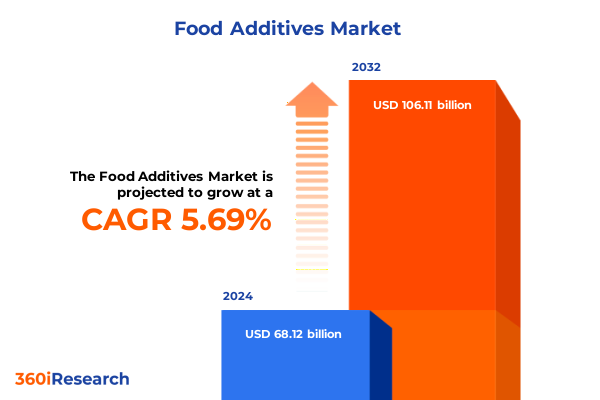

The Food Additives Market size was estimated at USD 71.93 billion in 2025 and expected to reach USD 75.96 billion in 2026, at a CAGR of 5.71% to reach USD 106.11 billion by 2032.

Exploring the Evolving Food Additives Landscape with Emerging Consumer Demands, Technological Innovations, and Regulatory Complexities Driving Transformation

From rising consumer expectations around clean label formulations to the advent of advanced extraction and encapsulation technologies, the food additives industry is undergoing a profound transformation. In recent years, health-conscious trends have driven brands to seek natural and plant-based solutions that deliver functionality without compromising on transparency. As a result, formulators are increasingly turning to fruit, herb, and vegetable extracts, as well as microbial and animal-derived ingredients, to achieve desired sensory and preservative effects. This convergence of consumer demand and technological capability has elevated research and development efforts worldwide.

Meanwhile, regulatory landscapes continue to evolve, with stringent requirements emerging across key markets. Regulatory bodies are refining safety thresholds and approval processes for novel additives, leading to a more complex compliance environment. Companies are responding by investing in robust safety data and real-time monitoring protocols, fostering greater collaboration between R&D teams, quality assurance functions, and external regulatory experts. This heightened regulatory scrutiny, coupled with shifting consumer expectations, underscores the strategic imperative to innovate responsibly.

At the same time, the digital revolution is reshaping how additives are discovered, tested, and commercialized. Artificial intelligence and predictive modeling are accelerating trend identification and optimizations, while digital twins and advanced analytics provide unprecedented visibility into formulation performance. Together, these forces are redefining the competitive landscape, compelling organizations to integrate cross-functional expertise, real-world evidence, and agile development practices. Against this backdrop of dynamic change, understanding the interplay between innovation, consumer behavior, and regulation is critical for industry leaders poised to drive growth and resilience.

Identifying the Transformative Shifts Reshaping the Food Additives Industry through Clean Label Movements, Sustainability Imperatives, and Digital Technologies

In recent years, sustainability has moved from a niche concern to a central pillar of strategic decision-making within the food additives sector. Companies now prioritize ingredient sourcing that minimizes environmental impact, opting for renewable plant extracts and microbial fermentation processes over petrochemical derivatives. This shift has catalyzed investments in supply chain transparency, as stakeholders demand full traceability from raw material cultivation through to finished product. Simultaneously, the clean label movement has compelled formulators to reduce synthetic modifiers and disclose origins, enhancing brand integrity.

Concurrently, the integration of digital technologies is unlocking new frontiers in additive innovation. Data-driven formulation platforms leverage machine learning algorithms to predict functionality outcomes, accelerating time to market and reducing experimental cycles. Advanced analytics also support adaptive manufacturing, allowing real-time adjustments that optimize resource utilization and product consistency. These digital capabilities are increasingly paired with automation and modular production, enabling scalable bio-based manufacturing of high-purity antioxidants, emulsifiers, and natural colorants.

