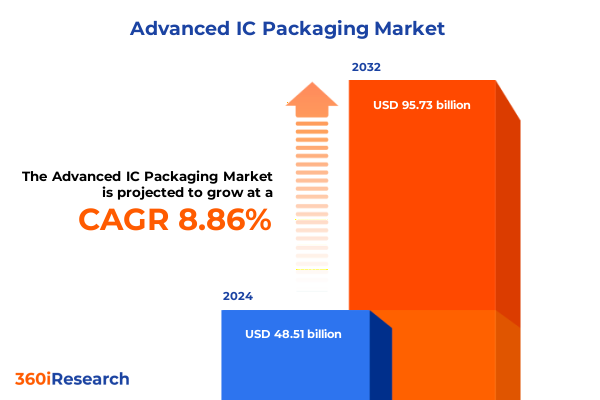

The Advanced IC Packaging Market size was estimated at USD 52.76 billion in 2025 and expected to reach USD 57.39 billion in 2026, at a CAGR of 8.88% to reach USD 95.73 billion by 2032.

Setting the Stage for Advanced Integrated Circuit Packaging: Bridging Fabrication and System-Level Integration to Empower Next-Gen Electronics

Advanced packaging has emerged as a pivotal discipline within the semiconductor industry, serving as the bridge between wafer fabrication and traditional integrated circuit encapsulation. By integrating multiple semiconductor dies, passive components, and interconnect structures into a single, highly efficient package, advanced packaging addresses the performance limitations faced by continued transistor scaling and delivers enhanced power efficiency, signal integrity, and form factor miniaturization.

This executive summary outlines the evolving landscape of advanced IC packaging as it strives to meet the rigorous demands of high-performance computing, artificial intelligence, 5G communications, and automotive electronics. Major industry players are expanding capacity and investing in next-generation technologies, ranging from fan-out wafer-level packaging (FOWLP) to heterogeneous multi-die assemblies. These developments reflect a collective drive to extend Moore’s Law through system-level integration, enabling unprecedented levels of functionality within ever-smaller footprints.

Unveiling the Transformative Shifts in Semiconductor Packaging That Are Catalyzing Ultra-High Performance, Miniaturization, and Scalable Production

In recent years, the semiconductor industry has witnessed an acceleration of architectural innovations that are redefining the boundaries of chip performance and integration. The rise of 2.5D integration, exemplified by interposer-based solutions like TSMC’s CoWoS and Intel’s EMIB, has enabled side-by-side placement of multiple dies, dramatically improving bandwidth and signal latency without the complexity of through-silicon vias.

Concurrently, 3D stacking and chiplet-based architectures have taken center stage. Techniques such as Cu-Cu hybrid bonding are delivering interconnect pitches in the single-digit micrometer range, facilitating vertical die stacking that boosts integration density and power efficiency for AI accelerators and high-bandwidth memory modules. Parallel advances in backside power delivery further optimize power integrity and routing efficiency, unlocking higher operating frequencies and lower power draw.

Fan-out wafer-level packaging remains a cornerstone for thin, high-I/O solutions in mobile and wearable devices, while panel-level packaging is scaling production to meet surging demand in AI and satellite markets. Collectively, these transformative shifts are enabling semiconductor manufacturers to overcome the physical limits of monolithic scaling and deliver higher-performance, more energy-efficient systems.

Assessing the Cumulative Impact of 2025 United States Tariffs on Global Semiconductor Packaging Supply Chains, Cost Structures, and Manufacturing Strategies

The imposition of Section 301 tariffs and related measures since 2018 has created a cascading impact on the supply chains for substrates, assembly materials, and test services integral to advanced packaging. In 2025, the cumulative effect of these duties is manifesting in elevated input costs, extended lead times, and the need for strategic realignment of manufacturing footprints.

Many OSAT providers and substrate suppliers have responded by diversifying production toward Southeast Asia, Mexico, and the United States, seeking to mitigate tariff exposure and strengthen supply-chain resilience. However, this migration introduces new challenges including workforce training, infrastructure readiness, and potential quality variability. Simultaneously, OEMs are accepting higher landed costs or negotiating long-term contracts to stabilize pricing, with some entering strategic partnerships to co-invest in localized packaging and testing facilities.

These dynamics underscore the importance of supply-chain agility in navigating tariff-driven cost pressures and regulatory complexity. Organizations that proactively assess tariff risk, invest in flexible capacity allocation, and cultivate strong supplier relationships will be best positioned to maintain lead times and cost competitiveness in an increasingly protectionist landscape.

