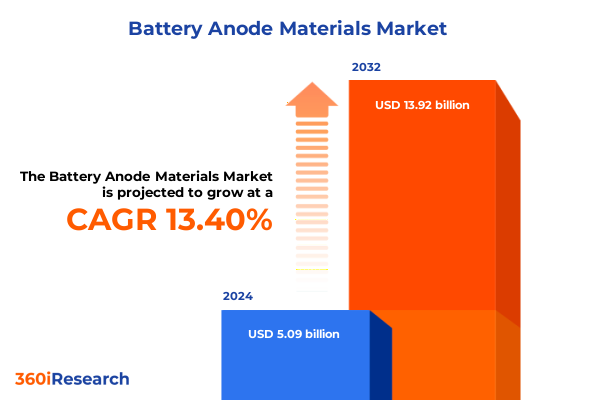

The Battery Anode Materials Market size was estimated at USD 5.70 billion in 2025 and expected to reach USD 6.40 billion in 2026, at a CAGR of 13.58% to reach USD 13.92 billion by 2032.

Exploring How Advanced Anode Materials Are Revolutionizing Battery Performance And Driving Sustainable Growth Across Multiple High-Tech and Industrial Sectors

Underpinning the rapid evolution of battery-enabled technologies, advanced anode materials have emerged as a crucial differentiator in performance and sustainability. As the electric vehicle market accelerates globally, the limitations of traditional graphite anodes-particularly in energy density and charging speed-have become increasingly apparent. Nanoscale silicon particles, for example, offer theoretical capacities nearly ten times greater than graphite, enabling batteries to store more energy without significant changes to form factors; collaborative efforts between major manufacturers such as Panasonic and innovators like Sila Nanotechnologies have already initiated pilot production of silicon powder anodes that integrate with existing electrode manufacturing processes, thereby promising substantial range and charging improvements while mitigating environmental impact through reduced reliance on heavily mined graphite sources.

Simultaneously, lithium titanate oxide (LTO) anodes persist as a transformative option in applications demanding exceptional cycle life and safety margins. LTO chemistry, verified in multiple industrial deployments, can sustain over 10,000 cycles and offers rapid charge acceptance under a broad temperature range, making it ideally suited for grid-scale storage and mission-critical aerospace systems. These advancements coexist with emerging carbon-based composites and coated anode technologies, collectively signaling a new paradigm in which material innovation aligns with regulatory imperatives to lower the carbon footprint of battery production and ensure robust performance across diverse end uses.

Mapping the Transformative Technological Shifts Disrupting Traditional Graphite Dominance And Paving The Way For Next-Gen Anode Materials

Today’s battery landscape is witnessing transformative technological shifts driven by material science breakthroughs that challenge the long-held dominance of conventional graphite. Enhanced silicon-carbon composites are rapidly moving from laboratory to pilot-scale manufacturing, leveraging advanced chemical vapor deposition and proprietary nano-coating techniques to counteract silicon’s volumetric expansion during cycling. Companies pioneering these processes report commercial deliveries of cells featuring energy densities exceeding 450 Wh/kg, representing a leap over standard graphite-based chemistries. This nano-engineered approach allows incremental integration into existing production lines, preserving supply chain continuity while delivering tangible performance gains.

In parallel, coated and treated anodes utilizing spherical graphite and alternative carbon allotropes such as graphene are redefining fast-charging capabilities. These materials optimize electrode porosity and surface morphology to facilitate higher lithium-ion mobility, enabling 80 percent charge in under ten minutes without compromising cycle life. Moreover, the advent of lithium-sulfur and next-generation nickel-metal hydride systems is broadening the material repertoire, reinforcing the industry’s pivot toward diversified solutions that reconcile energy density, safety, and cost. As regulatory bodies tighten environmental standards, manufacturers are also accelerating the adoption of recycled feedstocks and water-based binders, thus heralding a holistic shift toward sustainable battery production frameworks.

Analyzing The Cumulative Impact Of New United States Tariffs On Graphite Imports And Their Implications For Global Anode Material Supply Chains

With the implementation of substantial anti-dumping tariffs on Chinese graphite imports in early 2025, the United States has dramatically reshaped the competitive landscape for anode materials. The new measures raise total duties on certain graphite-based active materials to approximately 160 percent, prompting a swift rally in non-Chinese producers’ market valuations. Australian and Canadian natural graphite miners, alongside synthetic graphite manufacturers in North America, have seen investor enthusiasm surge as stakeholders anticipate a rebalancing of supply chains away from entrenched sources. While proponents argue that this policy fosters domestic capacity and aligns with strategic decoupling objectives, skeptics caution that local producers must rapidly scale quality and volume to meet demand from electric vehicle OEMs who currently rely extensively on Chinese suppliers.

