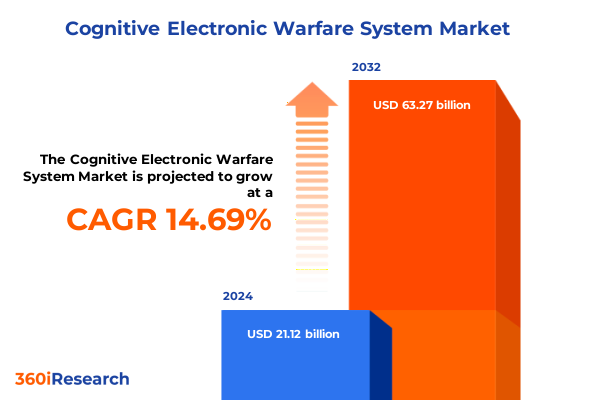

The Cognitive Electronic Warfare System Market size was estimated at USD 24.08 billion in 2025 and expected to reach USD 27.48 billion in 2026, at a CAGR of 14.79% to reach USD 63.27 billion by 2032.

Unlocking Strategic Advantages of Cognitive Electronic Warfare Systems Through Insightful Executive Context and Industry Relevance

Cognitive electronic warfare systems represent the next frontier in securing dominance over contested electromagnetic environments by integrating adaptive learning and decision-making capabilities directly into defense platforms. These systems leverage advanced neural networks and signal processing techniques to interpret, learn from, and respond to dynamic threat scenarios in real time. Their ability to autonomously adjust electronic countermeasures, exploit emerging vulnerabilities in hostile systems, and optimize spectrum usage positions cognitive electronic warfare as a strategic imperative for today’s defense organizations.

As geopolitical tensions intensify and threat actors deploy increasingly sophisticated electronic attack and deception methods, defense stakeholders require a comprehensive executive perspective to navigate this complex landscape. This executive summary presents a concise yet thorough exploration of the cognitive electronic warfare market, offering critical context for technology decision-makers, procurement leads, and strategic planners. By synthesizing industry insights, regulatory considerations, and technology integration challenges, this section lays the foundation for informed discussions on capability investments and operational readiness.

Transitioning from foundational concepts to actionable data, the overview that follows highlights key shifts in technology maturation, regulatory dynamics such as recent tariff adjustments, segmentation nuances across technology, components, applications, platforms, end users, deployment options, and frequency domains. It concludes with strategic recommendations and a detailed research approach, equipping stakeholders with the knowledge to harness cognitive electronic warfare systems effectively and sustainably.

Navigating the Paradigm Shift in Electromagnetic Spectrum Warfare with Next-Generation Cognitive Capabilities and Adaptive Countermeasures for Emerging Threat Environments

Electronic warfare has historically relied on static jamming and interception techniques, but an unprecedented paradigm shift is driving the adoption of cognitive capabilities within defense architectures. Adaptive algorithms now enable systems to learn from evolving threat signatures, reconfigure radio frequency behaviors on the fly, and deliver precise countermeasures with minimal human intervention. These advances coincide with breakthroughs in deep learning, neural networks, and signal processing that are revolutionizing the way militaries approach electromagnetic spectrum operations.

Concurrently, the proliferation of software-defined radios and open architecture platforms has lowered barriers to integration, allowing cognitive electronic warfare modules to plug into existing fleets and communication networks seamlessly. The rise of autonomous airborne platforms, unmanned ground vehicles, and maritime drones is further accelerating demand for embedded cognitive electronic warfare suites that can ensure mission resilience across contested zones. These transformative shifts underscore a broader trend toward system-of-systems thinking in defense procurement, where interoperability and data sharing are paramount.

Looking ahead, the integration of natural language processing for threat analysis and synthetic aperture radar enhancements will unlock new dimensions in situational awareness and rapid decision cycles. As governments and defense primes embrace these next-generation electronic warfare capabilities, the foundation is set for a radical redefinition of spectrum dominance and a strategic advantage that will be decisive in future conflict scenarios.

Assessing the Multidimensional Consequences of 2025 United States Tariff Adjustments on Cognitive Electronic Warfare Supply Chains and Innovation

The introduction of new tariff measures by the United States in early 2025 has exerted significant pressure on cost structures for imported semiconductor and electronic components critical to cognitive electronic warfare development. These levies have prompted many defense contractors and original equipment manufacturers to reassess their global supply chains, seeking alternative sourcing strategies to mitigate the impact of increased import duties. As a result, joint ventures and local assembly agreements have proliferated to preserve production timelines and maintain budgetary discipline.