Uncovering Critical Segmentation Insights Across Package Types, Advanced Technologies, Applications, End-User Profiles, Materials, and Assembly Processes That Drive Strategic Focus

A detailed segmentation analysis reveals the multifaceted nature of the advanced IC packaging market and guides strategic prioritization. Examining package types highlights critical distinctions between Ball Grid Array variants-such as Fine-Pitch, Micro, and Standard BGA-Flip Chip assemblies, Wafer-Level Packaging approaches including Fan-In and Fan-Out WLP, and traditional Wire Bond solutions. By evaluating packaging technologies, stakeholders can compare Embedded Die architectures-distinguishing substrate-embedded die from Known Good Die implementations-alongside Fan-Out options on both panel and wafer substrates, System-In-Package configurations like Chip-Scale and Multi-Chip Modules, and Through-Silicon Via methods in both Via-Last and Via-Middle processes.

Applications span from the stringent reliability demands of ADAS and powertrain systems in automotive electronics to emerging growth in gaming consoles, smart home devices, smartphones, tablets, and wearables. Telecom infrastructure requirements, driven by 5G base stations and network equipment, further diversify performance and thermal management criteria. End-user profiles range from pure-play foundries and IDMs to OEMs and outsourced assembly and test specialists. Material choices underscore the critical role of encapsulation compounds, underfills, solder balls, and advanced substrates, while assembly process stages-from die preparation and flip-chip interconnects to underfill, encapsulation, and final test-drive process optimization and yield enhancement.

This comprehensive research report categorizes the Advanced IC Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Package Type

- Packaging Technology

- Material

- Assembly Process

- Application

- End User

Illuminating Key Regional Dynamics and Investment Incentives Across the Americas, Europe-Middle East & Africa, and Asia-Pacific That Shape Advanced IC Packaging Leadership

Geographic dynamics exert a profound influence on advanced packaging innovation, investment incentives, and supply-chain resilience. In the Americas, robust policy support-underscored by multibillion-dollar incentive funds and targeted grants for domestic substrate and packaging development-has galvanized near-shoring efforts and accelerated capacity expansion in the U.S. and Mexico. This has also stimulated growth in Canada’s test-and-assembly sectors.

The Europe, Middle East & Africa region is responding to the European Chips Act’s renewed emphasis on chip production and packaging, channeling public and private investments to pilot advanced packaging lines and streamlined regulatory frameworks. Member states are refining funding mechanisms to ensure small and medium-sized enterprises gain access to pilot lines and open foundry statuses, reinforcing continental capabilities in heterogeneous integration and packaging R&D.

Asia-Pacific continues to lead in high-volume production with Taiwan, South Korea, and China advancing investments in interposers, fan-out packaging, and 3D IC pilot production. TSMC’s consideration of advanced packaging capacity in Japan, coupled with expanding OSAT operations across Vietnam, Malaysia, and India, exemplifies the region’s diversified manufacturing strategy to meet global demand while managing geopolitical risk.

This comprehensive research report examines key regions that drive the evolution of the Advanced IC Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Key Industry Stakeholders Driving Innovation, Strategic Alliances, and Competitive Dynamics in Advanced IC Packaging on a Global Scale

A competitive landscape analysis underscores the critical roles of integrated device manufacturers, foundries, and outsourced specialists in advancing packaging technologies. Leading IDM and foundry players such as TSMC, Samsung, Intel, and SK Hynix are investing heavily in proprietary packaging platforms-including CoWoS, InFO, and PowerVia-to secure performance advantages in AI, high-performance computing, and mobile markets. These efforts are complemented by strategic alliances with materials innovators for novel underfill compounds, high-density substrates, and eco-friendly encapsulants.

Among OSAT leaders, ASE Technology Holding retains its market leadership by scaling advanced packaging and testing revenues, projecting a rise from $600 million in 2024 to over $1.6 billion in 2025 through expanded leading-edge services. Amkor Technology, the only major U.S.-headquartered OSAT, stands to benefit from reshoring incentives and growing demand for AI processor packaging, while China’s JCET and HT-Tech are leveraging domestic demand and state support to achieve double-digit growth. Tier-two specialists such as Amkor’s SPIL unit, Tongfu Microelectronics, and Powertech Technology are similarly ramping capacity for heterogeneous integration, panel-level packaging, and fan-out wafer-level offerings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Advanced IC Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amkor Technology, Inc.

- ASE Technology Holding Co., Ltd

- ChipMOS Technologies Inc.

- GLOBALFOUNDRIES Inc.

