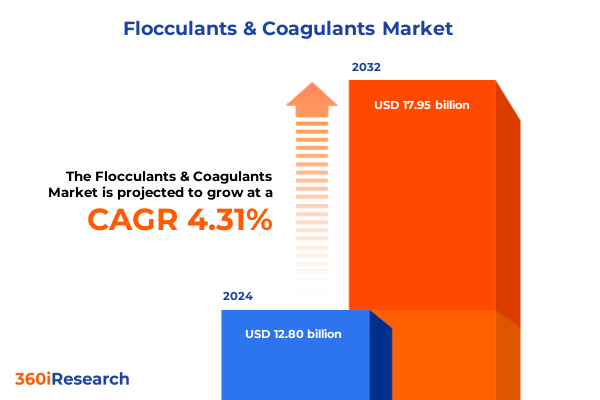

The Flocculants & Coagulants Market size was estimated at USD 13.33 billion in 2025 and expected to reach USD 13.88 billion in 2026, at a CAGR of 4.34% to reach USD 17.95 billion by 2032.

Examining the Crucial Role of Flocculants and Coagulants in Water Treatment: Key Drivers Shaping Industry Evolution and Market Dynamics

Flocculants and coagulants serve as indispensable components in modern water treatment processes, orchestrating the removal of suspended solids and colloidal particles to deliver safe, potable water and environmentally compliant effluent. By destabilizing and aggregating fine particulates, these chemical agents lay the foundation for downstream purification steps, enabling municipal, industrial, and mining operations to meet stringent regulatory standards. As urban populations continue to swell and industrial activity intensifies, the demand for reliable treatment solutions underscores the strategic importance of flocculation and coagulation technologies.

Beyond conventional applications in drinking water production and wastewater management, these chemistries now play critical roles in sectors as diverse as oil and gas extraction, food and beverage processing, and pulp and paper manufacturing. Continuous advancements in polymer science have broadened the functional profile of coagulants and flocculants, fostering the development of more efficient, eco-friendly formulations. Consequently, stakeholders must remain attuned to emerging material innovations, partnership opportunities, and shifting regulatory frameworks to capitalize on new avenues for performance optimization and cost efficiencies.

Understanding the Transformative Shifts in Coagulants and Flocculants Landscape Driven by Technological Innovations and Regulatory Pressures

Technological breakthroughs in polymerization techniques and green chemistry have catalyzed a transformative shift across the flocculant and coagulant landscape. Novel amphoteric and cationic polymers, featuring tailored charge densities and molecular architectures, deliver enhanced removal efficiencies while reducing environmental toxicity. Simultaneously, digital monitoring platforms enable real-time optimization of dosage and mixing parameters, ensuring precise process control. As a result, treatment facilities can minimize chemical consumption and sludge generation, aligning operations with circular economy principles.

Regulatory pressures are also reshaping market dynamics, as governments worldwide tighten effluent standards and incentivize the adoption of low-impact coagulants. This is particularly evident in regions targeting micro-pollutant reduction and nutrient removal, where advanced formulations have become essential to meet effluent discharge thresholds. Moreover, increasing stakeholder emphasis on carbon footprint reduction is driving interest in bio-based coagulants derived from renewable feedstocks. Together, these factors are rewriting the competitive playbook, compelling suppliers and end users to invest in sustainable innovation and forge collaborative supply chain partnerships.

Assessing the Cumulative Impact of 2025 United States Tariffs on Flocculant and Coagulant Markets and Supply Chain Dynamics

The introduction of new United States tariff measures in early 2025 has injected a layer of complexity into the supply dynamics for key raw materials used in flocculant and coagulant production. Elevated duties on imported aluminum and specialty polymers have driven up the landed cost of inorganic coagulants and certain high-performance flocculants, prompting manufacturers to reevaluate sourcing strategies. In turn, domestic producers are racing to scale capacity, leveraging proximity to North American feedstock suppliers to mitigate cost volatility and uphold continuity of supply.

Beyond immediate pricing impacts, the tariff regime has accelerated efforts to diversify raw material inputs and explore alternative chemistries. Several leading formulators have initiated pilot programs for locally sourced organic coagulants based on plant-derived polymers, aiming to reduce dependence on tariff-exposed imports. At the same time, end users are collaborating more closely with chemical suppliers to implement flexible procurement models and risk-sharing agreements. These strategic adaptations are not only dampening the short-term shock of duty escalations but also laying the groundwork for a more resilient North American treatment ecosystem.

Revealing Powerful Segmentation Insights Unveiling Product Type Form Material Type Molecular Weight Polymer Architecture End User and Distribution Channels

Analysis of product type segmentation reveals that the coagulant category, encompassing inorganic and organic variants, remains the backbone of conventional water purification. Within inorganics, both aluminum-based and iron-based coagulants continue to fulfill large-volume municipal and industrial applications, whereas advances in organic coagulants such as Epi-DMA and Polydadmac are capturing share by offering lower sludge yields and enhanced turbidity removal. Meanwhile, flocculants classified across amphoteric, anionic, cationic, and nonionic classes are demonstrating superior performance in specialized contexts, including heavy metal sequestration and fine particulate clearance.