Beyond mitigating supply chain concentration risks, these tariffs form part of a broader U.S. strategy to secure critical mineral supply chains under heightened geopolitical scrutiny. Government incentives are being directed toward synthetic graphite plants and next-generation anode material facilities, including multi-hundred-million-dollar loans to accelerate capacity build-out. However, achieving self-reliance will require overcoming legacy challenges such as raw material diversity, manufacturing expertise, and the establishment of environmental permitting frameworks. The net effect of these policies is expected to catalyze a reorientation of global value chains, compelling industry participants to forge strategic partnerships and invest in localized processing capabilities amid evolving trade dynamics.

Leveraging Diverse Segmentation Perspectives To Unlock Comprehensive Insights Into Material Types Battery Configurations And End-Use Markets

Segmenting the battery anode materials market unveils distinct performance, manufacturing, and application-driven insights that inform strategic decision-making. Material type segmentation highlights a tiered landscape: traditional graphite anodes remain dissected into natural and synthetic variants, each offering trade-offs in purity, conductivity, and cost. Lithium titanate oxide secures a niche for applications prioritizing longevity and safety, whereas silicon-based anodes-further divided into nanoscale silicon and silicon-carbon composite classes-present a compelling avenue for performance-centric use cases, albeit with pronounced engineering challenges to control volumetric expansion.

Examining segmentation by battery type underscores a diverse ecosystem spanning lead-acid, which retains relevance in starter and backup power configurations; lithium-ion, the prevailing chemistries under continuous innovation; lithium-sulfur, which promises higher theoretical energy densities; and nickel-metal hydride, a mature solution still deployed in certain hybrid systems. Form factor segmentation-encompassing cylindrical, pouch cell, and prismatic anodes-reveals material compatibility considerations; for instance, pouch formats often leverage silicon composites to maximize volumetric utilization, while cylindrical cells may favor coated spherical graphite for optimized packing density.

Manufacturing method segmentation identifies the salient techniques shaping anode innovation. Coated and treated processes refine surface characteristics for enhanced ion kinetics, nano-engineered materials introduce hierarchical structures to balance conductivity and mechanical resilience, and spherical graphite production delivers uniform particle size distributions that underpin consistent electrode fabrication. Finally, end-use segmentation spans aerospace and defense, where mission-critical standards elevate safety and cycle life; automotive markets bifurcated into commercial and passenger vehicle applications demanding high energy and power densities; consumer electronics, stretching from laptops to smartphones and wearables with miniaturization imperatives; and industrial equipment, including heavy machinery and power tools requiring robustness and rapid rechargeability. By synthesizing these segmentation lenses, stakeholders can tailor material portfolios and manufacturing strategies to precisely address evolving application requirements.

This comprehensive research report categorizes the Battery Anode Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Battery Type

- Form Factor

- Manufacturing Method

- End-Use

Deciphering Regional Dynamics In The Americas EMEA And Asia-Pacific To Understand Geopolitical Influences On Anode Materials Production And Demand

In the Americas, policy imperatives and market momentum coalesce to drive rapid anode material evolution. The United States’ anti-dumping measures against Chinese graphite have triggered strategic investments in synthetic and naturally sourced graphite production, supported by substantial government financing to expand domestic capacity. Private sector ventures are scaling pilot plants for silicon-based anodes, leveraging environmentally favorable feedstocks and low-carbon power sources. Canada and Mexico are emerging as vital contributors to the North American supply chain, hosting graphite mining and processing facilities that benefit from proximity to major automotive manufacturing hubs, thereby reducing logistics complexity and enhancing responsiveness to fluctuating demand cycles.

Europe, the Middle East, and Africa collectively manifest a multifaceted anode materials ecosystem shaped by stringent regulatory frameworks and raw material endowment. The European Union’s forthcoming battery passport regulations mandate supply chain transparency and sustainability disclosures, incentivizing the uptake of recycled and low-emission anode solutions. Concurrently, emerging economies in Africa present attractive prospects for graphite mining, although infrastructure and governance variables influence project viability. The Middle East is nurturing nascent lithium titanate and coated graphite ventures through public-private partnerships, aiming to diversify from oil-centric economic models and establish footholds in the battery value chain. Across this region, stakeholders navigate a complex mosaic of legal standards, geopolitical risks, and evolving consumer expectations.