Beyond immediate cost considerations, these tariff changes have accelerated domestic investment in advanced semiconductor fabrication and component assembly facilities. Technology firms and defense integrators have prioritized research partnerships with U.S.-based foundries to secure priority access to critical hardware. At the same time, some international suppliers have responded by realigning their production footprints toward tariff-free zones, fostering new manufacturing hubs in neighboring regions.

Ultimately, the cumulative impact of these policies extends beyond price adjustments; it reshapes strategic alliances, drives localization of sensitive technology assets, and influences long-term procurement roadmaps. Defense stakeholders must therefore incorporate tariff dynamics into their acquisition strategies, balancing risk mitigation with the imperative to maintain uninterrupted development of cognitive electronic warfare capabilities.

Unveiling In-Depth Segmentation Dynamics for Cognitive Electronic Warfare Systems Highlighting Technology Component Application Platform End User and Deployment Nuances

The market architecture for cognitive electronic warfare systems unfolds across a diverse set of technology domains, including machine learning and artificial intelligence, radar technology, and signal processing. Within the machine learning and artificial intelligence sphere, deep learning, natural language processing, and neural networks serve as the bedrock for autonomous threat analysis and adaptive response mechanisms. Radar technology contributes critical detection and tracking capabilities through the use of Doppler radar, electronic scanning, and synthetic aperture radar innovations. Signal processing remains indispensable, encompassing both digital signal processing techniques and time and frequency domain analyses that refine signal clarity and jamming precision.

Component segmentation further delineates the market by hardware, sensors, and software categories. Hardware platforms rely on high-performance processors, advanced receivers, and transmitters to execute rapid decision loops, while sensors range from acoustic and infrared modalities to specialized radar sensors that deliver multispectral situational awareness. The software layer, encompassing data analytics and threat analysis modules, orchestrates the fusion of sensor inputs and algorithmic outputs, allowing cognitive systems to prioritize, classify, and neutralize electromagnetic threats with unprecedented speed and accuracy.

Applications of cognitive electronic warfare span communication functions-such as satellite communication systems and wireless communication networks-to specialized military deployments on airborne, land, and naval platforms. Surveillance use cases extend from border security installations to coastal monitoring networks, while threat detection workflows protect critical assets through missile system and unmanned aerial vehicle countermeasures. Platforms hosting these capabilities vary across manned aircraft and unmanned aerial vehicles in the air segment, armored vehicles and tanks for land operations, and destroyers and submarines within maritime contingents. End users comprise defense forces-encompassing the air force, army, and navy-and homeland security entities charged with border protection and coast guard operations. Deployment models range from cloud-based architectures that facilitate rapid scalability to on-premise implementations designed for secure, air-gapped environments. Frequency considerations incentivize system designs that leverage high, ultra-high, and very high frequency bands to optimize performance against a spectrum of interference and jamming threats.

This comprehensive research report categorizes the Cognitive Electronic Warfare System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Platform

- Technology

- Frequency

- Application

- End User

- Deployment

Illuminating Regional Adoption Trends of Cognitive Electronic Warfare Systems across Americas Europe Middle East Africa and Asia-Pacific Geographies

Across the Americas, cognitive electronic warfare adoption is driven by robust defense budgets and a strong emphasis on domestic research and development initiatives. Partnerships between government research agencies and leading defense contractors have cultivated innovation clusters focused on integrating artificial intelligence into electronic warfare suites. This region also benefits from proximity to key semiconductor fabrication facilities, which bolsters resilience against supply chain disruptions.

In Europe, the Middle East, and Africa region, collaborative defense programs among NATO members and strategic alliances in the Gulf and North Africa foster cross-border integration of cognitive electronic warfare capabilities. Multinational procurement frameworks have accelerated joint exercises and capability demonstrations, while regional security dynamics have underscored the need for advanced spectrum management and resilient command-and-control networks.

The Asia-Pacific landscape presents a dual narrative of rapid modernization and geopolitical tension. Rising investments in indigenous defense manufacturing, particularly in East and Southeast Asia, are complemented by strategic technology transfers and joint ventures. Regional actors are prioritizing cognitive enhancements for maritime domain awareness and ballistic missile defense, reflecting both the complexity of local threat vectors and the strategic imperative to secure contested waters.

These regional insights illustrate that while budgetary allocations and security mandates vary, the universal imperative is clear: decision-makers across all geographies must integrate cognitive electronic warfare systems to maintain electromagnetic spectrum superiority in an era of heightened electronic conflict.