When examining form and material type, liquid and powder chemistries dominate established treatment workflows, but the emulsion segment is gaining traction due to improved handling safety and reduced dust exposure. Natural polymers are reemerging as eco-efficient alternatives to synthetic counterparts, meeting growing sustainability mandates without sacrificing efficacy. Additionally, granularity in molecular weight-ranging from low to high-and polymer architecture, whether linear or crosslinked, is allowing formulators to calibrate viscosity, shear tolerance, and settling rates to exact process requirements.

End-user analysis underscores that industrial water and wastewater plants, mining and metallurgy operations, municipal utilities, oil and gas facilities, and pulp and paper mills each maintain distinct performance thresholds and regulatory benchmarks. Suppliers are tailoring offerings to support high-TDS mine effluents, stringent nutrient removal targets in municipal systems, and complex organic load profiles in pulp bleaching circuits. Finally, distribution channel segmentation illustrates that while direct sales and distributor networks continue to serve bulk purchasers, company websites and eCommerce platforms are forging new pathways for smaller contractors and remote sites to access niche flocculant and coagulant solutions.

This comprehensive research report categorizes the Flocculants & Coagulants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Material Type

- Molecular Weight

- Polymer Architecture

- End User

- Distribution Channel

Examining Distinct Regional Dynamics Shaping the Flocculant and Coagulant Market Across Americas Europe Middle East Africa and Asia-Pacific

In the Americas, infrastructure modernization initiatives and stringent environmental regulations are fueling sustained demand for advanced coagulant and flocculant solutions. North American municipalities are investing heavily in nutrient recovery and micro-pollutant removal, driving adoption of next-generation polymers. Meanwhile, Latin American mining projects present opportunities for high-shear resistant flocculants capable of handling variable feed streams and high solids content.

Europe, the Middle East, and Africa exhibit a heterogeneous regulatory patchwork, where European Union directives on water reuse and circularity elevate the role of recycled polymer chemistries. In the Middle East, water scarcity has spurred desalination and zero liquid discharge plants that rely on robust coagulants for pre-treatment, while African markets are gradually upgrading treatment infrastructure, creating nascent demand for both inorganic and organic chemistries.

Across Asia-Pacific, rapid urbanization and industrial growth underpin significant investment in wastewater treatment assets. South Asian nations are tightening discharge limits, catalyzing uptake of organic coagulants with lower sludge volumes, whereas East Asian economies emphasize digital integration of treatment assets, leveraging IoT sensors and process analytics to optimize dosing. Additionally, Southeast Asian pulp and paper operations are increasingly partnering with specialty polymer providers to meet evolving effluent standards.

This comprehensive research report examines key regions that drive the evolution of the Flocculants & Coagulants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Landscape Through Key Company Strategies Partnerships Innovations and Market Positioning in the Flocculant and Coagulant Industry

Leading players in the flocculant and coagulant domain are forging strategic alliances, acquiring technology startups, and expanding green chemistry portfolios to outpace competition. Developers of novel bio-based coagulants are entering research collaborations with academic institutions to validate performance across diverse water matrices. At the same time, established chemical conglomerates are deploying advanced manufacturing techniques such as continuous polymerization and inline quality analytics to reduce batch variability and shorten lead times.

Investments in digital solutions are further defining competitive differentiation, as several companies have rolled out cloud-enabled dosing platforms that integrate predictive analytics and remote support. These tools not only optimize chemical consumption but also generate service revenues through subscription-based models. Moreover, industry leaders are pursuing vertical integration strategies, aligning with feedstock suppliers to secure premium monomers and mitigate raw material cost exposure.

Looking ahead, the competitive landscape will increasingly pivot on sustainability credentials and lifecycle performance. Organizations that can demonstrate lower carbon footprints, minimal sludge generation, and superior biodegradability will capture heightened preference from environmentally conscious end users. Consequently, joint ventures targeting circular economy initiatives and end-to-end treatment solutions are set to reshape market hierarchies in the coming years.

This comprehensive research report delivers an in-depth overview of the principal market players in the Flocculants & Coagulants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aditya Birla Chemicals by Aditya Birla Group

- Akzo Nobel N.V.

- Aries Chemical, Inc.

- BASF SE

- BAUMINAS Group

- Biomicrogel

- Buckman

- CarboNet

- ChemREADY by Zinkan Enterprises, Inc.

- Chemtrade Logistics Income Fund

- Condat

- CTX Professional by Fluidra S.A.

- Di-Corp, Inc.

- Dia-Chemical Sdn. Bhd.

- Ecolab Inc.

- Ecologix Environmental Systems, LLC

- Environex International Pty Ltd.

- Feralco AB

- Henan GO Biotech Co.,Ltd

- Hunan Yide Chemical Co., Ltd.

- INWACO process solutions AB

- Ion Exchange (India) Ltd.

- Ixom Operations Pty Ltd.

- Jayem Engineers

- Kemira Oyj

- Kendensha Co. Ltd.