Moreover, consumer interest in personalized nutrition is reshaping product development priorities. Additives that support targeted health benefits-such as cognitive support, gut health, or immune modulation-are gaining traction. This trend has driven collaborations between ingredient suppliers and digital health firms to co-develop tailor-made solutions. As such, the convergence of sustainability mandates, digital transformation, and personalization is creating a highly dynamic environment, where agility and strategic foresight determine competitive advantage.

Assessing the Cumulative Impact of 2025 United States Tariffs on Food Additives Supply Chains, Cost Structures, and Strategic Sourcing Decisions

The cumulative impact of recent tariff measures in the United States has created significant headwinds for the food additives supply chain. Since the average import duty rose to approximately 15 percent in early 2025, businesses reliant on imported antioxidants, acidulants, and specialty ingredients have faced elevated procurement costs. These pressures intensified when a 25 percent tariff was applied to key agricultural commodities from Latin America and Southeast Asia, including oils and starch derivatives critical to stabilizers and texturizers turn0search0. Against this backdrop, many formulators are reevaluating global sourcing strategies to balance cost, quality, and regulatory compliance.

Compounding these challenges, a 20 to 30 percent duty on processed food and beverage imports from the EU, India, and South Korea has disrupted established procurement channels for flavor enhancers and natural colorants0search1. Packaging inputs, including aluminum for capsules and cans, now bear a 15 percent levy, amplifying inflationary pressures across finished goods. In response, leading manufacturers have sought tariff exemptions for essential ingredients unavailable domestically, submitting formal petitions to the administration0search2. Meanwhile, some brands are accelerating investments in regional manufacturing hubs to mitigate the unpredictability of international trade policies.

Furthermore, the strategic ramifications extend beyond cost. The rapid imposition of tariffs has triggered supply chain fragmentation, with companies diversifying supplier networks and increasing inventory buffers to hedge against further disruptions. Regulatory compliance timelines have lengthened as new import classifications require additional documentation and testing. Ultimately, the confluence of elevated duties and shifting trade agreements has redefined competitive positioning for both additive producers and their customers, underscoring the need for agile sourcing frameworks.

Uncovering Key Segmentation Insights across Product Types, Applications, Functional Attributes, Ingredient Sources, and Formulations in Food Additives Markets

A nuanced understanding of product type segmentation reveals that certain categories have seen pronounced innovation. Antioxidants and preservatives are increasingly derived from microbial fermentation, offering cleaner label solutions compared to synthetic alternatives. Meanwhile, emulsifiers and thickeners have benefited from advances in biopolymer technology, resulting in multifunctional systems that enhance both texture and shelf life. Colorants have likewise shifted toward water-soluble plant extracts, enabling vivid hues without synthetic residues.

When examining application segmentation, the bakery and confectionery sector demands heat-stable emulsifiers that maintain structure during baking processes, while beverage formulators prioritize soluble flavor enhancers and stabilization systems to prevent phase separation and haze. In dairy and frozen desserts, the emphasis on creamy mouthfeel and syneresis control has driven the adoption of novel stabilizer blends. Processed foods and culinary products continue to integrate flavor-modifying agents that balance salt reduction with sensory appeal, addressing health trends without compromising taste.

Functionally, the differentiation between color enhancement, nutritional fortification, preservation, taste enhancement, and texture modification underscores the complexity of additive selection. Preservation systems now incorporate both antimicrobial peptides and antioxidant matrices to extend shelf life while maintaining clean labels. Texture modification technologies have branched into emulsification, gelling, stabilization, and thickening subcategories, each calibrated to precise rheological requirements. Across source segmentation, plant-based extracts-from fruit, herb, and vegetable origins-have gained prominence for their natural appeal, complemented by microbial enzymes and select animal-derived proteins. Finally, form considerations-from granular to liquid, paste to powder-drive logistical and handling decisions, influencing decisions across research, manufacturing, and end-use scenarios.