In the Asia-Pacific corridor, long-standing dominance of Chinese graphite production intersects with pioneering research in silicon and nano-engineered anodes. China’s vertically integrated supply chains deliver economies of scale, yet recent export constraints have prompted neighboring economies to amplify R&D investments and speed to market for alternative materials. Japan and South Korea continue to excel in high-purity spherical graphite and innovative coating processes, while technology companies explore pure-silicon anode applications to meet domestic OEM requirements. Collaborative research clusters in Southeast Asia are also gaining traction as regional governments prioritize green technology initiatives, thereby fostering innovation ecosystems that bridge material science with pilot-scale manufacturing.

This comprehensive research report examines key regions that drive the evolution of the Battery Anode Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling The Key Industry Players Shaping Next-Generation Anode Material Innovations And Their Strategies For Competitive Differentiation

Key industry participants are charting varied trajectories to address the performance, cost, and sustainability imperatives of next-generation anode materials. BTR New Material Group, for example, has leveraged proprietary nano-coating techniques to deliver silicon-carbon composite anodes exceeding 1,500 mAh/g capacity, securing multi-year supply contracts with major electric vehicle OEMs. The company’s vertically integrated manufacturing model affords tight control over raw material sourcing, process efficiency, and quality assurance, thereby positioning it as a frontrunner in performance-driven applications.

Shanghai Shanshan Technology has demonstrated leadership in lithium titanate oxide production, achieving over 95 percent capacity retention after 15,000 cycles at high charge rates, a breakthrough that has unlocked ultra-fast charging solutions for commercial vehicle fleets in partnership with CATL. Its recent advances in fluorine-doping of LTO anodes have mitigated gas evolution during cycling by upwards of 40 percent, directly addressing a critical barrier to widespread LTO adoption in high-throughput charging scenarios.

Meanwhile, Sila Nanotechnologies and Amprius Technologies embody the frontier of silicon-based innovation. Sila’s partnership with Panasonic has catalyzed pilot-scale production of silicon powder anodes slated for integration into next-generation EV platforms, while Amprius’s development of silicon nanowire anodes has delivered commercial cells at energy densities surpassing 450 Wh/kg, highlighting the scalability of chemical vapor deposition methods to produce robust silicon architectures. Collectively, these pioneers underscore a broader industry pivot toward nano-engineered solutions that reconcile high performance with manufacturability priorities.

Novonix, backed by significant government financing, is rapidly advancing synthetic graphite capabilities in North America to support the domestic push for anode self-sufficiency. By deploying innovative precursor formulations and high-temperature processing, it aims to match or exceed the purity and consistency traditionally sourced from China, thus underpinning a strategic diversification of graphite supply chains and bolstering resilience against trade disruptions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Battery Anode Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amprius Technologies

- Anovion LLC

- Asahi Kasei Corporation

- BASF SE

- BTR New Material Group Co., Ltd.

- Calyxo AG

- Daejoo Electronic Materials Co., Ltd.

- E-magy

- Enevate Corporation

- Epsilon Advanced Materials Pvt. Ltd.

- Glencore plc

- Gotion High-tech Co., Ltd.

- Grafoid Inc.

- Graphite India Limited

- Group14 Technologies, Inc.

- Henan Carbon Graphite New Material Co., Ltd.

- Himadri Speciality Chemicals Ltd.

- Hunan Kingi Technology Co., Ltd.

- JFE Chemical Corporation

- Kanthal AB

- Kuraray Co., Ltd.

- Kureha Corporation

- Mitsubishi Chemical Corporation

- Mitsui Mining & Smelting Co., Ltd.

- NanoGraf Corporation

- NEI Corporation

- NEO Battery Materials Ltd.

- Nexeon Ltd.

- Ningbo Shanshan Co., Ltd.

- Nippon Carbon Co., Ltd.

- Panasonic Corporation

- Petra Graphite Inc.

- POSCO Group

- Redwood Materials Inc.

- Resonac Holdings Corporation

- Samsung SDI Co., Ltd.

- SGL Carbon SE

- Shenzhen Capchem Technology Co., Ltd.

- Shenzhen Dangsheng Technology Co., Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Showa Denko K.K.

- Sila Nanotechnologies Inc.

- SK Innovation Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Talga Group

- Targray Technology International Inc.

- Tokai Carbon Co., Ltd. by Cabot Corporation

- Umicore SA

- Vianode AS

- Yichang Xincheng Graphite Co., Ltd.