- KSP Water Treatment Chemicals

- Kurita Water Industries Ltd.

- Mitsui Chemicals, Inc.

- NIPPON SHOKUBAI CO., LTD.

- REDA Group

- SERVYECO

- SNF S.A.

- Solenis LLC

- Solvay SA

- SUEZ S.A.

- The Dow Chemical Company

- Thermax Limited

- Tidal Vision

- Toagosei Co., Ltd.

- Veolia Environnement S.A.

- Vertex Chem Pvt. Ltd.

- Xylem Inc.

- Yixing Cleanwater Chemicals Co., Ltd.

Strategic Actionable Recommendations for Industry Leaders to Enhance Operational Efficiency Drive Sustainable Growth and Navigate Regulatory Complexity

Industry leaders must prioritize diversification of raw material supply chains to weather tariff-induced disruptions and feedstock volatility. Establishing multiple sourcing lanes, including domestic and regional suppliers, will bolster resilience and reduce lead time risks. Concurrently, investing in alternative chemistries-particularly plant-derived coagulants and next-generation polymers-can minimize tariff exposure and align with evolving sustainability mandates.

Operational optimization through digital transformation remains imperative. Adopting real-time monitoring and automated dosing systems will drive chemical usage down while enhancing treatment accuracy across variable influent conditions. Integrating advanced analytics with service-based models can unlock new revenue streams and foster deeper end-user partnerships, ultimately strengthening market positioning.

Finally, proactive engagement with regulatory bodies and participation in industry consortia will ensure early insight into emerging wastewater standards and circularity requirements. By collaborating on pilot projects and co-developing guideline frameworks, companies can influence policy development, accelerate technology adoption, and secure first-mover advantages in high-growth application segments.

Detailing Robust Research Methodology Employed to Ensure Comprehensive Data Collection Qualitative and Quantitative Analysis and Industry Validation

The research framework underpinning this analysis employed a multi-stage approach to ensure both breadth and depth of insights. Primary data collection involved comprehensive interviews with senior executives, process engineers, and procurement specialists across water treatment, mining, municipal utilities, and industrial end users. These discussions unearthed firsthand perspectives on performance pain points, procurement dynamics, and innovation priorities.

Secondary research encompassed an exhaustive review of technical papers, patent filings, regulatory publications, and company white papers to validate emerging trends and benchmark best practices. Quantitative analysis leveraged structured surveys administered to a representative cross-section of treatment professionals, capturing dosage patterns, cost considerations, and adoption barriers. Finally, iterative validation workshops with industry experts refined key assumptions and synthesized qualitative and quantitative findings into actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Flocculants & Coagulants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Flocculants & Coagulants Market, by Product Type

- Flocculants & Coagulants Market, by Form

- Flocculants & Coagulants Market, by Material Type

- Flocculants & Coagulants Market, by Molecular Weight

- Flocculants & Coagulants Market, by Polymer Architecture

- Flocculants & Coagulants Market, by End User

- Flocculants & Coagulants Market, by Distribution Channel

- Flocculants & Coagulants Market, by Region

- Flocculants & Coagulants Market, by Group

- Flocculants & Coagulants Market, by Country

- United States Flocculants & Coagulants Market

- China Flocculants & Coagulants Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Summarizing Critical Findings and Strategic Implications to Guide Stakeholders in Harnessing Opportunities within the Flocculant and Coagulant Market

This executive summary has underscored the pivotal roles of flocculants and coagulants in optimizing water treatment processes amid evolving regulatory, environmental, and economic landscapes. Transformative shifts driven by technological innovation, sustainability imperatives, and trade policy adjustments are redefining competitive dynamics and application opportunities. Stakeholders equipped with an in-depth understanding of segmentation nuances, regional intricacies, and leading company strategies will be poised to capitalize on emerging growth vectors.

As the industry continues to embrace digital integration and green chemistry, those who proactively align their portfolios with sustainability mandates and operational agility will command the greatest strategic advantage. By synthesizing these critical findings and strategic implications, decision-makers across chemical suppliers, treatment operators, and engineering firms can chart a clear path toward resilient, high-performance water management solutions.

Unlock Comprehensive Insights and Drive Strategic Advantage by Connecting with Ketan Rohom to Acquire the Flocculant and Coagulant Market Research Report

For industry stakeholders seeking a comprehensive understanding of the flocculant and coagulant landscape, direct engagement with Ketan Rohom, Associate Director of Sales & Marketing, will unlock unparalleled insights. His expertise bridges technical nuances and strategic imperatives, providing clarity on navigating tariff disruptions, regulatory shifts, and evolving customer demands. By coordinating a consultation with Ketan, you will gain tailored guidance on how to integrate sustainable chemistries, optimize supply chain resilience, and leverage cutting-edge innovations to secure competitive advantage.

Contacting Ketan Rohom now ensures you receive priority access to the complete market research report, empowering your team with data-driven recommendations and a roadmap for future growth. Schedule your discovery session today to transform high-level industry intelligence into actionable plans that drive measurable impact across your organization.

- How big is the Flocculants & Coagulants Market?

- What is the Flocculants & Coagulants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?