- Hana Microelectronics Public Co., Ltd

- Hana Micron Inc.

- Intel Corporation

- Jiangsu Changjiang Electronics Technology Co., Ltd

- King Yuan Electronics Co., Ltd

- Micron Technology, Inc.

- Nepes Corporation

- Powertech Technology Inc.

- Samsung Electronics Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Siliconware Precision Industries Co., Ltd

- SK hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited

- Tongfu Microelectronics Co., Ltd

- United Microelectronics Corporation

- UTAC Holdings Ltd

Providing Strategic and Operational Recommendations to Drive Resilient Growth, Technological Leadership, and Supply-Chain Agility in Advanced Integrated Circuit Packaging

To navigate the complexities of advanced IC packaging, industry leaders should adopt a multifaceted strategic approach. First, portfolio prioritization must align with end-market performance and cost metrics, ensuring that investments in hybrid bonding, chiplet platforms, and panel-level packaging yield the highest ROI. Organizations should conduct rigorous technology readiness assessments to identify production bottlenecks and mitigate integration risks.

Second, supply-chain resilience requires diversification of substrate and assembly partners across tariff-optimized geographies. Near-shoring critical processes and establishing dual-source agreements will shield operations from geopolitical disruptions and tariff fluctuations. Concurrently, collaborative R&D consortia can accelerate material and process innovations-such as low-loss laminates and Cu-Cu bonding-while sharing the risk and cost of pilot production.

Finally, workforce development and digitalization are essential enablers. Upskilling programs focused on micro-bump inspection, hybrid bonding equipment operation, and advanced process control will address talent shortages. Integrating data-driven quality analytics and real-time monitoring across packaging lines will enhance yield visibility and drive continuous improvement.

Outlining a Rigorous, Multi-Source Research Methodology Integrating Executive Interviews, Secondary Literature, and Triangulated Analysis of Advanced Packaging Trends

This research draws upon a comprehensive blend of primary and secondary data sources to ensure robust, credible insights. Primary intelligence was gathered through structured interviews with senior executives at leading foundries, OSAT providers, and materials suppliers, as well as technical experts in semiconductor packaging R&D centers.

Secondary research included peer-reviewed journals, industry consortium reports, patent filings, regulatory documents, and public financial disclosures. Market dynamics and technology trend analysis were validated through cross-referencing multiple reputable sources and in-depth case studies of pioneering packaging implementations.

The research methodology further incorporates scenario modeling and sensitivity analysis to account for tariff variations and regional policy shifts. All findings have been triangulated through expert panels and peer review to ensure accuracy, relevance, and actionable applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Advanced IC Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Advanced IC Packaging Market, by Package Type

- Advanced IC Packaging Market, by Packaging Technology

- Advanced IC Packaging Market, by Material

- Advanced IC Packaging Market, by Assembly Process

- Advanced IC Packaging Market, by Application

- Advanced IC Packaging Market, by End User

- Advanced IC Packaging Market, by Region

- Advanced IC Packaging Market, by Group

- Advanced IC Packaging Market, by Country

- United States Advanced IC Packaging Market

- China Advanced IC Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing Advanced Packaging Innovations With Strategic Imperatives to Secure Competitive Advantage in a Complex, Evolving Semiconductor Ecosystem

Advanced IC packaging stands at the forefront of semiconductor innovation, enabling performance gains that transcend traditional scaling limitations. The convergence of heterogeneous integration, 3D IC stacking, hybrid bonding, and panel-level approaches offers a rich palette of solutions to meet the demands of AI computing, automotive electronics, mobile connectivity, and network infrastructure.

However, tariff uncertainties, geopolitical realignments, and evolving regional policies demand agile strategies that encompass supply-chain diversification, strategic R&D partnerships, and targeted investments in workforce capabilities. Organizations that embrace a holistic approach-balancing cutting-edge technology adoption with resilient operational design-will secure leadership in a rapidly evolving market.

Ultimately, success in advanced packaging hinges on continuous innovation, collaborative ecosystems, and data-driven decision-making, ensuring that semiconductor value chains remain robust, cost-effective, and primed for next-generation applications.

Unlock Critical Market Intelligence and Propel Your Advanced IC Packaging Strategy Through a Direct Consultation With Our Associate Director

For a deeper dive into how these transformative insights and strategic imperatives can be tailored to your organization’s unique growth trajectory, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to explore our comprehensive advanced IC packaging market research report and unlock the competitive advantage your team needs to thrive.

- How big is the Advanced IC Packaging Market?

- What is the Advanced IC Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?