This comprehensive research report categorizes the Food Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Function

- Source

- Form

- Application

Deriving Key Regional Insights Highlighting Growth Drivers, Market Dynamics, and Strategic Priorities across the Americas, EMEA, and Asia-Pacific Food Additives Markets

Regional analysis highlights distinct dynamics in the Americas, where robust infrastructure and established distribution networks support rapid adoption of both natural and next-generation ingredients. Investment in onshore manufacturing has accelerated, as crude oil price fluctuations and tariff volatility incentivize regional production of emulsifiers and stabilizers. This environment fosters close collaboration between suppliers and multinational foodmakers, particularly in developing sustainable sourcing programs for plant extracts.

In the Europe, Middle East, and Africa region, stringent regulatory frameworks and ambitious sustainability targets have catalyzed the uptake of bio-based antioxidants and biodegradable packaging additives. The emphasis on circular economy principles drives R&D into waste- valorization pathways, where fruit and vegetable byproducts are transformed into high-value colorants and texture modifiers. Moreover, consumer demand for organic and clean label products has steered formulators toward non-GMO microbial enzymes.

Across Asia-Pacific, rapid urbanization and rising purchasing power are fueling growth in functional fortification and taste enhancement technologies. Beverage and dairy players are partnering with local research institutes to develop additives that complement regional flavor profiles and address nutritional gaps. Simultaneously, strong governmental support for bio-industrial development is spurring capacity expansion in microbial fermentation facilities, setting the stage for increased exports of high-purity functional ingredients to global markets.

This comprehensive research report examines key regions that drive the evolution of the Food Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Key Company Strategies and Competitive Differentiators among Leading Players Innovating in the Global Food Additives Ecosystem

Industry leaders have taken divergent strategic paths to secure competitive advantage. One multinational supplier has pursued an aggressive acquisition strategy, bolstering its portfolio with niche players in plant-based colorants and specialty sweeteners. This approach has strengthened its end-to-end capabilities, from raw material sourcing to advanced formulation services. Another leading organization has prioritized deep partnerships with academic institutions, co-investing in modular fermentation research to accelerate the commercialization of novel antimicrobial peptides.

In parallel, several companies have doubled down on digital platforms that connect customers with real-time formulation support, leveraging AI-driven recommendation engines to streamline product development. These interactive tools enable food manufacturers to simulate sensory and stability outcomes, reducing time to market and trial consumption. Meanwhile, collaborative initiatives between global additives groups and consumer goods giants have emerged, focusing on sustainability accreditation and supply chain traceability solutions.

Separately, a handful of innovators have differentiated through purpose-driven brands that spotlight origin stories and environmental stewardship. By integrating blockchain-enabled traceability and third-party certifications, these players appeal directly to end consumers seeking assurance around safety and ethical sourcing. Collectively, these varied strategies illustrate how leading companies navigate technological, regulatory, and consumer imperatives to foster resilience and drive growth in an increasingly complex marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Food Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- BASF SE

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- DuPont de Nemours, Inc.

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Nestlé S.A.

- Novozymes A/S

- POLYNT SPA

- SAUDI BASIC INDUSTRIES CORPORATION (SABIC)

- Syngenta AG

- Tate & Lyle PLC

- The Kraft Heinz Company

Formulating Actionable Recommendations for Industry Leaders to Navigate Disruption, Capitalize on Innovation, and Drive Sustainable Value Creation

Industry leaders should prioritize the development of agile sourcing frameworks that balance global access with regional hedging. By establishing dual-sourcing partnerships and strategically located manufacturing nodes, companies can mitigate tariff shocks and optimize lead times. Simultaneously, investing in modular and flexible production capabilities will enable rapid reformulation as consumer preferences and regulatory requirements evolve. Adopting predictive analytics for demand forecasting can further enhance supply chain resilience.

In parallel, organizations must cultivate deep expertise in clean label and bio-based technologies. Allocating dedicated R&D resources to explore microbial fermentation and plant extract innovations will ensure a pipeline of next-generation additives aligned with sustainability targets. Collaboration with academic and government research entities can accelerate breakthroughs, while targeted acquisitions may provide immediate access to specialized capabilities.

