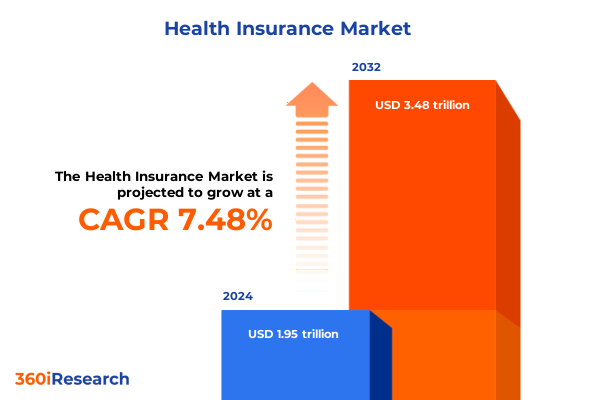

The Health Insurance Market size was estimated at USD 2.10 trillion in 2025 and expected to reach USD 2.25 trillion in 2026, at a CAGR of 7.49% to reach USD 3.48 trillion by 2032.

Navigating Complexities in Health Insurance Amid Rising Costs and Regulatory Shifts to Equip Stakeholders With Strategic Intelligence

Health insurance stands at the forefront of national economic and social priorities, driven by the dual forces of escalating medical costs and an increasingly complex regulatory terrain. Over the past five years, average family premiums for employer-sponsored coverage have climbed to an average of $25,572 in 2024, reflecting a 7% year-over-year increase that outpaces both general inflation and wage growth. Concurrently, industry profit margins have contracted from historic highs, falling from 5.3% in 2020 to 2.7% in 2024 as insurers grapple with higher utilization and evolving reimbursement models.

Employers, policymakers, and consumers alike are contending with the implications of emerging benefit trends, such as the adoption of GLP-1 agonist coverage, expanded mental health resources, and the integration of telehealth services into core insurance offerings. Shifting consumer expectations around network flexibility, transparency, and personalization further underscore the need for strategic agility among market participants. The Affordable Care Act’s ongoing refinements and state-level reforms continue to reshape risk pools and funding mechanisms, creating a dynamic environment that demands continuous innovation and operational efficiency.

This executive summary synthesizes the latest developments reshaping health insurance, from macroeconomic pressures and tariff impacts on medical supplies to granular segmentation insights and regional variations. By distilling key trends, competitive dynamics, and actionable recommendations, this report equips decision-makers with the clarity and foresight required to navigate the rapidly evolving landscape.

Emerging Technologies, Regulatory Reforms, and Elevated Consumer Expectations Are Converging to Redefine Health Insurance Experiences

The health insurance ecosystem is undergoing transformative shifts powered by technological innovation, policy evolution, and changing consumer dynamics. Artificial intelligence and machine learning are revolutionizing underwriting, claims processing, and fraud detection, enabling insurers to streamline operations and enhance member experiences. Robust digital platforms now facilitate real-time claims adjudication and predictive analytics, offering personalized plan recommendations and risk assessments that were unimaginable a decade ago.

Regulatory reforms are equally significant, with federal and state agencies redefining network adequacy standards, mandating price transparency measures, and introducing payment models that incentivize value-based care. The expansion of telehealth waivers and remote monitoring technologies, catalyzed by the COVID-19 pandemic, has become embedded in benefit designs, creating new opportunities for virtual care integration and population health management.

Meanwhile, consumer expectations have evolved, driven by the broader digital transformation in retail and finance. Members demand seamless omni-channel interactions, accessible wellness resources, and price clarity, challenging traditional distribution channels and fostering the rise of direct-to-consumer offerings. As these forces converge, insurers must adopt agile operating models, forge strategic partnerships with technology providers and healthcare systems, and develop robust data governance frameworks to harness insights effectively and drive sustainable growth.

Assessing the Cumulative Consequences of 2025 US Tariff Adjustments on Medical Device Expenses and Health System Financial Resilience

The United States’ tariff adjustments in 2025 have produced a cumulative impact on medical device costs and, by extension, insurance expenditures and healthcare provider margins. Tariffs on critical equipment such as imaging devices, surgical instruments, and personal protective equipment have increased to rates as high as 50% for goods originating from specific countries, directly influencing procurement budgets for hospitals and clinics.

Manufacturers and distributors are responding by reallocating supply chains, near-shoring production, and renegotiating long-term contracts to mitigate cost volatility. Despite these efforts, the pass-through effect is evident, with insurers facing higher claim liabilities for device-intensive procedures. In particular, cardiovascular implants, joint replacements, and diagnostic imaging usage now reflect elevated base costs, prompting payers to reevaluate reimbursement rates and cost-containment strategies.

