMEA, climate risk considerations are driving the rollout of parametric insurance schemes and public–private risk pools addressing extreme weather and agricultural vulnerabilities.

The Asia-Pacific region stands out for its rapid growth potential, propelled by expanding middle-class populations, government-led healthcare reforms, and burgeoning insurtech ecosystems. In mature Asian markets, digital channel adoption and super-app integrations are redefining distribution, while emerging economies benefit from leapfrog innovations leveraging mobile wallets and biometric enrollment to lower barriers to coverage. Cross-border collaboration and regional trade agreements further influence capacity flows and reinsurance dynamics, shaping risk transfer strategies and capital deployment within APAC’s diverse market tapestry.

This comprehensive research report examines key regions that drive the evolution of the Insurance Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Insurers and Insurtech Innovators Advancing Digital Platforms, AI Integration, and Strategic Partnerships

Leading incumbents and innovative insurtechs are charting diverse strategic paths to shape the future of insurance platforms. UnitedHealth Group has aggressively embedded artificial intelligence across its Optum division, powering over ninety percent of its claims adjudication workflows and deploying a thousand live AI applications spanning underwriting, clinical delivery, and pharmacy benefits. This scale of AI integration yields automation efficiencies that streamline operations and enhance customer responsiveness, though it also demands rigorous oversight to address regulatory scrutiny and algorithmic bias concerns.

Allianz has established data governance as the cornerstone of its digital strategy, instituting a global data platform and appointing chief data officers in nearly all operating entities to ensure high-quality data accessibility and analytics maturity. This framework underpins initiatives such as the underwriter guidance tool “BRIAN” and a real-time catastrophe warning system, demonstrating how data-driven insights can fortify risk mitigation and customer preparedness. Partnerships with technology leaders and a structured AI risk management policy reflect Allianz’s commitment to responsible innovation.

AXA is advancing its Digital Commercial Platform to deliver integrated protection and prevention services for corporate clients, harnessing geospatial analytics, IoT sensors, and digital twins to anticipate and avert losses before they occur. This preventive approach aligns product offerings with emerging risk complexity, from climate-driven disasters to political risk exposures, and underscores AXA’s emphasis on ecosystem collaborations with brokers and technology providers.

Insurtech players are also scaling rapidly. Lemonade has surpassed one billion dollars in in-force premiums within just eight and a half years of operation, propelled by an AI-first platform that automates onboarding and claims processes and integrates social impact through its B-Corp certified giveback model. The company’s expansion into multi-jurisdictional markets and its enhanced loss ratio performance demonstrate the viability of nimble, technology-driven business models in challenging competitive environments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Insurance Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Acko General Insurance Limited

- Cogitate Technology Solutions

- Coherent, Inc.

- Comarch SA

- EIS Software Limited

- FINEOS Corporation

- Guidewire Software, Inc.

- Haven Life Insurance Agency, LLC

- Infosys Limited

- iPipeline, Inc.

- Lemonade, Inc.

- LTIMindtree Limited

- Next Insurance, Inc.

- Policybazaar Insurance Brokers Private Limited

- Prima Solutions SA

- RGI Group

- Root Platform ZA (Pty) Ltd.

- SAP SE

- Sapiens International.

- Shift Technology

- Tata Consultancy Services Limited

- TIBCO Software Inc.

- Vertafore, Inc.

- Wipro Limited

Implementing Strategic Initiatives to Enhance Operational Resilience, Customer Engagement, and Sustainable Growth for Insurers

To capitalize on evolving market dynamics, insurance leaders should prioritize an integrated digital roadmap that aligns with organizational objectives and customer expectations. Embracing a modular cloud architecture enables rapid experimentation and feature delivery while mitigating integration risks with legacy applications. Concurrently, carriers must establish robust data governance practices and invest in talent development programs to build in-house expertise for AI model stewardship, data analytics, and cybersecurity resilience.

Strategic partnerships with technology firms, insurtech ventures, and academic institutions can accelerate innovation by providing access to specialized capabilities and emerging research. Collaborative ecosystem models, such as sandboxes and co-innovation labs, foster risk-controlled environments for testing novel products, distribution strategies, and underwriting algorithms. Insurers should also explore public–private collaborations to develop parametric and micro-insurance schemes that address climate and catastrophe risk in underinsured markets.