This comprehensive research report examines key regions that drive the evolution of the Cognitive Electronic Warfare System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Edge Innovators Shaping Cognitive Electronic Warfare Systems through Strategic Collaborations Technological Breakthroughs and Market Positioning

A select group of technology leaders and defense primes are spearheading advancements in cognitive electronic warfare systems through strategic partnerships and continuous R&D investments. These organizations leverage cross-disciplinary expertise-spanning artificial intelligence, signal processing, and radar engineering-to create modular, upgradeable architectures that align with evolving mission requirements. By collaborating with specialized sensor manufacturers and software innovators, they ensure seamless integration of end-to-end solutions that can be rapidly deployed across diverse operational theaters.

Innovative start-ups focusing on neural network optimizations and algorithmic acceleration have emerged as critical ecosystem contributors, often supplying niche capabilities that enhance threat classification and response times. Their agility complements the scale and domain knowledge of established defense contractors, enabling a balanced approach to disruptive technology adoption. Meanwhile, consortiums comprising academic institutions, government labs, and industry partners have accelerated prototyping cycles and sponsored field trials, validating cognitive frameworks under real-world electromagnetic conditions.

Looking ahead, these key companies insights reveal that success in the cognitive electronic warfare arena hinges on the ability to anticipate evolving threat paradigms, invest in scalable architectures, and cultivate multi-sector alliances that bridge the gap between foundational research and operational deployment. Such strategic foresight will determine which market participants emerge as leaders in spectrum dominance capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cognitive Electronic Warfare System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abaco Systems by AMETEK, Inc.

- Airbus SE

- BAE Systems PLC

- Bharat Dynamics Limited

- CACI International Inc.

- CAES Systems LLC by Honeywell International Inc

- Collins Aerospace

- Elbit Systems Ltd.

- Galleon Embedded Computing by Spectra Aerospace & Defense

- GBL Systems Corporation

- General Dynamics Corporation

- Hensoldt AG

- Honeywell International Inc.

- Huntington Ingalls Industries, Inc.

- Indra Sistemas S.A.

- Indra Sistemas, S.A.

- Israel Aerospace Industries Ltd.

- L3Harris Technologies, Inc.

- Leidos, Inc.

- Leonardo S.p.A.

- Lockheed Martin Corporation

- Mistral Solutions Pvt. Ltd. by AXISCADES Inc.

- Mitre Corporation

- Mitsubishi Heavy Industries, Ltd.

- National Instruments Corporation by Emerson Electric Co.

- NEC Corporation

- Northrop Grumman Corporation

- QinetiQ Group

- Rheinmetall AG

- Rohde & Schwarz GmbH & Co KG

- RTX Corporation

- Saab AB

- Tata Advanced Systems Limited

- Teledyne Technologies Incorporated

- Textron Systems Corporation

- Thales Group

- The Boeing Company

- Viasat Inc.

Advancing Competitive Edge through Actionable Recommendations for Leadership in Cognitive Electronic Warfare System Development Deployment and Collaboration

To maintain a competitive advantage, industry leaders should prioritize robust investments in artificial intelligence research focused on continuous learning algorithms that can rapidly adapt to novel electronic threat signatures. Strengthening partnerships with semiconductor fabricators and sensor specialists will safeguard critical supply chains and accelerate the integration of advanced components. By adopting modular, software-defined architectures, defense organizations can future-proof their assets and reduce time to deploy emerging enhancements.

Moreover, leaders must champion interoperability standards that facilitate secure data exchange between allied platforms and coalition forces. Establishing comprehensive training programs for operators and engineers will maximize the value of cognitive electronic warfare systems, ensuring personnel can confidently manage algorithm-driven countermeasures. Proactive engagement with regulatory bodies and spectrum management authorities will help shape policies that support innovation while maintaining robust oversight frameworks.

By executing these recommendations, stakeholders will not only mitigate operational risks but also unlock new strategic possibilities. A deliberate focus on collaborative research, standardized protocols, and workforce development will empower organizations to harness cognitive capabilities effectively and elevate their electromagnetic warfare posture in complex threat environments.

Detailing Rigorous Research Methodology Underpinning Analysis of Cognitive Electronic Warfare Systems through Data Triangulation Expert Engagement and Analytical Frameworks

This analysis is rooted in a structured research methodology that combines comprehensive secondary research with targeted primary interactions. The secondary phase involved an exhaustive review of academic publications, defense white papers, government procurement records, and trusted technology journals to build a foundational understanding of current cognitive electronic warfare innovations and industry dynamics. Data points were triangulated across multiple reputable sources to ensure coherence, eliminate bias, and uphold analytical rigor.