The sustained pressure on medical device pricing has led to a reassessment of co-pay and deductible structures, with some plans introducing tiered coverage to manage utilization and maintain affordability. Moreover, delayed elective procedures and supply shortages in critical care segments underscore the delicate balance between cost management and access preservation. Stakeholders must collaborate across the value chain to optimize inventory strategies, leverage bulk purchasing consortia, and advocate for targeted tariff exemptions to preserve patient access and financial stability.

Dissecting Plan Designs, Distribution Channels, Coverage Extensions, and Distinct Customer Cohorts to Reveal Critical Segmentation Dynamics

Health insurance offerings are shaped by distinct plan types, each driving unique utilization patterns and cost structures. Exclusive Provider Organizations and Health Maintenance Organizations, characterized by closed networks and primary care gatekeeping, emphasize coordinated care and cost control, while Preferred Provider Organizations and Point-of-Service plans blend network flexibility with managed cost sharing. Understanding these plan attributes is essential for designing benefit suites that align with member preferences and risk tolerance.

Distribution channels are similarly diverse, ranging from traditional broker networks and bancassurance partnerships to direct sales models and online marketplaces that cater to digitally native consumers. Brokers remain instrumental for complex group solutions, whereas direct and online channels capitalize on streamlined processes and digital engagement to attract self-funded employers and individual purchasers. Each distribution avenue demands tailored marketing strategies and technological investments to optimize conversion and retention.

Coverage categories extend beyond core medical and dental benefits into supplemental offerings, including accident protection, critical illness coverage, and hospital cash benefits, that enhance value propositions and address niche member needs. Vision benefits, often bundled or sold as standalone plans, further diversify product portfolios and revenue streams. Meanwhile, customer segments-be they individual, family, or group markets-exhibit distinct purchasing behaviors and satisfaction drivers. Large group clients prioritize comprehensive networks and wellness integrations, whereas small groups and individuals may emphasize affordability and telehealth access. These segmentation insights inform targeted underwriting approaches, product innovation, and go-to-market frameworks.

This comprehensive research report categorizes the Health Insurance market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Plan Type

- Coverage Type

- Distribution Channel

- Customer Type

Delineating Regional Divergences in Coverage Models Across Americas, EMEA, and Asia-Pacific to Highlight Strategic Opportunities

Geographical dynamics exert a profound influence on health insurance markets, with regional socioeconomic factors, regulatory landscapes, and healthcare infrastructures shaping coverage models and consumer experiences. In the Americas, the interplay between private employer-sponsored plans and public programs such as Medicaid and Medicare determines risk pooling, pricing strategies, and population health initiatives. States with robust Medicaid expansion have seen shifts in enrollment patterns and premium stabilization, while employer mandates in specific jurisdictions drive competitive plan offerings.

In Europe, Middle East, and Africa, a mosaic of single-payer systems, multilateral risk pools, and emerging private insurers coexist. Regulatory harmonization efforts, such as the European Union’s Solvency II framework, are influencing capital requirements and product compliance, whereas market liberalization in regions like the Gulf Cooperation Council fosters new entrants and digital health collaborations.

Asia-Pacific markets exhibit rapid growth trajectories, propelled by rising incomes, expanding middle classes, and government-driven universal coverage schemes. Private insurers are capitalizing on demographic shifts and demand for supplemental plans, often partnering with digital health platforms to deliver remote services and health coaching. Each region’s unique policy environments and economic drivers present tailored opportunities for product innovation, distribution partnerships, and cross-border investment strategies.

This comprehensive research report examines key regions that drive the evolution of the Health Insurance market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Competitive Strategies, Financial Robustness, and Innovation Initiatives of Leading Insurers to Illuminate Market Leadership Dynamics

The competitive landscape in health insurance is dominated by a handful of global and domestic leaders, each pursuing distinct strategies to reinforce market position. Vertical integration has emerged as a pivotal theme, with leading players forging alliances with provider networks, pharmacy benefit managers, and digital health startups to secure downstream value and drive care coordination efficiencies. This trend is evident in recent collaboration agreements aimed at embedding telehealth solutions into core product offerings and streamlining chronic disease management through real-time data sharing.

Innovation in product design also differentiates market leaders. Customized high-deductible health plans paired with health savings accounts appeal to cost-conscious consumers seeking tax-advantaged savings and flexibility, while value-based care models reward providers for quality outcomes over service volumes. Insurers are leveraging predictive analytics to refine risk stratification and personalize member engagement, deploying mobile health apps and AI-driven coaching to improve adherence and reduce claim severity.

Emerging competitors and insurtech disruptors are challenging incumbents by offering niche products through digital-first channels, emphasizing transparent pricing and rapid onboarding. These agile entrants focus on underserved segments-such as gig economy workers and telecommuters-introducing modular benefit packages that can be scaled and integrated with lifestyle applications. Established insurers must therefore defend market share by accelerating digital transformation, enhancing customer experience, and nurturing ecosystems that foster innovation and partnership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Health Insurance market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Centene Corporation

- Cigna Corporation

- CVS Health Corporation

- Elevance Health, Inc.