Operational excellence initiatives focused on end-to-end process optimization can reduce cycle times and enhance customer satisfaction. Claims automation through AI-driven adjudication and intelligent document processing liberates human resources to focus on complex case management and customer engagement. Embedding customer feedback loops and personalization engines into digital channels further strengthens loyalty and lifetime value.

Governance and compliance frameworks must evolve in tandem with digital efforts. Proactive engagement with regulators to shape emerging guidelines on AI transparency, data privacy, and third-party risk management ensures alignment with legal requirements and fosters trust among stakeholders. By weaving these elements into a cohesive strategy, industry leaders can chart a path toward sustainable growth and competitive differentiation.

Employing Rigorous Qualitative and Quantitative Research Practices to Validate Market Insights and Ensure Data Integrity

This research synthesizes qualitative and quantitative methodologies to deliver a comprehensive market analysis. Primary research consisted of structured interviews with C-suite executives, product strategists, and technology leaders across insurance carriers, ecosystem partners, and regulatory agencies. These engagements provided direct insights into strategic priorities, innovation roadmaps, and risk management practices.

Secondary research involved an extensive review of public disclosures, industry white papers, regulatory filings, and thought leadership from financial institutions and consulting firms. Data from specialized trade journals, government trade statistics, and academic publications supplemented proprietary datasets and enabled cross-validation of growth trends and technology adoption rates.

To ensure data integrity and relevance, findings were triangulated through multiple sources and vetted by subject matter experts. Statistical analyses were conducted to identify correlation patterns between technology investments and operational outcomes, while thematic coding of interview transcripts uncovered emerging best practices and organizational challenges. Segmentation and regional assessments were informed by standardized frameworks and refined through iterative feedback loops with domain specialists.

This rigorous approach underpins the report’s conclusions and recommendations, ensuring that stakeholders receive actionable intelligence grounded in both empirical evidence and experiential knowledge.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Insurance Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Insurance Platform Market, by Product Type

- Insurance Platform Market, by Customer Type

- Insurance Platform Market, by Distribution Channel

- Insurance Platform Market, by Deployment Model

- Insurance Platform Market, by Region

- Insurance Platform Market, by Group

- Insurance Platform Market, by Country

- United States Insurance Platform Market

- China Insurance Platform Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Market Insights to Inform Decision-Making and Illuminate the Future Trajectory of the Insurance Sector

The insurance platform market stands at a critical juncture where the confluence of digital innovation, regulatory evolution, and macroeconomic pressures is reshaping traditional paradigms. Across product segments, distribution channels, and deployment models, carriers are challenged to deliver greater efficiency, personalized experiences, and resilient infrastructures that can adapt to unprecedented risks.

Regional dynamics reinforce that no single playbook fits all markets; successful strategies are those tailored to local regulatory, economic, and technological contexts. Leading incumbents and agile insurtechs have demonstrated that investments in AI, data platforms, and ecosystem partnerships yield tangible benefits in operational performance and customer satisfaction.

Given the substantial impact of external factors such as tariffs on cost structures and inflationary trends, forward-looking organizations must integrate sophisticated scenario planning and dynamic pricing models into their core operations. Maintaining regulatory alignment and cultivating strong stakeholder relationships will be equally critical as technological adoption accelerates.

By synthesizing these insights, decision-makers are equipped to prioritize initiatives that deliver measurable outcomes, optimize resource allocation, and drive long-term competitiveness in a rapidly evolving landscape.

Engage with Our Expert Team to Acquire Comprehensive Insurance Market Analysis and Drive Strategic Business Outcomes

Explore the transformative insights detailed within our comprehensive analysis and connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of this indispensable market research report. His expertise will guide you through tailored data offerings and ensure you obtain the precise intelligence needed to inform your strategic decisions and accelerate your organization’s growth in a rapidly evolving industry.

- How big is the Insurance Platform Market?

- What is the Insurance Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?