Implementing Strategic Actions For Industry Leaders To Navigate Tariffs Enhance Supply Chains And Accelerate Adoption Of Advanced Anode Technologies

To navigate the evolving dynamics of anode materials and maintain competitive advantage, industry leaders should prioritize the diversification of raw material sources alongside strategic alliances with specialized technology partners. Establishing joint ventures focused on silicon composite R&D can accelerate the resolution of volumetric expansion challenges while ensuring alignment with automotive OEM specifications. Concurrently, ramping up investments in nano-engineered coatings and advanced manufacturing techniques will reduce cycle degradation and enhance fast-charging performance, thus meeting stringent consumer expectations for range and reliability.

Further, stakeholders must engage proactively with regulatory developments by integrating sustainability criteria-such as recycled feedstocks and water-based binder systems-early in product roadmaps. Collaborations with governmental bodies to secure funding or loan guarantees for domestic processing facilities can mitigate tariff-induced supply chain risks and foster a resilient manufacturing footprint. Additionally, implementing closed-loop recycling initiatives for end-of-life anode materials, in partnership with waste management and chemical recycling firms, will not only address circular economy mandates but also create secondary feedstock streams that alleviate raw material constraints and reduce environmental impact.

Finally, leadership teams should adopt a modular approach to cell design, enabling flexible adaptation across form factors and end-use requirements. By standardizing interfaces and materials packages for cylindrical, pouch, and prismatic formats, manufacturers can optimize production lines for rapid product customization and scale-up, reinforcing agility in response to shifting market segments-from consumer electronics to heavy industrial applications. This strategic focus on agility, sustainability, and collaboration will underpin robust growth trajectories in the decade ahead.

Detailing A Rigorous Research Methodology Combining Primary Interviews Secondary Data And Analytical Frameworks For Comprehensive Anode Material Insights

Our research methodology integrates comprehensive secondary data analysis, including peer-reviewed journals, industry whitepapers, and regulatory documentation, to establish a foundational understanding of current anode material technologies. This is complemented by qualitative primary interviews with key stakeholders-ranging from materials scientists and battery manufacturers to policy experts-to validate hypotheses and capture nuanced market dynamics. Data triangulation across multiple sources ensures internal consistency and mitigates biases inherent in single-source analyses.

Analytical frameworks such as SWOT and PESTLE provide structured lenses through which competitive, economic, and regulatory factors are examined, while segmentation analysis dissects market dynamics across material types, battery formats, manufacturing methods, and end-use applications. The converged insights are further subjected to expert panel reviews to refine conclusions and recommendations, guaranteeing that the final report delivers actionable intelligence underpinned by rigorous validation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Battery Anode Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Battery Anode Materials Market, by Material Type

- Battery Anode Materials Market, by Battery Type

- Battery Anode Materials Market, by Form Factor

- Battery Anode Materials Market, by Manufacturing Method

- Battery Anode Materials Market, by End-Use

- Battery Anode Materials Market, by Region

- Battery Anode Materials Market, by Group

- Battery Anode Materials Market, by Country

- United States Battery Anode Materials Market

- China Battery Anode Materials Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Summarizing Core Findings And Emphasizing The Strategic Imperatives For Stakeholders Engaging In The Evolving Anode Material Landscape

This executive summary captures the pivotal forces reshaping the battery anode materials landscape-from the ascendance of silicon-based innovations and nano-engineered composites to the strategic realignments prompted by U.S. tariffs on Chinese graphite. The interplay of regulatory mandates, technological breakthroughs, and evolving application demands underscores a dynamic market environment where material performance, supply chain resilience, and sustainability converge as critical success factors.

As stakeholders navigate this transformative era, the ability to integrate advanced materials across diverse battery architectures, adapt to shifting trade frameworks, and collaborate across public and private sectors will distinguish industry leaders. The insights and recommendations presented herein offer a roadmap for aligning strategic initiatives with technological trajectories and policy developments, thereby enabling informed decision-making and positioning organizations to capitalize on the next wave of growth in the anode materials domain.

Engage With Ketan Rohom For A Tailored Presentation Of Comprehensive Market Research On Anode Materials To Drive Your Strategic Decision-Making Forward

We invite you to collaborate with Ketan Rohom, Associate Director of Sales & Marketing, to secure comprehensive insights tailored to your strategic priorities. This report offers a deep dive into the latest advances in anode material technologies, tariff impacts, segmentation dynamics, regional trends, and leading company strategies. Engaging with Ketan will enable you to receive a personalized presentation and executive briefing, equipping your organization with the actionable intelligence needed to navigate the competitive landscape and capitalize on emerging opportunities in the battery anode market.

- How big is the Battery Anode Materials Market?

- What is the Battery Anode Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?