In parallel, primary research engagements included in-depth interviews with defense procurement officials, electronic warfare system architects, spectrum management experts, and senior technology leaders. These qualitative insights provided nuanced perspectives on implementation challenges, capability gaps, regulatory considerations, and long-term investment priorities. Quantitative data collection through structured surveys of defense end-users supported the validation of thematic trends and emerging adoption patterns.

The research approach also incorporated iterative workshops with domain specialists to stress-test analytical frameworks and refine segmentation models. A detailed data validation process ensured that findings align with real-world operational requirements and technological trajectories. This robust methodology underpins the strategic accuracy of the insights presented throughout this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cognitive Electronic Warfare System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cognitive Electronic Warfare System Market, by Component

- Cognitive Electronic Warfare System Market, by Platform

- Cognitive Electronic Warfare System Market, by Technology

- Cognitive Electronic Warfare System Market, by Frequency

- Cognitive Electronic Warfare System Market, by Application

- Cognitive Electronic Warfare System Market, by End User

- Cognitive Electronic Warfare System Market, by Deployment

- Cognitive Electronic Warfare System Market, by Region

- Cognitive Electronic Warfare System Market, by Group

- Cognitive Electronic Warfare System Market, by Country

- United States Cognitive Electronic Warfare System Market

- China Cognitive Electronic Warfare System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 3021 ]

Synthesizing Executive Insights into Cognitive Electronic Warfare System Evolution Strategic Drivers and Imperatives for Defense and Security Stakeholders

The convergence of machine learning, advanced radar techniques, and sophisticated signal processing is redefining the electronic warfare domain through systems capable of autonomous threat assessment and adaptive response. Recent policy shifts, particularly the 2025 tariff adjustments, have reshaped supply chain strategies and catalyzed domestic technology investments. Embedded within these dynamics are rich segmentation nuances across technology pillars, component categories, application scenarios, platform environments, end-user mandates, deployment architectures, and frequency domains.

Regionally, the Americas leverage strong domestic research infrastructures, the Europe, Middle East & Africa region benefits from multinational collaboration frameworks, and Asia-Pacific drives rapid modernization amid geopolitical complexity. Leading companies are carving out competitive advantages through strategic partnerships, disruptive start-up collaborations, and rigorous R&D roadmaps. To navigate these multidimensional forces, industry leaders must embrace forward-looking AI initiatives, foster interoperability, and invest in workforce readiness.

This executive summary synthesizes crucial insights into transformative shifts, regulatory influences, and segmentation dynamics, equipping defense and security stakeholders with the strategic clarity required to harness cognitive electronic warfare capabilities. Armed with actionable recommendations and a transparent research foundation, decision-makers are poised to secure spectrum dominance and safeguard operational superiority in an era of heightened electronic conflict.

Empowering Decision Makers to Secure Comprehensive Cognitive Electronic Warfare Intelligence through Direct Engagement with Associate Director of Sales and Marketing

In an era defined by rapidly evolving electromagnetic warfare challenges, acquiring the most comprehensive market research can redefine competitive positioning and strategic foresight. Connect with Associate Director of Sales & Marketing, Ketan Rohom, to secure full access to the definitive market intelligence report on cognitive electronic warfare systems. Engaging directly with Ketan ensures personalized guidance tailored to your organization’s objectives and delivers a streamlined pathway to actionable insights.

By initiating a conversation with Ketan Rohom, you gain an expert collaborator committed to understanding your unique strategic requirements. This direct engagement provides clarity on report scope, delivers supplementary data customization options, and unlocks priority support for urgent decision-making timelines. His deep familiarity with defense procurement cycles, technology adoption patterns, and strategic partnerships will enhance your ability to capitalize on emerging opportunities.

Take decisive action today to fortify your strategic planning and technology roadmaps. Reach out for a consultative discussion that clarifies how the cognitive electronic warfare systems report can address your specific challenges and unlock growth avenues. Partnering with Ketan Rohom opens the door to exclusive briefings, trial data excerpts, and a seamless purchasing experience-empowering you to make informed investments that safeguard operational superiority and drive organizational resilience

- How big is the Cognitive Electronic Warfare System Market?

- What is the Cognitive Electronic Warfare System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?