- Health Care Service Corporation

- Highmark Health

- Highway to Health, Inc.

- Humana Inc.

- ICICI Lombard General Insurance Company Ltd.

- International Medical Group, Inc.

- ISIC Service Office d.o.o.

- Kaiser Foundation Health Plan, Inc.

- Molina Healthcare, Inc.

- UnitedHealth Group Incorporated

Strategic Imperatives for Health Insurance Executives to Leverage Data, Partnerships, and Resilience for Sustainable Growth

Industry leaders must act decisively to harness emerging opportunities and mitigate risks in a rapidly evolving environment. First, investing in advanced analytics and AI-powered platforms will be critical to optimize underwriting accuracy, detect fraud, and deliver personalized member experiences. Organizations should establish data governance councils to ensure robust oversight, compliance, and ethical use of predictive models.

Second, forging strategic partnerships with technology providers, healthcare systems, and wellness vendors can expand service portfolios and enhance care management capabilities. Collaborative pilots on telehealth integration and digital therapeutics testing should be prioritized to validate efficacy and scale successful models. Insurers must also engage with regulators to shape favorable policy frameworks for value-based care and telehealth reimbursement.

Finally, strengthening resilience against external shocks, such as tariff-induced supply disruptions, requires proactive supply chain assessments and advocacy for targeted tariff relief on essential medical devices. Developing flexible cost-sharing designs can shield members from sudden price spikes while preserving network access. Executives should align product development roadmaps with regional policy trends and prioritize embedded digital health solutions to drive differentiation and sustainable growth.

Overview of the Multi-Modal Research Framework Employing Secondary Analysis, Primary Interviews, and Quantitative Modeling

Our research employed a multi-modal framework to ensure comprehensive and reliable market insights. Secondary research encompassed extensive review of industry publications, regulatory filings, and peer-reviewed journals, including Kaiser Family Foundation surveys and recent financial reports from leading insurers. Tariff impact analysis leveraged data from industry associations and trade databases to quantify cost implications for medical equipment and supplies.

Primary research included in-depth interviews with C-suite executives, benefits managers, and policy experts across diverse geographies, capturing firsthand perspectives on strategic priorities and operational challenges. Insights from provider group leaders and technology vendors enriched our understanding of care model innovations and digital transformation trajectories.

Quantitative modeling synthesized these inputs, blending historical claim data with macroeconomic indicators and tariff scenarios to simulate cost and utilization outcomes. Rigorous data validation procedures and cross-referencing against publicly available benchmarks ensured the robustness of findings. This hybrid methodology delivers a balanced, actionable view of the current health insurance landscape and its near-term evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Health Insurance market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Health Insurance Market, by Plan Type

- Health Insurance Market, by Coverage Type

- Health Insurance Market, by Distribution Channel

- Health Insurance Market, by Customer Type

- Health Insurance Market, by Region

- Health Insurance Market, by Group

- Health Insurance Market, by Country

- United States Health Insurance Market

- China Health Insurance Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings to Chart a Forward-Looking Path Through Evolving Health Insurance Dynamics for Stakeholder Success

The health insurance sector stands at a critical juncture, shaped by accelerating technological innovation, evolving policy landscapes, and macroeconomic pressures. As tariffs on medical devices influence cost structures and regional dynamics create differentiated market conditions, insurers must adopt agile strategies that balance cost containment with member engagement and access.

Segmentation insights underscore the importance of tailoring product offerings to distinct plan types, distribution channels, coverage extensions, and customer cohorts, while leading companies illustrate the competitive imperative of digital transformation and value-based care integration. Actionable recommendations focus on leveraging advanced analytics, building strategic partnerships, and fortifying resilience against supply chain and policy disruptions.

Looking ahead, success will hinge on the ability to anticipate regulatory shifts, harness data-driven decision-making, and foster collaborative ecosystems that deliver holistic, consumer-centric care experiences. Stakeholders who embrace these imperatives will be best positioned to navigate complexities, drive innovation, and secure long-term value for both members and shareholders.

Contact Ketan Rohom to Secure the Comprehensive Health Insurance Market Research Report and Unlock Detailed Insights for Informed Decision-Making and Competitive Advantage

Unlock unparalleled market intelligence and actionable strategies by speaking directly with Ketan Rohom, Associate Director of Sales & Marketing. Gain exclusive access to our comprehensive health insurance market research report, meticulously crafted to address the dynamic challenges and opportunities in today’s industry environment. Whether you seek to refine product portfolios, optimize distribution strategies, or navigate evolving regulatory landscapes, Ketan’s expertise will guide you to the insights essential for informed decision-making and competitive differentiation. Don’t miss the opportunity to leverage this deep-dive analysis and equip your organization with the foresight needed to thrive. Contact Ketan Rohom today to secure your copy and transform your market approach.

- How big is the Health Insurance Market?

- What is the Health Insurance Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?