Furthermore, leveraging digitalization across the value chain-including AI-enabled formulation platforms and blockchain-backed traceability systems-will enhance transparency, reduce development cycles, and build consumer trust. Concurrently, active engagement with regulatory authorities can facilitate early insights into evolving safety standards and expedite approvals. By integrating these measures, industry executives can position their organizations to capitalize on emerging trends, deliver differentiated offerings, and achieve sustainable growth.

Detailing the Robust Research Methodology Employed to Analyze Food Additives Trends, Market Segmentation, and Industry Dynamics with Precision

The research methodology underpinning this analysis blended comprehensive secondary and primary approaches to ensure robust insights. Secondary research included a systematic review of scientific publications, regulatory databases, patent landscapes, and industry white papers to map historical trends and emerging technologies. Relevant patent filings were analyzed to assess innovation trajectories in key additive categories such as antioxidants, emulsifiers, and colorants.

Primary research involved structured interviews with over 30 senior stakeholders across additive suppliers, food manufacturers, and regulatory bodies. These conversations explored strategic priorities, pain points, and investment plans, providing qualitative context to quantitative observations. Data triangulation was achieved by cross-referencing interview findings with supply chain case studies and trade data on tariff impositions.

Additionally, segmentation models were validated through workshops with subject-matter experts, ensuring the granularity of insights across product types, applications, functions, sources, and forms. Regional dynamics were examined using trade flow analysis and collaboration with local consultants in the Americas, Europe, Middle East & Africa, and Asia-Pacific. The combined methodology delivers a nuanced perspective on market drivers, competitive intensity, and future opportunities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Food Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Food Additives Market, by Product Type

- Food Additives Market, by Function

- Food Additives Market, by Source

- Food Additives Market, by Form

- Food Additives Market, by Application

- Food Additives Market, by Region

- Food Additives Market, by Group

- Food Additives Market, by Country

- United States Food Additives Market

- China Food Additives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Future Trajectory of the Food Additives Industry amidst Innovation, Regulation, and Shifting Consumer Expectations

The food additives industry stands at a pivotal juncture, defined by the dual imperatives of innovation and responsibility. Technological advancements in bio-based production, data-driven formulation, and clean label extraction are converging with heightened regulatory expectations and empowered consumer demands. As sustainability and transparency become non-negotiable, companies that embrace holistic strategies-integrating agile sourcing, digital capabilities, and cross-sector collaboration-will unlock the greatest value.

Looking ahead, the interplay of geopolitical factors, such as the evolving tariff landscape, will continue to reshape supply chains and cost structures. Organizations that proactively adapt through diversified manufacturing footprints and dynamic procurement frameworks will maintain competitive advantage. Simultaneously, investment in R&D ecosystems-infused with partnerships across academia, government, and startups-will generate breakthrough additives that cater to personalized nutrition, functional fortification, and sensory excellence.

In essence, the future trajectory of food additives hinges on the ability to harmonize consumer-centric innovation with operational resilience. By anchoring strategies in sustainability, leveraging digital transformation, and engaging stakeholders across the value chain, industry players will chart a course toward enduring growth and societal impact.

Engage with Ketan Rohom to Access the Comprehensive Market Research Report and Empower Strategic Decision-Making in Food Additives

I invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure full access to the comprehensive food additives market research report. Engaging with Ketan provides a personalized overview of how the insights align with your strategic objectives, enabling you to uncover untapped opportunities and build resilience against ongoing market disruptions. Through a direct consultation, you will gain clarity on segmentation deep dives, regional analyses, tariff impacts, and competitive benchmarks tailored to your specific needs. Reach out today to discuss volume licensing options, custom add-ons, and exclusive advisory sessions designed to accelerate your time to value. Position your organization at the forefront of food additive innovation and sustainability by leveraging the detailed findings and recommendations within this definitive report.

- How big is the Food Additives Market?

- What is the Food Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?